What You Should Know about USANA

Supplement MLM takes down dozens of deceptive claims following TINA.org investigation.

False advertising is generally an inclusive endeavor: Bad ads don’t care who you are; they just want to part you from your money.

But seniors make up one particularly vulnerable group. Scammers see older consumers with access to retirement funds as easy targets, and the FTC reported that fraud complaints from Americans 60 or older jumped from 10% of all fraud complaints to 26% of all fraud complaints between 2008 and 2012.

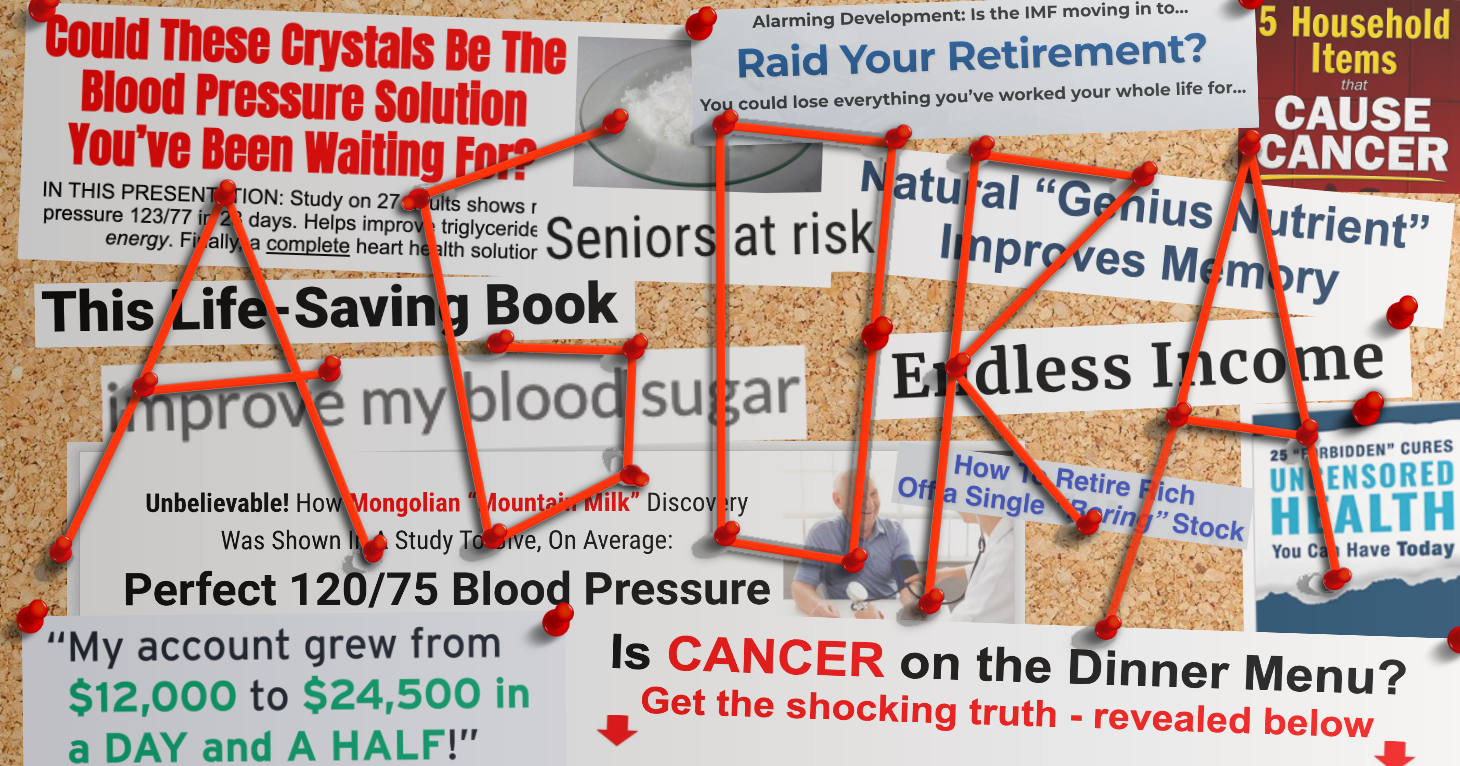

With that in mind, here are six types of bad ads targeting older Americans that TINA.org has spotted:

1. Anti-aging products:

Age brings about wrinkles and ads promising to smooth away those new wrinkles. Do stem-cell facelifts get rid of wrinkles? Perhaps not. What about wrinkle creams? Mixed results there. Although many creams promise impressive results in their advertising, Consumer Reports found in 2012 that the wrinkle creams they tested “had a small effect, and not on everyone.” Consumers looking for wrinkle treatments may want to talk with their doctors instead of trusting ad claims: Retinoids are the only proven topical prescription treatment for wrinkles.

2. Sex pills:

Older Americans are getting still active in the bedroom, thanks in part to erectile dysfunction drugs sildenafil and tadalafil (the active ingredients in Viagra and Cialis, respectively).

But devious supplement makers try to cash in by selling knock-off sexual enhancement pills that either don’t work, or more dangerously ones that DO work because they contain sildenafil or tadalafil on the sly. Those hidden drug ingredients can put seniors at risk. Sildenafil and tadalafil can interfere with nitrates and cause dangerous drops in blood pressure, which is why consumers should consult their doctor before taking any prescription drug or supplement.

3. Social Security scams:

Seniors may be targeted by advertisements claiming they can get more out of their Social Security if they just pay to learn this one trick. And while that’s sort of true — there are ways seniors can maximize their Social Security income — many of those tips are available for free elsewhere on the web. That “one trick” the ad promises may not be applicable to your situation, or it may not exist at all. You could be paying money for nothing, and that doesn’t maximize anything.

4. Funeral insurance:

Senior citizens sometimes worry about the cost of their funerals. Marketers try to take advantage by selling “funeral insurance” that promises to cover the cost of a burial. But funeral insurance policies are often just life insurance policies sold under another name – a distinction that may confuse older consumers. The insurance may also duplicate coverage seniors already have.

Virginia’s State Corporation Commission found several issues when it reviewed Lincoln Heritage’s marketing of its Funeral Advantage plan in 2012. The commission found the company may be misleading consumers by

But Funeral Advantage continues to use these or similar claims in its advertising. Consumers should review plans carefully to be sure they are not paying extra for coverage they may already have.

5. Native ads:

Ads disguised as content can be hard to recognize even by the savviest web users. But what about those new to the Internet? Senior citizens are the fastest growing population on Facebook, and the A website that allows you to build a profile and connect with others doesn’t always make it obvious what content is an ad and what is not. Often deceptive ads grab your eye by pretending not to be ads – see our story on native ads for more on this trend.

6. Reverse mortgages:

Reverse mortgages allow you to convert some of the equity of your house into cash without having to sell your house or pay any extra monthly bills. But some lenders who pitch their reverse mortgages aggressively – just watch daytime TV for a few hours you’ll see at least a couple of ads featuring senior celebrities touting reverse mortgages – fail to explain the risks and fees that sometimes leave seniors without a place to live. The FTC warns consumers to make sure they know all the fees associated with a reverse mortgage and the conditions that would make the loan due before signing up. Make sure you and your loved one understands all the risks and benefits of a reverse mortgage before cashing in.

Supplement MLM takes down dozens of deceptive claims following TINA.org investigation.

TINA.org refers publishing giant to FTC for enforcement action.

Comparing the amount companies agree to pay to settle deceptive marketing charges with their annual revenue.