Navy Federal Credit Union

Allegations: Misrepresenting how many overdraft fees will be charged on a single transaction

Sanchez et al. v. Navy Federal Credit Union

23-cv-285, C.D. Cal.

(Feb. 2023)

Zelle at Navy Federal Credit Union

Marketing Zelle as “backed by banks,” “safe” and providing accountholders with “Zero Fraud Liability” when the credit union denies fraud claims without explanation or recourse

Pending

Allegations: Misrepresenting how many overdraft fees will be charged on a single transaction

Allegations: Misrepresenting how many overdraft fees will be charged on a single transaction

Allegations: Misleadingly representing that the credit union charges foreign transaction fees on transactions made outside of the United States when it charges such fees on transactions made online in the…

Allegations: Representing that accountholders will not be held responsible for fraudulent transactions when it rejects fraud claims without explanation or recourse

Allegations: Marketing Zelle money transfers as safe and secure without disclosing there is no protection for victims of fraud and no recourse for lost funds

Allegations: Misleadingly representing that the credit union only charges Foreign Transaction Fees on transactions made in foreign countries when it also charges such fees on transactions made online in the…

Allegations: Misrepresenting when consumers will be charged overdraft fees

Stephanie Zimmerman, ABA Journal

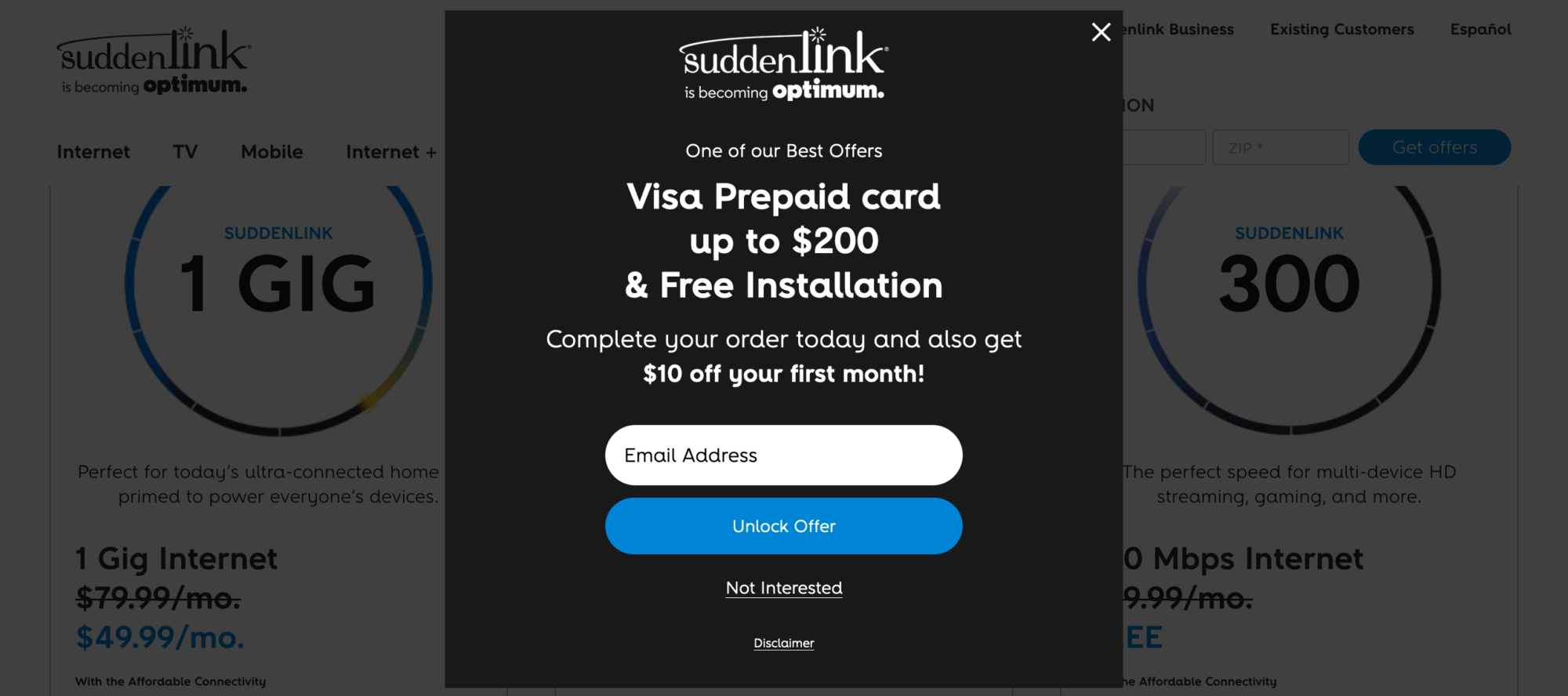

Enticing promotion for a Visa gift card has strings — and a cautionary tale from a consumer.

TINA.org breaks down recent self-regulation efforts by the direct selling industry.

With the click of a button, a 90-day warranty shrinks to a 30-day warranty.

TINA.org publishes a groundbreaking new report about the history and effectiveness of self-regulation in the MLM industry.