Citibank’s Overdraft and Insufficient Funds Fees

Allegations: Misrepresenting how many overdraft or insufficient funds fees consumers could be charged on a single transaction

June 2019: A federal judge granted the bank’s motion to compel arbitration and the case was stayed pending the outcome of arbitration.

February 2019: A class-action lawsuit was filed against Citibank for allegedly misleadingly representing that it charges Foreign Exchange Fees on transactions made outside of the United States without disclosing that it also charges such fees on transactions conducted within the United States on international websites. (Sponheim et al v. Citibank, N.A., Case No. 19-cv-264, C.D. Cal.)

For more of TINA.org’s coverage of banks, click here.

Allegations: Misrepresenting how many overdraft or insufficient funds fees consumers could be charged on a single transaction

Allegations: Marketing that the bank is dedicated to military members, veterans, and their families and provides more benefits than required under the Servicemembers Civil Relief Act (SCRA) when it systematically…

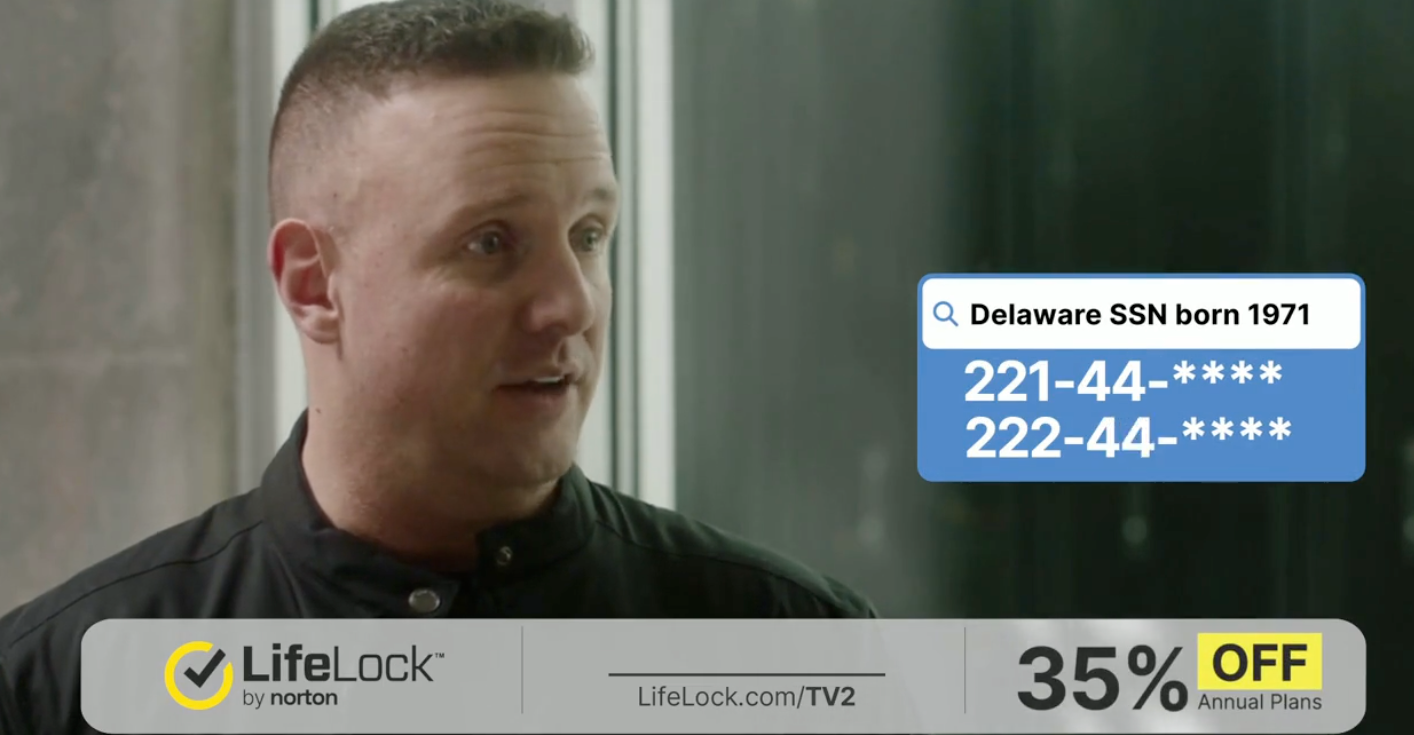

Is your Social Security number as vulnerable as this company claims?

Lawsuit alleges the McRib is a McScam.

A closer look at what we’ll be monitoring in the new year.

The problem hasn’t gone away.

Why parents may need to be called in to this Roblox game rated 13+.