FTC to MLMs: You Lie, You Pay

The agency puts the MLM industry on notice.

Council blesses MLM’s use of unsubstantiated earnings claims.

| | Bonnie Patten

To state the obvious, there is a huge difference between making money and losing money. But in a recent Direct Selling Self-Regulatory Council decision, that distinction didn’t seem to matter. Acting on a TINA.org complaint filed against Arbonne, a California-based MLM company that sells skincare, cosmetics and nutritional products, the DSSRC opined that this MLM could market its business opportunity using earnings claims despite the fact that the typical Arbonne distributor doesn’t appear to make any money. Not only does this DSSRC decision run counter to FTC law and the council’s own Earnings Claims Guidance, it also sets a dangerous precedent in an industry not known for its veracity when it comes to its methods for recruiting and retaining new distributors.

The mandate to provide all necessary material facts in marketing is required to ensure that consumers can make well-informed decisions. But the DSSRC’s Arbonne opinion recommends doing away with such a requirement and instead forcing consumers to independently remediate any deceptive or misleading impressions that an advertising campaign conveys — a standard that, if applied to all ads, would leave consumers exposed to constant deception.

Time and again in its written opinions the DSSRC has referenced the FTC’s MLM guidance on earnings claims stating that:

Earnings claims should accurately reflect what the typical salesforce member can generally expect to earn from the business opportunity. MLMs or participants making income claims must have a reasonable basis for these claims at the time they are made, supported by reliable, empirical evidence rather than subjective beliefs or personal anecdotes. Making claims without proper supporting evidence is considered deceptive.

In previous self-regulatory inquiries, DSSRC has similarly stated that it is misleading for a direct selling company or its salesforce members to make earnings claims unless they have a reasonable basis for the claim at the time it is made and possess documentation to substantiate the claim at the time.

And there’s the rub: Arbonne has not produced any reliable, empirical or supporting evidence or documentation to substantiate the claim that the typical Arbonne distributor actually earns any money. In fact, all evidence points to the contrary. Below, we take a deep dive into Arbonne’s earning claims, TINA.org’s complaint to the DSSRC, and the DSSRC’s Arbonne decision to explain how the council got it all so very wrong and why it matters.

At the top of a crowded page-and-a-half of text, Arbonne indicates in its latest income disclosure statement that all of its independent consultants must pay a $99 fee (plus taxes where applicable) every year — which translates to a fixed annual cost for all distributors. Thus, it follows that in order for Arbonne distributors to earn more than they pay to the company, at a minimum, they must make more than this fixed cost, which begs the question – how many of the company’s distributors make more than $99 annually? Arbonne never provides consumers with this information (and from all indications, the DSSRC is similarly in the dark on this count).

Instead of providing consumers with this material information in its income disclosure statement, Arbonne requires consumers to get out their calculators and work through a bunch of math problems to gain an inkling of what a typical distributor may earn (or lose). Below are some of the issues with Arbonne’s disclosure statement:

The company highlights that 18% of its lowest ranking distributors, known as “Consultants,” which comprise 85.3% of all Arbonne distributors “had no gross earnings in 2023.” This is a confusing statistic. First, the company is providing a percentage of a percentage of distributors with “no gross earnings” — 18% of 85.3% of all distributors grossed nothing. This actually works out to more than 15% of all Arbonne distributors making no money in 2023. Second, this calculation is for “gross earnings,” meaning no expenses were taken into consideration. But as the disclosure statement indicates at the top of the page, all distributors must pay the company $99 each and every year. When this single fixed expense is factored in, the more accurate statement would be that this cohort of Arbonne distributors not only didn’t make any money but actually lost money.

If the above analysis is too confusing to follow, consider ignoring it altogether because the implication from the above representation — that 82% of Consultants made money with Arbonne — simply isn’t true. The reality is that the number of Arbonne distributors losing money is much, much greater than 15%. Another calculation shows just how misleading Arbonne’s statement above really is.

