The Cost of Doing Business

Comparing the amount companies agree to pay to settle deceptive marketing charges with their annual revenue.

Questionable leaders and international bans are just the tip of the iceberg for this forex trading MLM.

|

Editor’s Note: Updates have been posted at the end of this article.

You don’t need to be Jordan Belfort, the “Wolf of Wall Street,” to make Wall Street level money, according to iMarketsLive, a foreign exchange or forex trading Multilevel Marketing – a way of distributing products or services in which the distributors earn income from their own retail sales and from retail sales made by their direct and indirect recruits. with offices in New York and London. In fact, you don’t even need to be awake. All you need, the company says, are the trading tools that iMarketsLive provides.

At the helm of iMarketsLive is its co-founder and CEO Christopher Terry. Terry, who boasts of making tens of millions of dollars in trading, got his start in multilevel marketing in the early 90s with Amway, where in lieu of actual earnings he says he cultivated a “mindset of wealth.” Should you decide to get involved with iMarketsLive, you may find yourself similarly lacking in financial success.

That’s because while iMarketsLive markets itself as a way for novice traders to “design [their] lifestyle” while generating residual income in their sleep, the truth is forex trading is a notoriously risky endeavor. As the SEC puts it:

It is common in most forex trading strategies to employ leverage. Leverage entails using a relatively small amount of capital to buy currency worth many times the value of that capital. Leverage magnifies minor fluctuations in currency markets in order to increase potential gains and losses. By using leverage to trade forex, you risk losing all of your initial capital and may lose even more money than the amount of your initial capital.

And if you think that you’ll just market the “opportunity” to others and not use the products yourself, iMarketsLive requires distributors to use “the products and services of the Company on a regular basis” in order to receive any bonuses or commissions. (Editor’s Note: In response to an inquiry by TINA.org, iMarketsLive Chief Operating Officer Frank Gomez said while this used to be the policy, it isn’t anymore, even though TINA.org took the language straight from iMarketsLive’s Policies & Procedures. Distributors, however, still must pay their “monthly subscription” to qualify for bonuses and commissions. Gomez said the company is amending the language.)

Here are a few more issues a TINA.org investigation dug up:

With iMarketsLive our primary focus is on forex and I’ll tell you why: forex gives the individuals who don’t have a lot of money a low barrier to enter. You could start a forex account for fifty bucks, where on these other markets it’s a thousand, two thousand, five thousand. But forex allows people to come in at a very, very low price, [it’s a] low barrier to entry and then they could learn.

But learning is not a requirement, Terry says later in the interview when discussing FX Signals Live. It is this program that iMarketsLive says allows a user’s trades to mirror those the company traders are making whether they’re “sleeping, partying, working, or all three.” “Let’s just say Troy Dooly doesn’t want to learn,” Terry says. “Just put your money to work. That’s it.” (Gomez informed TINA.org that FX Signals Live is “no longer in existence.”)

But if you do want to learn (to the extent that learning is possible with the forex trading tools that iMarketsLive offers), you can watch Terry make trades in the Live Trading Room — where he claims in the Dooly interview he once performed for an audience of more than 4,000 people — and copy his moves. You can also glean supposed insights from the Harmonic Scanner, another iMarketsLive tool that the company says “automatically draws and labels different harmonic patterns in the FOREX market” and which Terry describes in the interview as a “learn and earn experience.”

But even the self-proclaimed “best trading education on the market” isn’t enough to protect customers from losing all their money, the company admits. In a disclaimer at the bottom of its website, iMarketsLive acknowledges that:

Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is no guarantee of future results.

Moreover, in regard to the cost of the training tools ($195 upfront and $145 a month after that for the platinum package, which amounts to more than $1,700 annually), one consumer’s complaint to the FTC says “you can easily get it for free on Youtube.” (See more FTC complaints below.)

Though there is little to no mention on the official iMarketsLive website of the need to hire a broker to make trades, that is the reality. As Terry says in the Dooly interview, “I don’t take your investments. You invest with a broker. … Your transaction fees, that has nothing to do with me.” (Which means they have everything to do with you.) In the interview, Terry seems to suggest that by not accepting investments, iMarketsLive is able to avoid regulatory scrutiny, including from the National Futures Association. “I wanted our company to be clean,” Terry says when explaining why iMarketsLive doesn’t take investments. “Clean, clean, clean.”

