BayPort Credit Union

In April 2020, a class-action lawsuit was filed against BayPort Credit Union for allegedly misleadingly representing that it charges overdraft and non-sufficient funds fees when an account does not have enough money to cover a transaction when, according to plaintiffs, the credit union assesses such fees using an artificial balance that deducts holds placed on deposits and pending transactions instead of the actual balance. In addition, plaintiffs claim that the credit union misleadingly represents that it charges only one fee on a single transaction when, according to the complaint, a new fee is charged every time a transaction is reprocessed for payment resulting in multiple fees being charged on one transaction. (Barker et al v. BayPort Credit Union, Case No. 20-cv-195, E.D. Va.)

For more of TINA.org’s coverage of banks and credit unions, click here.

Class-Action Tracker

The Latest

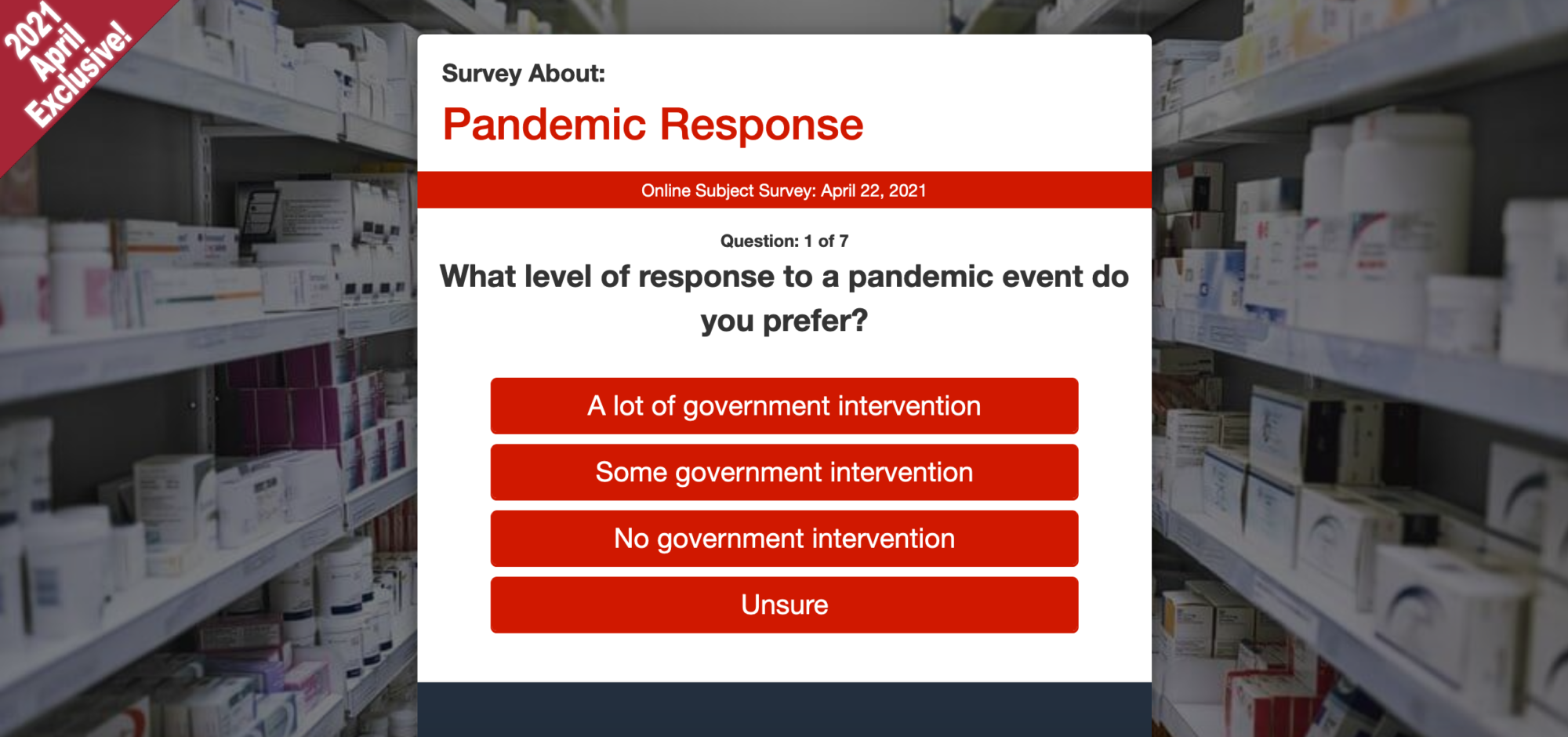

COVID Vaccine Survey Scam

Not a real survey. Not a real reward.

Ariat International

Apparel company known for its equestrian products gets made in USA lesson straight from the horse’s mouth.

J.G. Wentworth

If you have a structured settlement but you need ‘cash now,’ you may want to call someone else.

Midas Oil Change Coupon Stalls at Checkout

A coupon only a mechanic can love.

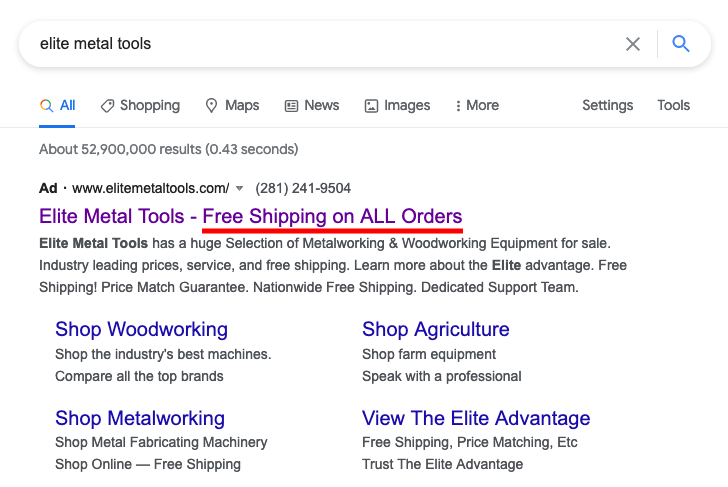

Elite Metal Tools: ‘Free Shipping on ALL Orders’

“Free Shipping on ALL Orders” turns out only to be good on around 90 percent of orders.