Arbonne’s earnings chart (pictured above), unhelpfully categorized by distributor rank instead of by earning ranges, indicates that 85.3% of its distributors are in its lowest rank. For this lowest rank, referred to as “Consultants,” the chart shows that the median annual gross earning in 2023 was $77 — not enough to cover the fixed $99 fee. Again, using a calculator [the midpoint/middle of 85.3% is found by dividing this percentage by 2], this works out to about 43% of Arbonne distributors losing $22 or more in 2023. The chart also includes “average annual earnings,” despite the fact that averages always inflate how much distributors typically earn. According to the chart, Consultants earned an average of $188 but when the $99 fee is factored in it means that the average the vast majority of distributors earned (before taxes or other expenses) was $89 in 2023 or less than $8 per month.

Only by undertaking these multistep calculations are consumers able to learn that, at a minimum, approximately 43% of Arbonne distributors lost money and more than 85% on average earned less than $8 per month. And there is every indication that more than 43% of distributors failed to make money with Arbonne. Why? Because in addition to the $99 fixed fee (and possible taxes), there are additional expenses distributors may incur including but not limited to “event registration fees, travel, office supplies, insurance premiums, products purchased for business purposes, etc” according to Arbonne’s income disclosure statement.

Tellingly, Arbonne never reveals in its income disclosure statement how many distributors gross more than $99 a year (the absolute minimum break-even number after taking the company’s fixed fee into account). Given the data it does provide, however, all evidence points to the fact that the typical Arbonne distributor makes no money or loses money.

Despite the dire financial reality for most Arbonne distributors, for decades the company has advertised its business opportunity as a path to financial success. TINA.org has catalogued the company’s marketing over the years claiming that consumers can “take control of your paycheck,” achieve time and financial freedom, go on exotic trips, earn a Mercedes, quit a full-time job and replace your income, if they just sign up as a distributor.

This bullish marketing has continued despite repeated efforts by TINA.org and the FTC to stop the misleading messaging. In 2017 and again in 2024, TINA.org — as part of its larger investigations into the MLM industry’s use of unsubstantiated income claims — sent Arbonne letters calling out the company’s inappropriate use of earnings claims to recruit new distributors and retain low-level distributors. Further, in 2020 — in the midst of the COVID-19 pandemic — the FTC sent Arbonne a letter demanding, among other things, that the company cease using unsubstantiated earnings claims such as the ability to earn six figures and replace a full-time income. And in 2021, the FTC doubled down on its message by sending the company a Notice of Penalty Offenses letter reminding Arbonne of the law as it pertains to earnings claims (namely, that it must have substantiation that its earnings claims are representative of what distributors will generally achieve).

Unfortunately, these efforts have done little more than inspire a game of whack-a-mole — with Arbonne deleting specific deceptive marketing claims called to its attention but failing to address the problem on a larger scale.

In yet another effort to put an end to Arbonne’s use of deceptive income claims, in July 2024, TINA.org filed a complaint against the company with the DSSRC. The complaint explained that:

Any claim that the Arbonne business opportunity provides any income is deceptive as it is not consistent with the typical net earnings of Arbonne distributors. As the FTC noted in its March 2024 letter to the DSSRC, “[s]hould expenses nullify income for many participants, any projected earnings claim—even an income claim for $25 per week—is likely to leave a net impression that is deceptive.” In this case, expenses nullify income for at least half of all Arbonne participants. Despite this bleak reality, Arbonne misleadingly claims in various marketing materials that distributors can make money with the company.