But this raises the question: How much better are the trading tools that iMarketsLive offers than the services that a broker provides? If the company’s products are inferior by comparison, you may have a tough time selling the products. And if the “opportunity” side of the business is less about selling products than about recruitment, well, that’s one of the hallmarks of a pyramid scheme. (Gomez agreed that an emphasis on recruitment over product sales is one of the hallmarks of a pyramid scheme but said iMarketsLive’s customer-to-distributor ratio shields it from scrutiny, telling TINA.org: “[W]ith nearly 90% Customers and 10% IBO’s we feel it is very clear that IML is not about recruitment, it is about education and selling services which customers enjoy.” He did not provide supporting documentation.)

According to iMarketsLive’s compensation plan, those who purchase a platinum package are only $30 away from becoming an independent business owner (IBO), which to hear the company and its distributors tell it, is where the real money is made (but not really — see unrealistic income claims section below).

The purchase of a $195 platinum package generates 145 in group volume (GV). From there, IBOs need an additional 290GV and three “active members” in their downline to reach the first rank in the compensation plan, Platinum 150. But it’s a mystery how many IBOs even make it this far because while the compensation plan provides a link to see the income disclosure statement of distributors, the link as of the time of publication … doesn’t work. (Gomez said this linked to an old income disclosure statement so the company had it removed. A new one is expected in 45-60 days. When it’s ready, Gomez said, it’ll be added to the compensation plan. UPDATE 4/26/19: It’s arrived and it’s confusing. But one thing appears to be clear: The vast majority of distributors — 87 percent — make only around $50 a year on average.) It is therefore impossible to know how much iMarketsLive IBOs are actually making (or losing) beyond what is reported through the company’s promotional material, which skews toward those who are successful. Speaking of which…

It is unlawful for an MLM to make use of unusual earnings when discussing the income of its distributors. IMarketsLive’s Policies & Procedures, to which all distributors are bound, actually takes it a step further, stating, “No past, potential or actual income claims may be made to prospective Independent Affiliates…” (More on this to come.)

Yet TINA.org has assembled a sampling of more than 50 inappropriate income claims made by iMarketsLive and its distributors. These include:

(Gomez called the existence of any income claims “not good” and said iMarketsLive is “working with our leaders to address and eliminate income claims,” including those identified by TINA.org. As of 7/12/18, 41 of the income claims in TINA.org’s database had been taken down.)

On the official iMarketsLive website there is zero mention of the Vice President of Sales Alex Morton. Morton got his start and rose to fame in the MLM industry as a distributor for Vemma Nutrition Company, an MLM which reached a $238 million settlement with the FTC over allegations that it was a pyramid scheme in 2016. Morton was one of the FTC’s star witnesses against Vemma at the preliminary injunction hearing as the FTC showed a video of Morton making inappropriate income claims. (Here’s one of TINA.org’s favorites from Morton’s Vemma days.)

On the official iMarketsLive website there is zero mention of the Vice President of Sales Alex Morton. Morton got his start and rose to fame in the MLM industry as a distributor for Vemma Nutrition Company, an MLM which reached a $238 million settlement with the FTC over allegations that it was a pyramid scheme in 2016. Morton was one of the FTC’s star witnesses against Vemma at the preliminary injunction hearing as the FTC showed a video of Morton making inappropriate income claims. (Here’s one of TINA.org’s favorites from Morton’s Vemma days.)

Just before the FTC sued Vemma, Morton jumped ship and moved to another MLM, Jeunesse Global, where he continued to make inappropriate income claims. In July 2016, Jeunesse faced a class-action lawsuit that alleged it was a pyramid scheme. This time round, the complaint named Morton as a defendant and co-conspirator. Morton enlisted with iMarketsLive the very next month.

Morton uses his personal brand to promote iMarketsLive with particular attention paid to young people. On his personal Facebook page, Morton regularly posts videos promoting his lifestyle with the promise that hard work in network marketing will yield the same results for others. In this video, he explains the iMarketsLive business opportunity to a room full of young adults with a focus on recruiting them as distributors — the same business practice that brought Vemma to the attention of the FTC.

In another video, Morton pledges to make anyone who wants to be one, a millionaire, though he buries the lead:

I told these two dudes yesterday at Applebee’s, I said … I am going to act as if I personally brought you in and your account is my account. Until these guys are both making at least $25,000 a month, which is gonna happen very quickly, in the next 60 to 90 days, I am going to be here for you 24/7, 365, and that’s my commitment to all of you on this call right now … my goal is to have as many people as possible [making] $10,000 a month and that’s what we’re doing … anyone that wants to I’m going to make sure they become millionaires in iMarketsLive.

