BayPort Credit Union

In April 2020, a class-action lawsuit was filed against BayPort Credit Union for allegedly misleadingly representing that it charges overdraft and non-sufficient funds fees when an account does not have enough money to cover a transaction when, according to plaintiffs, the credit union assesses such fees using an artificial balance that deducts holds placed on deposits and pending transactions instead of the actual balance. In addition, plaintiffs claim that the credit union misleadingly represents that it charges only one fee on a single transaction when, according to the complaint, a new fee is charged every time a transaction is reprocessed for payment resulting in multiple fees being charged on one transaction. (Barker et al v. BayPort Credit Union, Case No. 20-cv-195, E.D. Va.)

For more of TINA.org’s coverage of banks and credit unions, click here.

Class-Action Tracker

The Latest

Quicken Loans’ ‘No Registration, No Login’ Claims

Even without an account, lender may share users’ personal information with third parties.

U-Haul’s Hidden Fees

How a $19.95 rental can cost you more than $60.

He Promised a Dreamy Wedding Proposal. Fans Got a 5-Hour Sale.

Tiffany May, New York Times

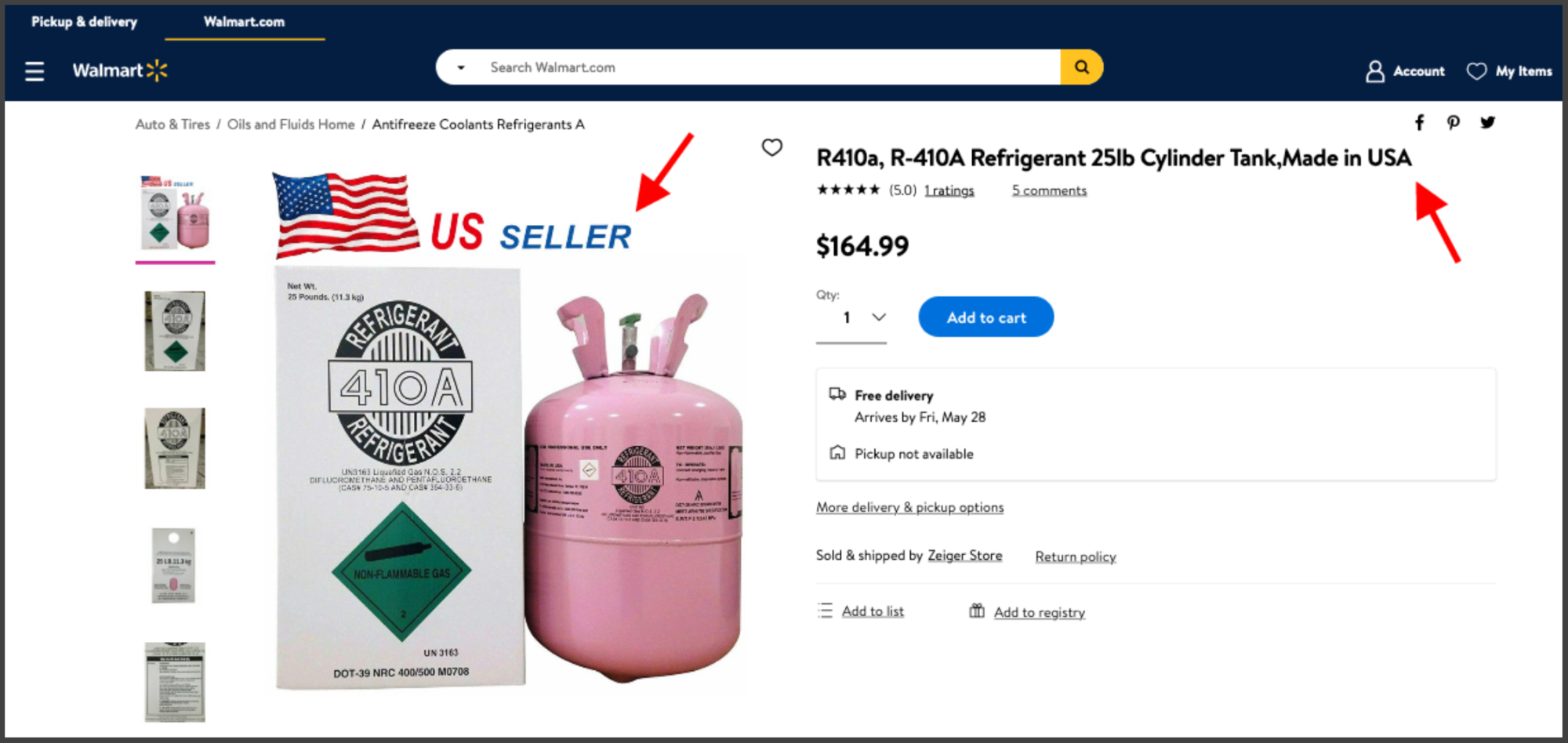

Made in USA Refrigerants on Walmart.com

When it comes to made in the USA claims on Walmart’s website, there’s a lot of hot air.

CATrends: Phthalates in Boxed Macaroni and Cheese

Lawsuits against Kraft and Annie’s mac and cheese allege brands fail to disclose harmful chemical ingredients.