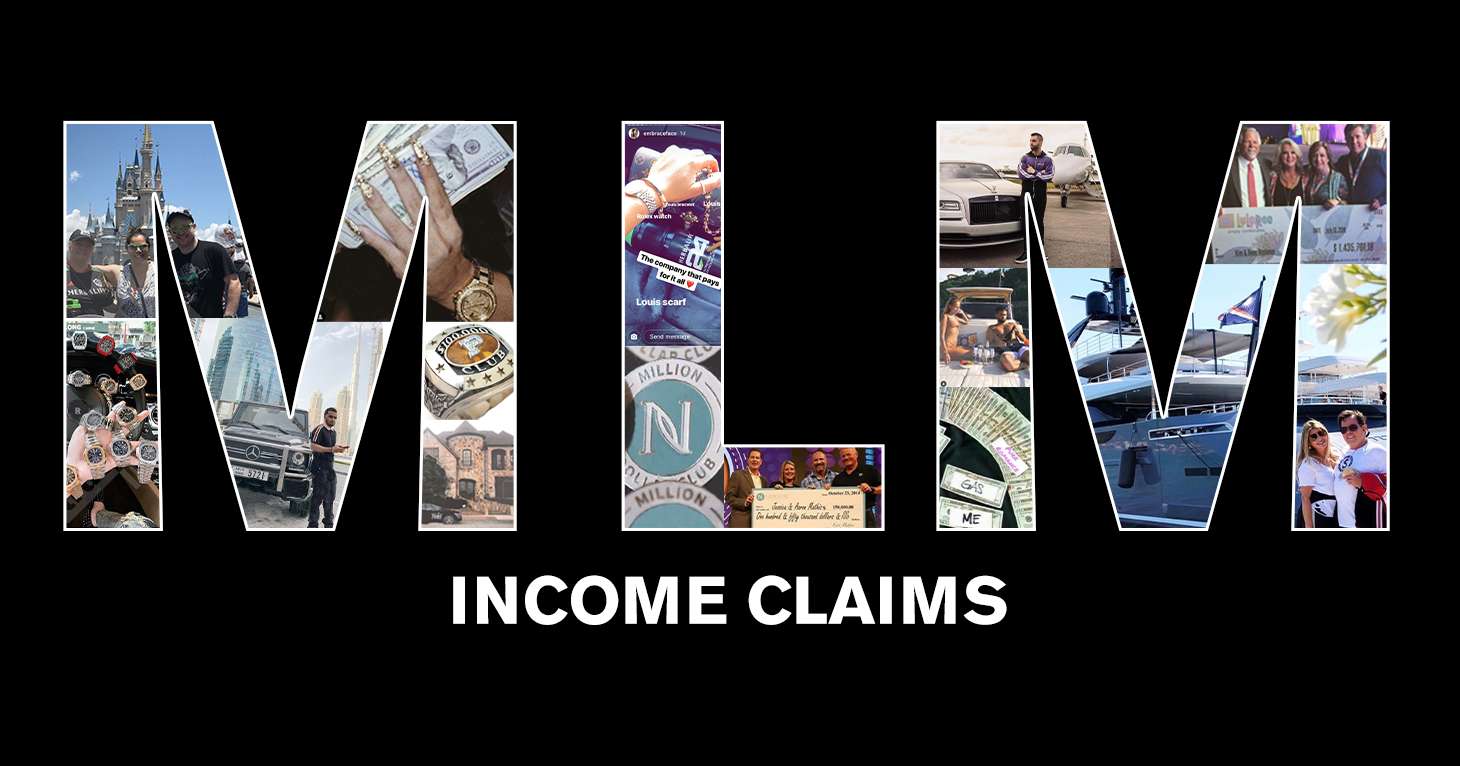

TINA.org provided more than 50 examples of unsubstantiated income claims to the DSSRC, including the following:

TINA.org also called out a business ethics video about income and lifestyle claims, in which Arbonne instructed distributors that they could make income representations, such as: “Earn a little extra money,” “Earn supplemental money” and “Earn commissions by selling the products I love.”

TINA.org concluded its letter to the DSSRC by stating that, “Arbonne’s lopsided marketing fails to convey that its typical distributor makes no money or loses money. As a result, consumers are being misled into believing they can earn an income with Arbonne.”

As a result of TINA.org’s complaint and the DSSRC’s subsequent inquiry, Arbonne removed 43 income claims, modified another 13 earnings representations and revised its income disclosure statement, which we examined above. Neither Arbonne nor the DSSRC disputed the fact that all the marketing statements collected by TINA.org were earnings claims in need of substantiation. And yet, wholly missing from the DSSRC’s opinion is any attempt to determine whether or not the typical Arbonne distributor earns money or loses money.

