BayPort Credit Union

In April 2020, a class-action lawsuit was filed against BayPort Credit Union for allegedly misleadingly representing that it charges overdraft and non-sufficient funds fees when an account does not have enough money to cover a transaction when, according to plaintiffs, the credit union assesses such fees using an artificial balance that deducts holds placed on deposits and pending transactions instead of the actual balance. In addition, plaintiffs claim that the credit union misleadingly represents that it charges only one fee on a single transaction when, according to the complaint, a new fee is charged every time a transaction is reprocessed for payment resulting in multiple fees being charged on one transaction. (Barker et al v. BayPort Credit Union, Case No. 20-cv-195, E.D. Va.)

For more of TINA.org’s coverage of banks and credit unions, click here.

Class-Action Tracker

The Latest

Safe & Healthy Disinfecting UV Light

When it comes to UV devices and COVID-19, there is no magic wand.

LuLa-NO: Clothing MLM Violating Court Order

TINA.org alerts Washington AG’s office to deceptive income claims and more.

ActivePure Technology Air Purifiers

Products’ purported efficacy against COVID-19 reflects results from lab studies, not real-world studies. There’s a big difference.

American Blanket Company

Deceptive made in the USA claims threaten to fleece consumers.

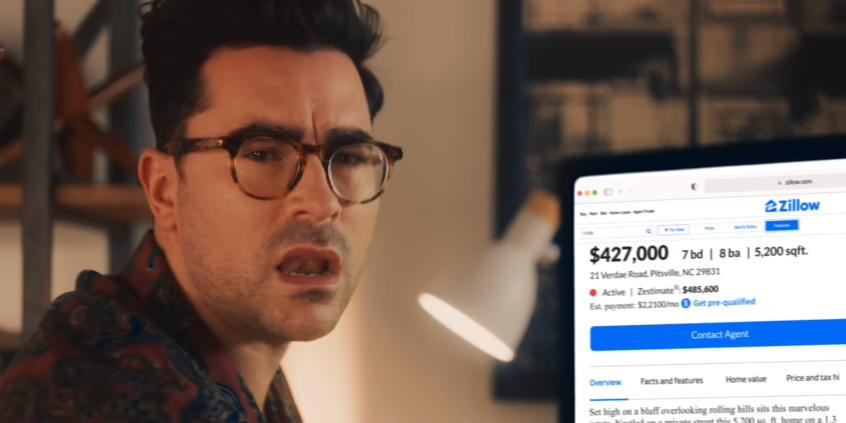

Live from New York, it’s … an ad for Zillow?

Funny Saturday Night Live sketch raises more questions about show’s foray into branded content.