The Cost of Doing Business

Comparing the amount companies agree to pay to settle deceptive marketing charges with their annual revenue.

Achieving financial freedom from this MLM is as hard as finding those unicorn prints.

|

If you’re on Facebook or any social media for that matter, you might be seeing posts for a business opportunity that claims you can earn income working from home while taking care of your kids by selling “buttery soft” leggings and other colorful clothing with limited patterns (known as unicorns) via LuLaRoe.

In fact, if you work hard enough you can achieve financial freedom, some pitches claim. That all sounds great, right? But there’s more to this California-based Multilevel Marketing – a way of distributing products or services in which the distributors earn income from their own retail sales and from retail sales made by their direct and indirect recruits. that you should know before you plunk down thousands of dollars to become an independent fashion consultant (aka distributor).

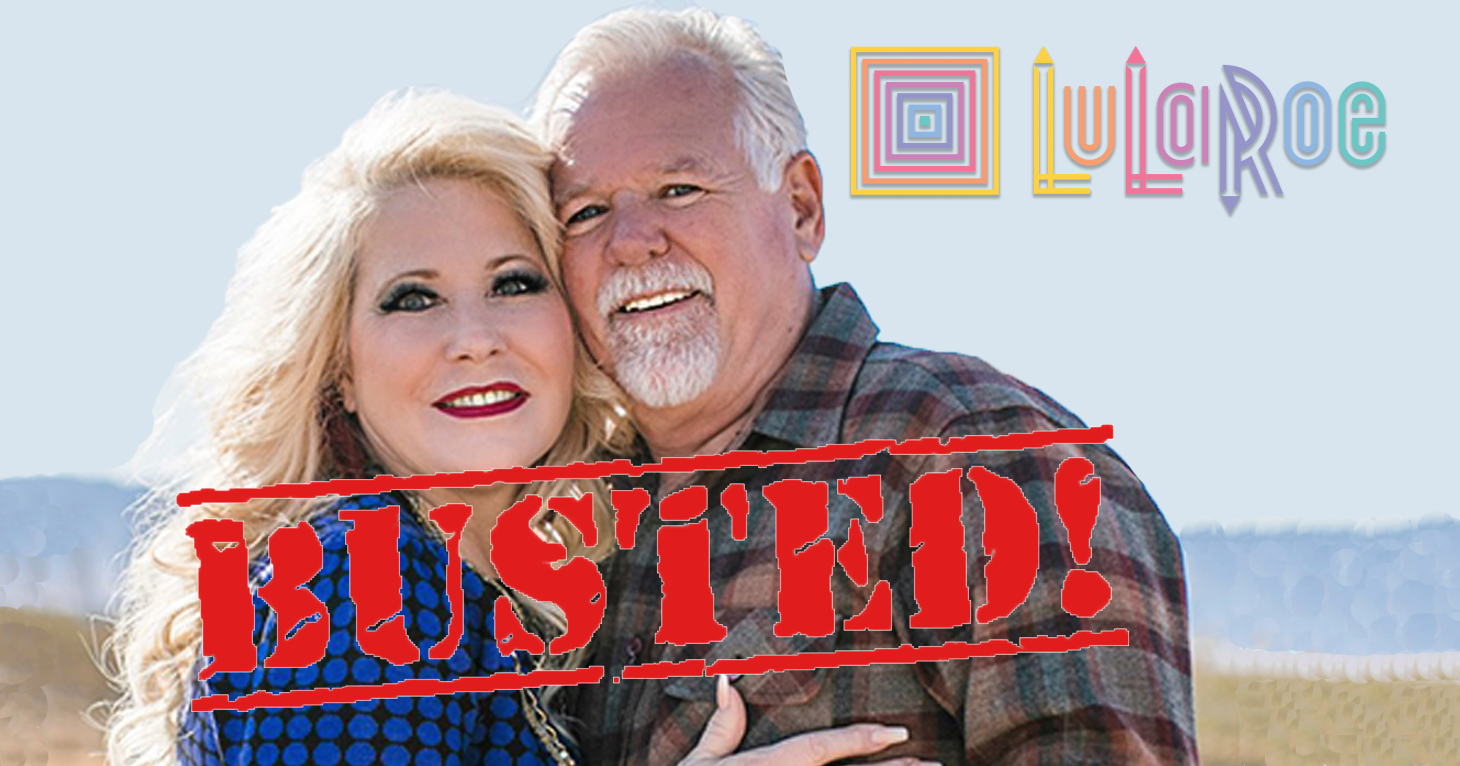

Founded in 2012 by DeAnne Brady (Stidham) and her husband Mark Stidham, LuLaRoe has grown into a $1 billion business with 80,000 distributors. Aimed at moms and millennials, the company markets an economic empowerment opportunity with flexible hours that can bring in thousands of dollars of income each month. But the facts tell a different story.