As the council has stated time and again earnings claims cannot be made unless the MLM has a reasonable basis for the claim at the time it is made and possesses documentation to substantiate the claim. But this most vital piece of evidence — how much the typical Arbonne distributor earns (or loses) — was never brought to light. Such a glaring analytical omission renders the council’s opinion utterly useless, and worse, it provides cover for MLM companies to make unsubstantiated earnings claims despite clear FTC guidance to the contrary. As the FTC states in its Business Guidance Concerning Multi-Level Marketing:

Rather than take the initial step of determining whether or not Arbonne provides the typical consumer with an earnings opportunity, the DSSRC instead spends most of its decision discussing what types of disclosures Arbonne (and its distributors) should use to modify earnings representations. With regard to what it terms “extraordinary” income claims, such as “earn as little or as much as you want,” the DSSRC determined that such statements could not be cured with a disclosure and had to be modified or deleted. Nevertheless, in its zeal to permit Arbonne to make earnings claims, the council established a new disclosure dichotomy for non-extraordinary income claims — distinguishing between “general references to earnings” and “specific, atypical earnings.” The opinion states:

Rather than take the initial step of determining whether or not Arbonne provides the typical consumer with an earnings opportunity, the DSSRC instead spends most of its decision discussing what types of disclosures Arbonne (and its distributors) should use to modify earnings representations. With regard to what it terms “extraordinary” income claims, such as “earn as little or as much as you want,” the DSSRC determined that such statements could not be cured with a disclosure and had to be modified or deleted. Nevertheless, in its zeal to permit Arbonne to make earnings claims, the council established a new disclosure dichotomy for non-extraordinary income claims — distinguishing between “general references to earnings” and “specific, atypical earnings.” The opinion states:

…the data required to accurately represent the earnings of all salesforce members is extensive and difficult to be succinctly summarized in a manner that would be clear and comprehensible to consumers within the limited space of a social media post. Therefore, DSSRC determined that in the context of qualifying general references to ‘earnings’ … it may be appropriate to provide this detailed information through a clear and conspicuous hyperlink to a company’s IDS in the post to ensure transparency and clarity. … DSSRC does not agree that every passing reference to ‘income’ or ‘earnings’ in a direct selling social media post may automatically necessitate a disclosure of generally expected results that can never be placed behind a properly labeled hyperlink. … Conversely, DSSRC determined, that when a social media post makes reference to a specific, atypical earnings amount … it creates a clear and quantifiable expectation for the viewer and a clear and conspicuous disclosure of the generally expected earnings of the typical salesforce member in the body of the post would be essential to ensure transparency and avoid a misleading representation, as the recipient of the message is likely to interpret this specific figure as a realistic and achievable income that they can reasonably expect to earn.

Here are two before-and-after images to put this in context and illustrate what the DSSRC deems permissible for “general” earning references even when a company’s distributors typically make no money or lose money:

This disclosure distinction between general and specific income claims is not found in the DSSRC’s Guidance on Earnings Claims, and runs contrary to FTC guidance and practice. (For example, in FTC stipulated orders prohibiting companies from using unsubstantiated and misleading earnings claims, the standards applied to “any specific or general representation, express or implied, about income…” are the same.)

Moreover, even if the typical Arbonne distributor makes money (which they don’t), the qualifying language that the DSSRC approved in this case is inadequate and misleading. For “specific” income claims, the council determined that the following disclosure language would cure an otherwise misleading earnings claim:

85% of business building Consultants earned a median of $77 in 2023. For typical earnings, see Earnings.arbonne.com

With regard to the advice that consumers can learn about “typical earnings” for Arbonne distributors by reviewing the company’s earnings statement — that simply isn’t true. Nowhere in Arbonne’s earnings statement does the company ever disclose what the typical Arbonne distributor earns. And because of the flaws and difficulty interpreting Arbonne’s income disclosure statement, the DSSRC’s approval of this document, stating that it is “presented in a format that was clear and concise and that the earnings data was provided in a context that was straightforward and would not be misinterpreted by the reasonable consumer,” is ludicrous. Equally problematic is the earnings representation in this disclosure. Again, factoring in Arbonne’s universal $99 annual fee, an accurate disclosure would state:

85% of business building Consultants lost a median of at least $22 in 2023.

