Best Reader Tips of 2024

Consumer complaints worth remembering.

Investigation finds company is using deceptive marketing to lure consumers to an illegal gambling site.

|

DealDash, one of the largest penny auction sites in the world, markets itself as “the fair and honest bidding site.” But a TINA.org investigation has found that the company is actually engaged in a widespread deceptive marketing campaign to lure bargain-hunting consumers to an illegal gambling site from which it profits handsomely while users typically lose money.

The Finnish company with offices in Minnesota spent more than $50 million on ads in 2016. And it is using those ad dollars to deceive consumers in its TV commercials, online ads, social media posts, and promotions on its mobile app and website on a myriad of issues. These include the true cost and actual likelihood of winning a bargain, the ability to get a refund, the real price of “bid packs,” and the company founder’s undisclosed connection to products DealDash sells on its site — all to entice consumers to its illegal gambling operation.

While the company, which was founded in Finland in 2009, maintains it is legitimate and that its “Buy it Now” feature shields it from being an illegal gambling site, those claims are undercut by how its penny auctions actually work. Unlike a traditional auction house, on DealDash consumers have to pay for every penny bid they make. Bids, which can cost between 12 and 60 cents and come in bundles generally ranging from 220 to 5,000 bids, are expended the second a penny bid is placed on an item in an auction. Consumers who do not win the item lose the purchased bids unless they elect to buy the product through the Buy It Now option. But to take advantage of this option, consumers must have the economic means to finance the item, many of which cost thousands of dollars and some of which can be purchased for less on other sites. If they opt not to buy it from DealDash, they walk away from the auction having lost money.

Even if they do win, TINA.org found, consumers can end up paying more for an item than its face value.

Hundreds of consumers, in fact, have complained to the FTC about the company’s deception. Said one:

Site is deceptive because it promotes itself as an auction when in reality everyone pays not just the winner. More so than an auction, it is a gambling game with way too many variables that are not clear nor controllable to be promoted as discount shopping.

TINA.org warned the company in a letter dated May 25 about the deceptive advertising issues and that its pay-to-bid scheme — which generates at least half of DealDash’s revenue — constitutes a form of illegal gambling. Because the company has not taken action to rectify the issues, TINA.org on June 5 notified six state attorneys general and the FTC about its findings. In addition, TINA.org alerted the BBB, which has given DealDash an A-plus rating, about the ongoing deception.

“DealDash’s marketing claim — that consumers can generally expect to win items on the cheap — is simply not true,” said TINA.org Executive Director Bonnie Patten. “DealDash’s illegal gambling venture, which charges users for chances to win prizes, actually leaves most consumers who lose auctions with two unattractive options — walk away having lost money or buy the item at an inflated price.”

Within hours of notifying the BBB, DealDash’s rating was changed from an A-plus to an NR, or “No Rating.” TINA.org reached out to DealDash for comment on this story but the company did not respond. Click here to read DealDash’s response to TINA.org’s warning letter.

Company’s sleight of hand

DealDash refers to its penny auctions as “entertainment shopping” and its founder, William Wolfram, who launched the business when he was 16, maintains that its key distinction from gambling sites is a consumer’s ability to purchase an item through the Buy It Now feature if he or she loses an auction. At a presentation at the Hanken School of Economics in Finland, Wolfram said:

So the Buy It Now is really important. It changed the game from being a gamble, which you might try once or twice, to actually something that people would come and shop. ‘I’m thinking about buying that, I might as well try DealDash and see if I can get a good deal. If not, the worst case, I’ll pay retail.’

But DealDash also admits that its site is similar to gambling. It states that it’s “very easy to get carried away and break your budget” and advises consumers that:

Being responsible is expected with any kind of bidding sites as it is with gambling sites because in a sense, it is somewhat similar [to] gambling.

In a 2015 edition of its Terms of Use DealDash revealed that consumers “are likely to spend more money than [they] may receive in merchandise value.” (The terms also warned users at the time, “Do not buy bids or spend money on the site if you cannot afford to lose the money.” Both statements have since been removed from the site’s terms.)

In fact, TINA.org found several instances of auctions in which items sold for more than they were worth. For example, a $100 Walmart gift card auctioned on the site this spring sold for $115.19 plus the cost of bids.

Yet, that is not how the penny auction site is advertised. In commercial after commercial, DealDash emphasizes the ease with which great bargains are won. In fact, in a sampling of more than 100 ads TINA.org reviewed, only one, a TV commercial, even mentioned the Buy It Now feature.