Starting a LuLaRoe business is expensive. And keeping yourself fully qualified to earn bonuses adds even more costs. How so? Let’s start with how much distributors have to invest to join LuLaRoe, which is between about $5,000-$11,000 for an initial purchase of clothing at wholesale prices. Then add on how many items of clothing distributors have to buy each month to stay fully qualified for all bonuses and compensation, which is anywhere from a minimum of 100 items (costing about $2,000) to 250 items (costing about $5,000) each month. Additionally, LuLaRoe recommends having lots of inventory on hand (translation, invest even more money).

If you add up all the business expenses of running your own enterprise — such as the cost of hosting and promoting the pop-up boutiques to sell the clothing — plus the value of your time spent working for LuLaRoe, the reality is that this venture could cost you tens of thousands of dollars.

Distributors may also obtain more initial inventory on credit but any compensation and bonuses a distributor receives is applied to what is owed until such time as the inventory is paid in full. Which all means that whether you pay upfront or obtain your inventory on credit you’re going to have to sell thousands of pairs of leggings just to break even.

When discussing the earnings of its distributors, an MLM may not make deceptive use of unusual earnings realized by only a few distributors without running afoul of the law.

Likewise, a failure to disclose that the structure of a program ensures that the vast majority of consumers cannot achieve substantial income is deceptive under the law.

In addition to the law, LuLaRoe policies prohibits its distributors from making any income projections, income claims, and/or disclosing their own personal LuLaRoe income, including the showing of checks.

LuLaRoe says it instructs its distributors to tell recruits that LuLaRoe makes no guarantee of financial success and that “success with LuLaRoe results only from successful sales efforts, which require hard work, diligence, skill, persistence, competence, and leadership.”

(Note: The FTC flagged similar type statements about effort in a settlement agreement with another MLM called Vemma, banning it from claiming that “participants who do not earn significant income fail to devote substantial or sufficient effort.”)

Yet, despite these prohibitions, TINA.org has catalogued more than 30 examples of these sorts of improper income claims. LuLaRoe’s website features emotional video testimonials from distributors who tell viewers how they were struggling financially before joining the company as fashion consultants. One distributor tells viewers she is now able to send her kids to private school with the money she’s earned from LuLaRoe. Two other moms discuss how their husbands have been able to quit their jobs because of the income they have made since joining LuLaRoe.

DeAnne, the founder, tells listeners on a 2015 recorded phone message promoted on social media that they can earn $5,000 a month.

On YouTube, LuLaRoe distributors tout eye-popping sales figures. One consultant boasts in a video that she earned an “insane salary” almost immediately.

The bottom line? Ninety-eight percent of distributors don’t earn enough money from bonuses to recoup their investments and many are turning to online forums to warn others.

In reality, the ability to earn bonuses as a distributor of LuLaRoe is as difficult as finding those coveted unicorn patterns, or a real unicorn itself.

At about $25 a pair, LuLaRoe leggings are expensive. But their quality is under fire. More than 70 percent of complaints filed with the FTC obtained by TINA.org through a Freedom of Information request focused on defective clothing, including leggings that spring holes and are ill-sized, as well as problems in obtaining refunds. There were more than 80 complaints about the company filed with the FTC as of March 2017.

Said one consumer:

4 out of the 10 leggings I’ve recently purchased have had holes varying from pinholes to several inches big. … It’s ridiculous for me to be paying $25 (plus shipping and tax) for a pair of leggings that cannot be worn more than an hour without crumbling! Nor should I have to pay for return shipping on defective merchandise. … The quality control is abysmal and customer service from corporate is a joke. …

(See more on returns in the Terms of Surrender section below.)

Another major issue consumers complained about to the FTC was being charged for sales taxes that their states don’t require they pay.

One consumer said:

Clothing is not a taxable item in my state (Massachusetts) and I am not charged tax when I purchase clothing from an online retailer regardless of whether or not that retailer has a presence/nexus in Massachusetts. So I was surprised to see that my LuLaRoe receipt included the addition of sales tax … When I queried the consultant about the tax charge, she said that LuLaRoe’s home office rolled out a special training for all consultants yesterday on this subject, and as part of that training, all consultants were instructed to begin charging sales tax based on their own (the consultants’) state sales tax laws, regardless of the location of their buyers …

(See more about taxing issues in the lawsuits section below.)