And taking this single expense into consideration is not optional. As explained by former FTC Commissioner Noah Phillips, in order not to be misleading, earnings claims need to factor in expenses rather than state gross income, and need to reflect typical earnings, not mean or average earnings — which may be significantly higher than typical earnings because of outlier high earners. Nevertheless, the DSSRC completely rejects the notion that expenses need to be factored into earnings claims or earnings data. The DSSRC opined that:

DSSRC agreed with [TINA.org] about the importance of providing prospective salesforce members with business expenses, but does not agree that it is incumbent (or practical) for a direct selling company to include each and every business expense in its calculation of the earnings data presented in its earnings chart, so long as it clearly and conspicuously provides mandatory, de facto mandatory, or recommended costs of participation in the Company’s business opportunity (e.g., starter kits, registration, travel, and accommodation costs incurred when attending highly recommended or required company events) in close proximity to the earnings data.

To avoid the harms that Arbonne’s marketing creates, the DSSRC places the burden on consumers to discover the full details of what a typical Arbonne distributor earns, which is impossible given that Arbonne never provides consumers with this information anywhere. Despite the position of the DSSRC, caveat emptor simply is not the law in this country — consumers have a right to assume that fraudulent advertising traps will not be laid to ensnare them.

In October 2023, the DSSRC published its Guidance on Income Disclosure Statements for the Direct Selling Industry, stating, among other things, “in most cases the typical salesforce member should not expect to earn more than modest and supplemental income.” Nevertheless, the DSSRC’s guidance encouraged MLMs to state in their income disclosures that the business opportunity provides distributors “with an opportunity to earn modest or supplemental income.”

This guidance caught the attention of FTC staff, which in March 2024, issued a staff advisory opinion taking issue with the DSSRC encouraging MLMs to tell distributors that most participants can earn modest or supplemental income. Specifically, the letter stated:

We are concerned that some of the Guidance either is not fully consistent with federal law or fails to address key concepts of FTC law. For example, it is well-settled that a company must have a reasonable basis for earnings claims at the time the claim is made. In its Guidance, the DSSRC advises that MLMs may make claims about “the amount of income that direct selling members can generally expect to earn,” even if they have only “some indication” of participant expenses or “an estimate of mandatory costs.” … In the view of FTC Staff, this advice is not consistent with FTC law.

The letter concluded by stating that “FTC Staff is concerned that the DSSRC’s Guidance will encourage deceptive conduct and facilitate deceptive earnings claims and will result in consumer harm.”

Not long after this FTC letter, the DSSRC revised its guidance to state “in most cases the typical salesforce member, at best, should not expect to earn more than modest and supplemental income and many will not earn any net income.” However, this late-to-the-game recognition by the council — that many distributors will make no money or lose money — does not seem to have reversed its open-armed acceptance of the supplemental income claims.

With this Arbonne decision, the DSSRC has further undermined adherence to FTC law within the direct selling industry and negatively impacted consumer welfare by failing to protect consumers and low-level distributors from the damaging consequences of deceptive marketing tactics used by MLM companies such as Arbonne. TINA.org’s 2024 investigation into earnings claims within the MLM industry made clear that many direct selling companies have similarly taken to promoting their businesses as Arbonne does with unsubstantiated claims of “general references to earnings,” as the DSSRC puts it. And these companies will no doubt use this decision as cover. Indeed, self-regulation in the MLM industry appears to be doing more harm than good by shielding rampant misconduct.

And if there are any doubts concerning the previous statement, TINA.org collected more than 200 deceptive income claims made by Arbonne and its distributors in short order following the DSSRC’s publication of its decision that include assertions that the company’s business opportunity not only provides a means to earn extra money, but also offers a way to achieve financial freedom, legacy money, an uncapped earning potential, complete financial flexibility, and a financially abundant life, among others, because, as one Arbonne distributor put it, “there is no losing in this business.” TINA.org couldn’t disagree more.

UPDATE 5/27/25: In response to this blog, the DSSRC issued a statement defending its Arbonne decision as “principled, balanced, and consistent with the current regulatory environment.”

The agency puts the MLM industry on notice.

And if you don’t know, now you know.

How income claims, even truthful ones, can be deceptive when marketing the MLM business opportunity.