Agora Still Using Deception and Dark Patterns to Ensnare Seniors

TINA.org refers publishing giant to FTC for enforcement action.

An investment in gold or another precious metal can be alluring.

“This is a no brainer,” you say. “I mean gold is one of the safest investments of all time.”

It might make sense for you. But you need to ask the right questions. And do some research.

Let’s take a trip down memory lane. History can be instructive.

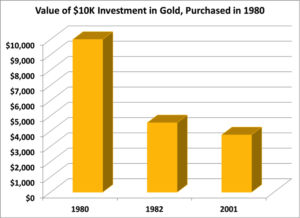

The year is 1980. The economy is in the crapper. The 1970s were a tough slog, economically speaking. The glory days of America feel like they are over. Families are hurting. Panicked about the U.S. economy and the future of the U.S. dollar, people invest in gold. They “conservatively” buy it at $682 per ounce. They are told it’s a smart move and history shows it has performed incredibly well over the preceding decade.

But within two years of 1980 the value of an ounce of gold fell to a mere $310. Yep. Less than HALF of what investors paid. Two decades later, by 2001, the market value was just $256. Investors had to wait until 2007 to just break even on the $682 they paid.

The point illustrated here with gold also applies to other precious metals. Before you invest in any, consider the following:

Precious metal investments can be useful components of your portfolio. They can help you diversify and they can help hedge against inflation. Just play it smart.

More information about investment in metals can be found here.

TINA.org refers publishing giant to FTC for enforcement action.

A master list of known and alleged scams.

From fairwashing to fragrance, consumers have plenty to watch out for in 2021.