The company, which has an“F” rating with the BBB at this writing, said it was unaware of any complaints filed with the FTC.

The company is also facing multiple lawsuits, including class-actions regarding the quality of LuLaRoe’s leggings, issues with its return policy, and allegations that LuLaRoe is a pyramid scheme.

LuLaRoe distributors have filed two California federal class actions regarding the company’s return policy. The first complaint filed in October claims damages in excess of $5 million and seeks to represent a nationwide class of distributors who either attempted (unsuccessfully) to return inventory or purchased inventory during the five-and-a-half month period in which LLR had a “100% Buy Back” policy. The second case filed about three weeks later demands $1 billion and claims that LuLaRoe maintains “a secret policy and practice to delay and/or ignore return requests, and/or refused to send return authorizations, and/or charged Plaintiff substantial fees for any returns.”

In October, two class action lawsuits were filed in California federal court alleging that LuLaRoe is a pyramid scheme. The first suit seeks $1 billion in damages and alleges that tens of thousands of distributors were “unknowingly recruited into Defendants’ pyramid scheme through manipulation and misinformation.” The second suit filed four days later claims that “[t]he only people who make money from the LLR pyramid scheme are the very few at the top of the pyramid.”

In April, a consumer whose pair of $25 LuLaRoe leggings ripped the first time she wore them and who couldn’t obtain a refund from the company filed a lawsuit in Oregon state court. The lawsuit alleges that the company is fully aware that the leggings are defective but “recklessly continues to manufacture, market, and sell them to Oregon consumers anyway.” It seeks to require the company to pull the leggings off the market.

In March, two customers, who operate a Facebook page dedicated to complaints about defective LuLaRoe leggings and clothing items that has more than 25,000 members, filed a federal class-action lawsuit alleging that the company has failed to employ proper quality control measures to avoid shipping out defective products and that it represents that the products are fit for normal use despite knowing about the defects.

The lawsuit also alleges that the company shifts the burden of the defective products to its distributors who have to deal with consumer refunds and returns. The distributors, according to the lawsuit, have difficulty reaching the company to obtain credits for returned goods and have reported that when they call LuLaRoe they are placed on hold for an hour, then disconnected, and their emails are not answered. The suit states:

Aside from investing thousands of dollars and having to sell hundreds if not thousands of pieces of Defendants’ clothing to make a return on their investment, excluding the time and expenses involved Fashion Consultants’ ability to be profitable is also greatly diminished because of the defective Products they receive from Defendants.

The suit claims that during a weekly conference call, the founders told distributors not to spend time and energy sending defective products back to the company but to resell them instead.

LuLaRoe said in a statement to TINA.org that it stands by the quality of its products and that the lawsuit is without merit.

The company established a new returns policy in April allowing customers who aren’t satisfied with a purchase to return it for a full refund, credit or exchange within the first 30 days and a credit or exchange within 90 days. In addition, a new “Make Good Program” allows anyone who purchased a clothing item between Jan. 1, 2016 and April 24, 2017 that is defective to return it to the distributor for a gift card, refund or replacement if they file a claim by July 31 2017. The returns do not cover items that ripped because of improper care or normal wear and tear, among other exceptions.

But a lawsuit filed in May in federal court in California alleges that the new return policies fail to provide adequate relief for consumer and aggressively shifts the burden of the company’s defective product issues to distributors.

One lawsuit filed against the company alleges that it illegally used a design developed by a Hungarian artist as a pattern on its clothing. The artist filed the lawsuit in January alleging that the company misappropriated his “Cool Lion” design and marketed items with a similar pattern. LuLaRoe said it is investigating this claim and is trying to resolve the matter.

Another complaint, a federal class-action lawsuit filed against the company in February, focuses on the taxing issue that was the subject of many FTC complaints. It alleges that the company collected sales tax on purchases in locations where there are no such tax. LuLaRoe’s payment platform charges customers a retail tax based on the location of the distributors selling the item, though retail sales are only subject to taxation regulations based on where the goods are delivered.

LuLaRoe told TINA.org the tax issue stemmed from a software failure that misidentified the accurate location of its purchasers and that it is in the process of providing refunds to all affected customers.

It is not the first tax issue company owners Mark and DeAnne have faced. The IRS and California have placed liens against their properties and businesses totaling more than $700,000 in the past decade and property records show several remain outstanding. The company said the Stidhams have been “very transparent about the financial challenges they faced prior to the launch of LuLaRoe and the success of the business” and that “all viable liens have been satisfied and resolved.”