Clearly, Morton has not changed his ways.

In the Dooly interview, Terry says what attracted him to Morton was his “millionaire mindset” (we’re noticing a trend here). And in regard to what some might see as baggage, Terry says: “Whatever else there is out there in the public, the guy is the most incredible individual out there.”

(Regarding Morton, Gomez said, “We cannot change past actions other than removal of any social media posts, which he is actively doing.” As of 7/12/18, Morton had removed all of his posts identified by TINA.org. Some time in the months that followed, Morton was promoted to executive vice president.)

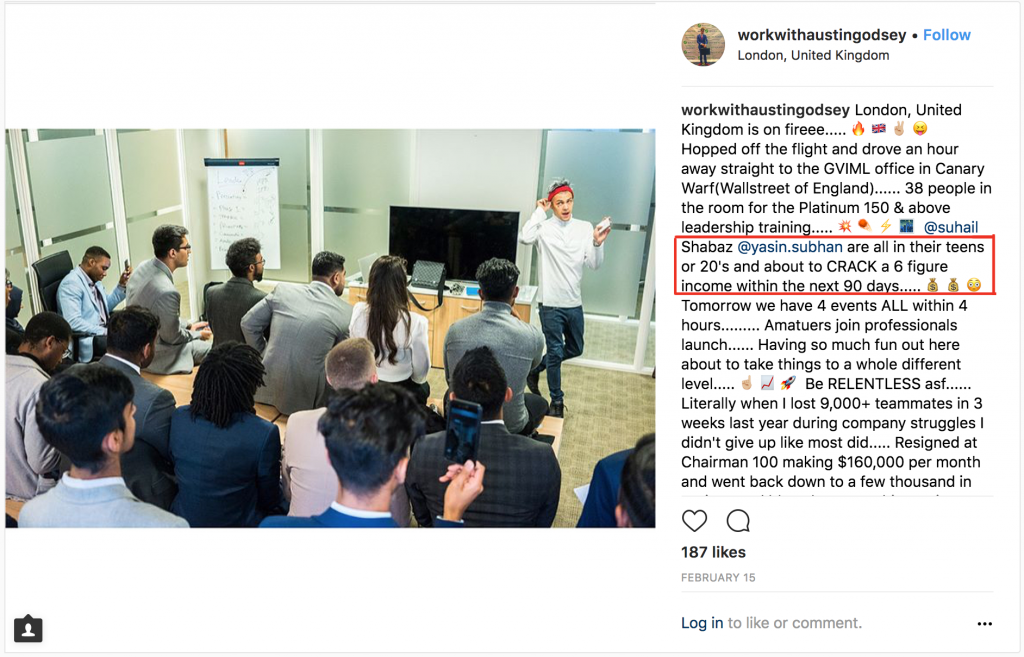

Morton isn’t the only person involved in iMarketsLive who has used deceptive promises of wealth and lucrative lifestyles to lure young people to this MLM. Austin Godsey, the founder and CEO of an iMarketsLive-distributor group called Global Visionariez (GV) who holds the top rank of Chairman 100 in iMarketsLive, has boasted on Instagram of teenagers about to make six-figure earnings:

Godsey says he was homeless before he discovered iMarketsLive. Now, he’s a “7 Figure Earner,” according to his Instagram profile. A couple other things he’s said that are equally unbelievable (which is to say, out of reach for the vast majority of iMarketsLive distributors):

One can apply to become a member of Global Visionariez by filling out an online application that doubles as a platform for inappropriate income claims, requesting that applicants select from a list of monthly earnings the amount of “extra income” they’re looking to make. The amounts range from $100 to $500 a month to more than $100,000 a month, which, if you do the math, makes one a millionaire (if only it were as easy as checking a box).

(Gomez told TINA.org that Godsey “removed 99.99% of his Instagram posts, thus eliminating any non-compliant posts.” He added, “Austin now understands the gravity of posting ‘out of this world’ claims and there is no excuse for it.” There’s just one problem: Godsey did not remove 99.99 percent of his Instagram posts. He has the same number of posts — 206 — as when TINA.org published these findings. We’ve added five containing inappropriate income claims to our database. UPDATE: As of 7/12/18, Godsey had removed all of his posts identified by TINA.org, in addition to scrubbing “7 Figure Earner” from his Instagram bio.)

