TINA.org Joins Over 300 Orgs. in Letter Urging Congress to Support Financial Watchdog

Legislators should protect the work of the Consumer Financial Protection Bureau.

National Consumer Protection Week is a good time to bring attention to this bill.

| Bonnie Patten

This is National Consumer Protection Week, a perfect time to call attention to a consumer protection bill introduced in Congress known as The Unsubscribe Act.

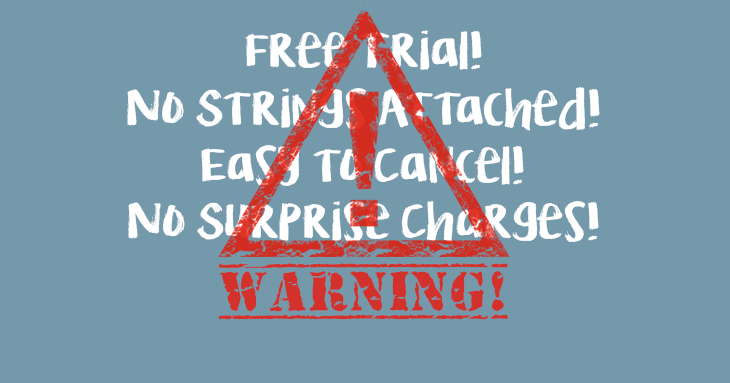

No, it’s not a bill that gets you off emails you didn’t want. It’s a bill that would protect consumers from misleading marketing that ensnares them into costly automatic monthly shipments known as a Recurring offers or subscriptions that continue to bill you until you take steps to shut down the account. These types of offers put the onus on the consumer to remember and to take action, allowing a company to keep gathering in cash from forgetful or busy customers. Be wary of these types of offers, and remember to stop services you no longer want. without their knowledge.

TINA.org has heard from many readers who were unknowingly enrolled in automatic billing plans after responding to special discounts or free-trial offers that sapped their bank accounts and who had trouble getting companies to cancel and refund their money. We’ve spent a lot of time investigating, reporting on, and filing complaints about these online billing practices, which are used by a wide variety of companies advertising products ranging from e-cigarettes to lingerie.

Subscription-based billing has been making an internet comeback, with companies such as Peet’s Coffee, Blue Apron, Spotify, and Kate Hudson’s Fabletics earning profits through monthly enrollments. But they’ve also faced legal scrutiny. Fabletics’ parent company, JustFab, for example, paid $1.8 million to resolve deceptive advertising allegations with district attorneys in Santa Cruz and Santa Clara that it did not “clearly and conspicuously” disclose that discounted products, including those on Fabletics.com, required enrollment into a monthly subscription service.

Just last month, the FTC sued Better Health Nutritionals along with eight other defendants marketing brain and joint supplements through a free trial off that failed to adequately disclose that customers would have to enroll in a negative-option offer. The scheme raked in more than $6 million in sales before the FTC shut it down.

The Unsubscribe Act, introduced by U.S. Representatives Mark Takano and Sanford Bishop, and endorsed by TINA.org, Consumer Action and the Consumer Federation of America, would require sellers to provide:

The bill builds on the Restore Online Shopper’s Confidence Act (ROSCA), which doesn’t specify mechanisms companies must provide to enable consumers to cancel recurring charges and doesn’t cover certain automatic billing deals.

“Through negative option billing, companies take millions of dollars every year from consumers who are not aware they are being charged or unable to navigate an intentionally complex cancellation process,” said Rep. Takano, of California. “This bill gives power back to consumers by forcing companies to get their explicit permission before charging them, allowing consumers to cancel a service through a straightforward process, and ensuring companies are transparent about their cost and cancellation policies.”

We here at TINA.org will keep our fingers crossed that this bill becomes law. In the meantime, consumers must be ever vigilant when ordering goods and services online to ensure that they are not inadvertently roped into an unwanted negative option offer.

Legislators should protect the work of the Consumer Financial Protection Bureau.

A reminder to be careful about ad claims that may seem too good to be true.

The agency puts the MLM industry on notice.