Colonial Penn’s ‘Whole Life Insurance’

Life insurance company’s TV ad doesn’t tell the whole story.

According to an 18-second TikTok video, “If you need $1 to $5,000 … you can just go to CoffeeBreakLoans.com and request it, and it works even if your credit score isn’t that good right now.” Is it really that simple? The short answer is nope.

To start, Coffee Break Loans doesn’t actually loan money to anyone. As the company puts it on its About Us page:

We are not a lender or lending partner, but submitting your information through our secure online form will help us connect you with one of our participating lenders and lending partners in our network.

Who those “participating lenders and lending partners” are is not readily apparent on CBL’s website but the website does say that most of these lenders require a completed application and credit check. At a minimum, most require the following:

Qualified consumers may then be offered loans that include fees and an interest rate as high as 35.99 percent. Such high interest-rate loans are not permitted in all states so depending on where you live, you may not be eligible.

Oh and the woman with glasses on the company’s homepage providing her positive testimonial for CoffeeBreakLoans.com – that’s actually a stock image purchased by the company.

The bottom line is that getting a loan isn’t as simple as the ads would have you believe. These types of payday loans can be really expensive, can trap you in debt and ruin your credit. So before you sign on the dotted line, you should consider other possible ways to get money or credit quickly.

If you do decide to take out a high-interest loan make sure you read everything, understand how it works and are confident that you can pay it back on time.

To read more TINA.org coverage regarding payday loans, click here.

Our Ad Alerts are not just about false and deceptive marketing issues, but may also be about ads that, although not necessarily deceptive, should be viewed with caution. Ad Alerts can also be about single issues and may not include a comprehensive list of all marketing issues relating to the brand discussed.

Life insurance company’s TV ad doesn’t tell the whole story.

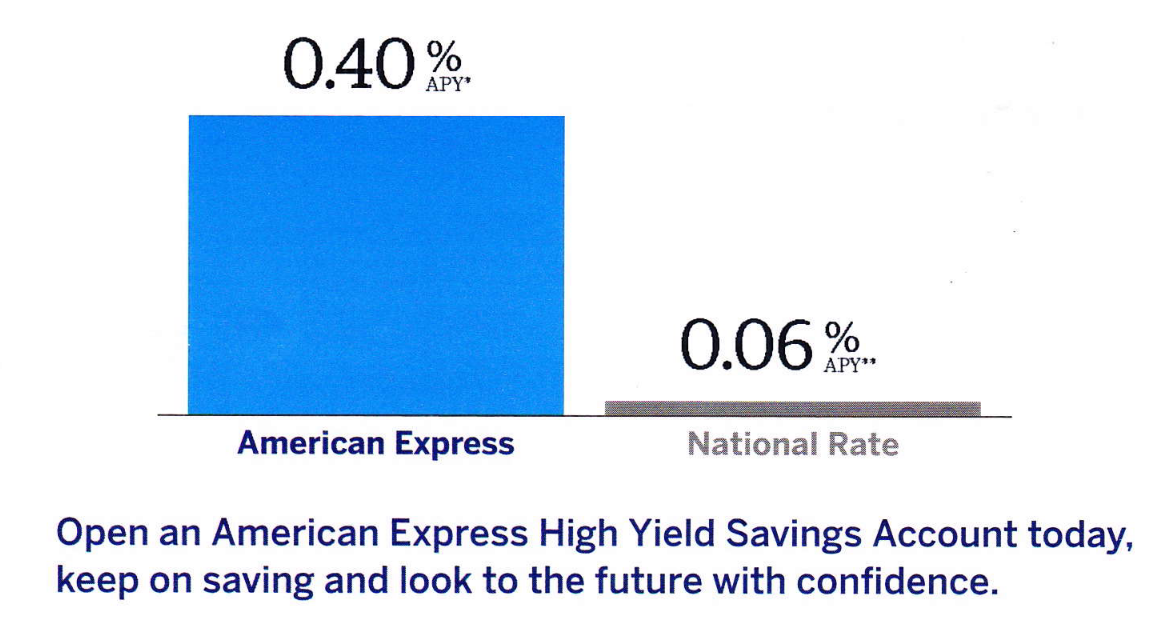

Bar chart in Amex mailing exaggerates annual rate of return for advertised savings account.

Even without an account, lender may share users’ personal information with third parties.