By signing up to become a distributor with iMarketsLive, one agrees to the company’s Terms & Conditions and Policies & Procedures. The combined 33 pages contractually binds distributors to a multitude of provisions, including termination from the company at the discretion of iMarketsLive. Other items in the contracts that distributors should be aware of are:

If you’re wondering what the “i” in iMarketsLive stands for, it’s “international.” Of course, this doesn’t extend to the entire international community as financial regulatory organizations in the U.K., Spain, Columbia, France and Belgium have issued statements urging citizens not to invest in iMarketsLive, because the company is not an authorized financial institution in those countries. From the Belgian Financial Services and Markets Authority:

International Markets Live is not, however, authorized to offer financial services and products in Belgium. Moreover, the system proposed by International Markets Live exhibits features characteristic of a pyramid scheme.

Belgian authorities advise against “responding to any offers made by International Markets Live.”

The company’s Polices and Procedures lists 19 territories in which iMarketsLive is “unable to offer services,” including China, Iraq and “Montana, USA,” with no explanation given.

(Regarding the bans in Belgium and other foreign countries, Gomez said the company has hired lawyers to iron out what he described as a misunderstanding of the iMarketsLive business model and to “help us become complaint and registered” in those countries. As for the prohibited territories, Gomez said: “There are two main reasons. The first is the federal sanctions placed on specific countries by the US Government. The second is we just do not do business in some countries where the risk for fraud is high.” He didn’t explain Montana.)

Among the complaints to the FTC obtained by TINA.org through a Freedom of Information request are consumer woes concerning trouble with cancellations, pushy distributors, and pyramid scheme accusations. Here are some notable excerpts:

But the most colorful complaint by far does not mince words when it calls iMarketsLive “a huge scam consisting of pathological liars and thieves that illegally represent bs in disgusting ways I have never experienced.”

Perhaps because of that binding arbitration clause (see contracts section above), litigation involving iMarketsLive is scarce. However, one particular legal challenge is pretty juicy.

A competitor, Wealth Generators (WG), sued iMarketsLive in November 2017 alleging that iMarketsLive stole confidential information, intellectual property, business, and even bribed WGs’ leaders to leave the company and join iMarketsLive. The complaint alleges that iMarketsLive’s “Binary Options Live Educational Platform” was implemented after the theft of “confidential information” from WG by former WG distributors that iMarketsLive attempted to lure to the company. Terry, De La Torre (the CFO), Morton, and top distributors in the company were named as defendants. Terry is alleged to have called the acquisition of the confidential information and WG distributors “a massive benefit for iMarketsLive.”

The company has also gone to court as a plaintiff. In February 2018, the company filed a five-count complaint against Chakra Capital Group and others alleging trade libel and civil conspiracy to commit libel, among other things. Specifically, the complaint alleges that defendant Robert Halterman, who controls Chakra Capital Group, used his website and Facebook page to post derogatory comments about iMarketsLive, making claims like:

They are a pyramid scheme solely focused on recruiting and ranking up. They use forex to ENTICE people to get other people to join.

The company is claiming damages in excess of $1 million.

(Gomez described the Wealth Generators lawsuit as an “incorrect complaint” and in regard to the company’s case against Halterman said “he removed all negative and slanderous comments on Facebook and we removed our lawsuit.” Indeed, the claims filed by iMarketsLive against Halterman, as well as three other defendants in that case, have been dismissed. )

For more on TINA.org’s coverage of MLMs, click here.

UPDATES

UPDATE 11/18/24: IM Mastery Academy, formerly known as iMarketsLive, has been rebranded as IYOVIA. The company made the announcement at a convention in November 2024.

9/25/20: The Direct Selling Self-Regulatory Council has issued a case decision based on a TINA.org complaint finding that iMarketsLive and its distributors were making inappropriate income claims to promote the company’s business opportunity. The DSSRC recommended that the company “engage in effective training and monitoring of its IBOs (distributors) and use appropriate enforcement procedures to provide reasonable assurance that earnings claims made by its IBOs are substantiated, contain appropriate disclosures and are not misleading.”

1/10/20: iMarketsLive has a new website and a new name: IM Mastery Academy.

6/26/18: iMarketsLive has filed another defamation lawsuit, this time against the founders and employees of Copy Profit Success Global, an MLM that, according to the suit, plans to roll out its own forex trading tools in the future.

Comparing the amount companies agree to pay to settle deceptive marketing charges with their annual revenue.

From fairwashing to fragrance, consumers have plenty to watch out for in 2021.

A network marketing coach doesn’t deliver on his (expensive) promises.