Hidden costs of bids

More than 10 million consumers have flocked to DealDash in search of the kind of bargains touted in the company’s ads. Few have found them. That’s because the ads leave out the cost of bids. For example, in a long-running TV ad that TINA.org first alerted readers to in 2013, a consumer named Barbara boasts that she “won a 55-inch TV for less than $30 on DealDash.com.” But that figure doesn’t include the cost of bids and, according to the barely legible fine print in the commercial, Barbara had to bid no less than 414 times. If she paid 60 cents per bid, which is the full price of bids according to DealDash’s advertising, Barbara would have actually shelled out more than $250 for the TV.

Similar advertising that fails to reflect the true cost of bids are found on the company website’s “Winners” page and on its social media accounts, including Twitter:

This $552 Canon Camera was won for only $28.65 using only 227 bids! pic.twitter.com/hGdesNdVjc

— DealDash (@DealDash) December 3, 2016

Additionally, consumer testimonials citing terrific bargains also fail to clearly and conspicuously disclose that those are atypical results and that most customers end up spending more than they get back in value.

The sale that isn’t

Not only is DealDash failing to disclose the true cost of “winning” an auction, it’s deceiving consumers about its supposed sales on the cost of bids. While it claims the regular price of its bids are 60 cents, TINA.org’s investigation tracked the cost of bids during a four-month period and found that the site is running an illegal perpetual sale. At no time during the four-month period did DealDash actually sell the bids for 60 cents. Thus, the sales used to entice consumers to purchase bid packages or “bid packs” are entirely fictitious.

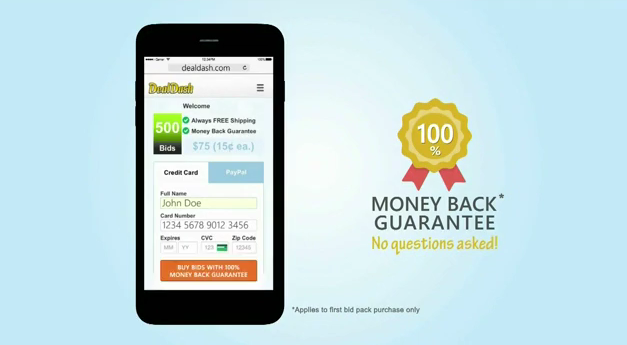

Unsatisfying guarantee

DealDash’s advertising holds out the promise that there’s no risk in using the site. If consumers aren’t satisfied, they can get their money back — it promises a “100% money back guarantee. No questions asked.”

But this guarantee carries a number of restrictions, including that DealDash only refunds the purchase price of products and not the bids spent to win the item (with two narrow exceptions).

Indeed, refund issues are cited in nearly two-thirds of the more than 600 consumer complaints filed with the FTC. (For the full FTC file, click here). Said one consumer:

I set a budget for my bidding with the intent to save on a computer purchase only to be [misled]. I want a full refund back to my PayPal account for $202.80 so that I can purchase a computer locally.

Others have complained about not receiving the items they won or purchased and being offered different products instead, unauthorized charges on their credit cards, and bots that trick users into bidding over the value of an item as well as other problems with the auction and the gambling involved. See a full breakdown of all the FTC consumer complaints here.

Doubling dipping

So who is really benefiting from the site?

Definitely Wolfram, DealDash’s founder, who TINA.org found is profiting from the auctions of products sold by companies that he also chairs. During a 24-hour period, TINA.org found that more than 40 percent of DealDash auctions are for items made and sold by nine companies that Wolfram is the chairman or co-founder of, including an electronics company called Schultz whose designers are lauded on DealDash as “some of the leading experts in the industry.” Yet the site fails to disclose any of these material connections to consumers.

Wolfram has said he aims to make DealDash, which has made tens of millions of dollars in revenue, “the world’s largest recreational shopping company.” But the company — rather than its customers — seems to be reaping the most financial rewards.

In 2011, the FTC issued a consumer alert regarding online penny auctions. In many ways, the agency said, “a penny auction is more like a lottery than a traditional online auction.”

UPDATE 8/8/17: DealDash now indicates on its “Winners” page the estimated total cost of products “won,” assuming the bids used to obtain the products cost 20 cents each, even though that is not the regular price.

UPDATE 1/31/18: A January 2018 audit of DealDash marketing revealed that the company has ceased to advertise misleading winners’ testimonials on its social media accounts (although the vast majority of testimonials prior to TINA.org’s complaint remain up). Additionally, a disclosure specifying the estimated total cost of products “won” when accounting for the price of bids now appears in a recent DealDash TV commercial. However, this disclosure is insufficient because, among other reasons, it appears in inconspicuously small, quickly disappearing text at the bottom of the screen.

Read more about TINA.org’s investigation of DealDash here.

Consumer complaints worth remembering.

Problems persist seven years after TINA.org complaint against penny auction site.

The illusion of savings.