Colonial Penn’s ‘Whole Life Insurance’

Life insurance company’s TV ad doesn’t tell the whole story.

Upgrading your living situation with the help of this credit-monitoring app depends on the credit score your landlord looks at.

We have a saying here at TINA.org: The fine print is a must-read.

The fine print in the above Credit Karma commercial, which shows a woman moving into shiny new digs after she hits “begin” on the Credit Karma credit-monitoring app, reads:

The score you see on Credit Karma is provided for educational purposes and may be different than the score your landlord uses.

This is because Credit Karma only shows credit scores from two of the big three credit-reporting agencies, Equifax and TransUnion (a fact that is not disclosed in the commercial). Which is to say, if your landlord runs a credit check with Experian and Experian only, you might have an idea of the credit score he or she looks at based on the Equifax and TransUnion scores that Credit Karma provides, but you won’t know the exact number.

A difference of 20 points from one credit-reporting agency to the other is not uncommon (and generally not cause for concern), according to this post on creditcards.com. But it only takes one point to go from what is considered a fair or average credit score (630 to 689) to a good credit score (starting at 690), which could be the difference between moving out of your parent’s basement and staying put.

Credit scores may vary from agency to agency depending on whether lenders report to all three or just one or two and whether the reporting occurs at different times. (For information on free credit reports, not scores, click here.)

In the end, while Credit Karma may provide you with a credit score, it’s ultimately up to you to improve it if you want to upgrade your living situation.

Find more of our coverage on Credit Karma, including how it makes money, here.

Our Ad Alerts are not just about false and deceptive marketing issues, but may also be about ads that, although not necessarily deceptive, should be viewed with caution. Ad Alerts can also be about single issues and may not include a comprehensive list of all marketing issues relating to the brand discussed.

Life insurance company’s TV ad doesn’t tell the whole story.

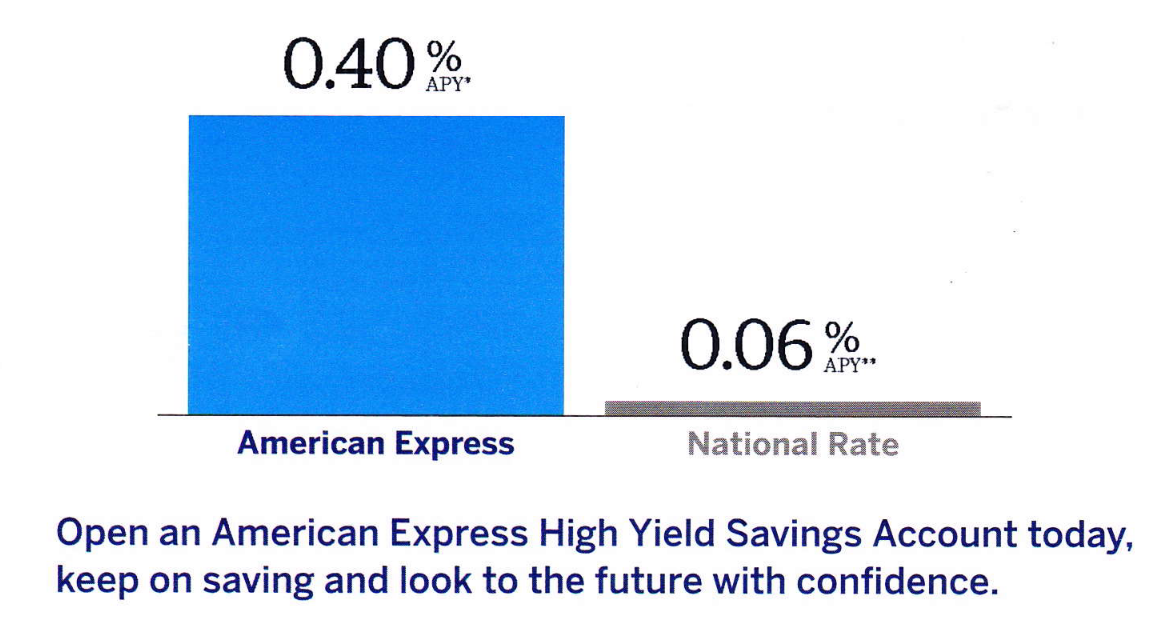

Bar chart in Amex mailing exaggerates annual rate of return for advertised savings account.

Even without an account, lender may share users’ personal information with third parties.