American Express Mailing

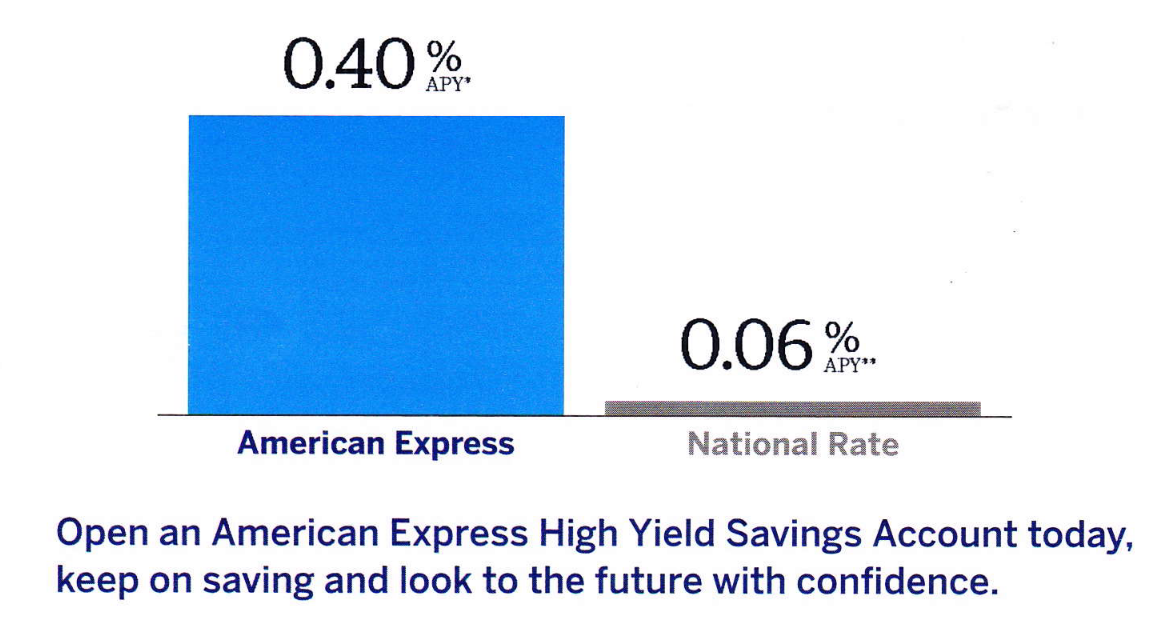

Bar chart in Amex mailing exaggerates annual rate of return for advertised savings account.

Life insurance company's TV ad doesn't tell the whole story.

“With our $9.95 [a month whole life insurance] plan, your acceptance is guaranteed,” Colonial Penn sales manager and spokesman Jonathan Lawson says in the above TV ad. “You cannot be turned down for any health reason.”

But what Lawson leaves out of his pitch is the reason why acceptance is guaranteed and how that might affect the amount the insurance plan pays out in the first two years. Fine print on the Colonial Penn website states:

We can guarantee your acceptance because of a two-year limited benefit period for death from non-accidental causes. If death from non-accidental causes occurs during the first two years of coverage, the beneficiary will receive the premiums paid plus 7% interest compounded annually. After the first two years, the full face amount will be paid for death from any cause.

In other words, if you die within the first two years of coverage, the beneficiary of your plan only receives the full benefit if the death is ruled an accident. Not to be grim – though it may be too late for that – but the older you get the less likely you are to die from an accident and the more likely you are to die from disease, according to the CDC.

Meanwhile, Colonial Penn’s TV ad targets people ages 50-85 with preexisting health conditions. In addition to telling consumers that they “cannot be turned down for any health reason,” Lawson says that “[t]here are no health questions with this plan.”

Also, your idea of what constitutes an “accidental death” may be different than the criteria Colonial Penn uses to determine the cause of death:

Accidental death does not include death resulting from bodily or mental illness or disease, infection, suicide, medical or surgical treatment, voluntary use of any controlled substance unless prescribed by a physician, or any act of war.

None of this is disclosed in the ad. In fact, the only indication that the advertised plan may not pay out in full in the first two years of coverage comes via a written disclaimer that flashes on screen twice for a total of eight seconds. It states: “Limited benefit first 2 years.”

Find more of our coverage on life insurance here.

Our Ad Alerts are not just about false and deceptive marketing issues, but may also be about ads that, although not necessarily deceptive, should be viewed with caution. Ad Alerts can also be about single issues and may not include a comprehensive list of all marketing issues relating to the brand discussed.

Bar chart in Amex mailing exaggerates annual rate of return for advertised savings account.

Even without an account, lender may share users’ personal information with third parties.

If you have a structured settlement but you need ‘cash now,’ you may want to call someone else.