Under LuLaRoe’s compensation plan, in order to be fully eligible for all bonuses and compensation, distributors not only have to keep up with monthly orders of inventory, but they have to recruit new distributors. For example, to be qualified as a “trainer” — the second level of the leadership tier — distributors must purchase at least 100 pieces of clothing a month, recruit three other fashion distributors, and have a minimum of 10 in their A term most frequently used in association with multilevel marketing, it describes all the distributors who have been recruited to work under another distributor. Generally, distributors make money from the sales of all the other distributors below them in the business. who also have to purchase at least 1,750 clothing items combined each month as well as recruit others.

Two complaints on file with the FTC assert that LuLaRoe’s business structure is a pyramid scheme. According to the FTC, one of the hallmarks of a pyramid scheme is its “recruitment focus” in which a company bases most of distributors’ compensation on getting more people to join the team rather than the retail sale of the product or service to the general public. Another red flag is Inventory loading is the practice of requiring participants to purchase merchandise in order to receive commissions..

In response to a question about the pyramid scheme complaints, LuLaRoe said the majority of its distributors “earn all of their income from retail sales and do not participate in the Leadership Bonus Plan.” In addition, the company said “in order to qualify for leadership bonuses retailers must continue to sell products directly to consumers.”

LuLaRoe distributors must agree to at least 63 pages of policies in four separate documents before becoming a distributor. Deep in those pages are some important details that relate back to many of issues discussed above.

Here are some notable ones that we found from the policies and terms posted on a distributor’s website.

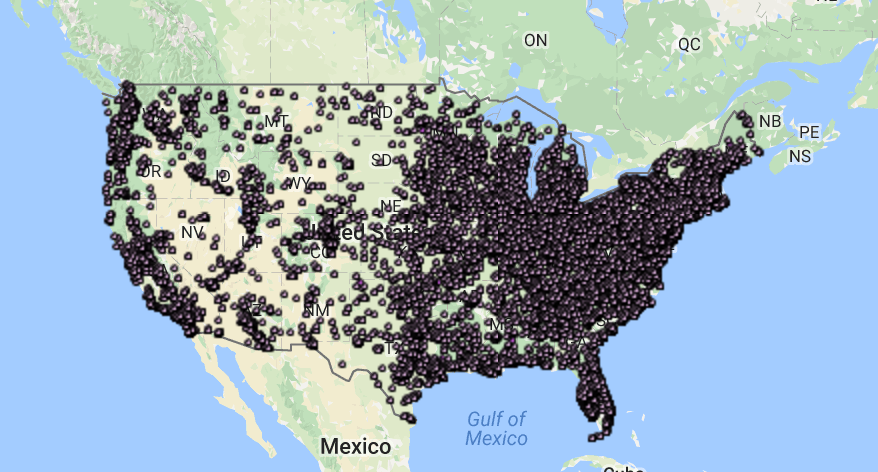

One of the issues in MLMs is market saturation, i.e. running out of people to recruit. Under its policies, the company may limit the number of distributors in any given area but is not obligated to do so, which means that eventually a distributor may run out of other distributors to recruit because the market population is dwindling.

Also, LuLaRoe distributors don’t get to pick the designs they purchase. The company sends the inventory and urges distributors to have unpacking parties to create a buzz for the items. But that can also mean that distributors get stuck with patterns they may not be able to sell. And distributors have strict limitations on where and how they can sell the clothing. Distributors may not sell the clothing at any commercial outlet or websites such as eBay or Craigslist.

In addition, as noted above, refunds are not easy to obtain under the company’s return policy. Customers have to request refunds and credits through the LuLaRoe distributor they purchased the item from and distributors have to abide by these restrictions:

Another term distributors must agree to is giving the company an irrevocable license to use their name, image, likeness, and testimonials in advertising or promotional materials and waive any right to prior approval.

Distributors must also agree to a non-disparagement clause in which they can’t make any negative comments about the company, abide by its confidentiality clause even after they leave the company, and agree to binding arbitration.

To read LuLaRoe’s full response to TINA.org’s inquiry, click here.

For more of TINA.org’s coverage of LuLaRoe, click here.

This story was most recently updated on 11/2/17.

Comparing the amount companies agree to pay to settle deceptive marketing charges with their annual revenue.

TINA.org alerts Washington AG’s office to deceptive income claims and more.

Settlement avoids a trial that had been scheduled to begin on Feb 16.