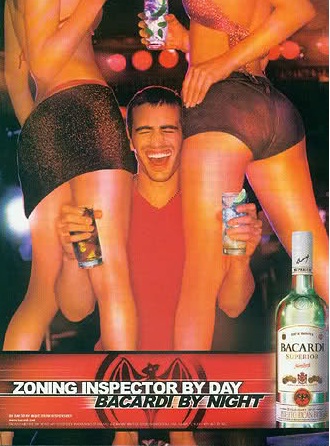

Are All Alcohol Ads Misleading?

I was surprised when I learned that there are no specific rules or regulations governing alcohol advertising on television. While tobacco products are prohibited from advertising on TV altogether, it’s…

Ads can legally lie to you as long as the lie is so obvious an exaggeration that you know not to take it seriously.

| Bonnie Patten

Puffery—not to be confused with the cute little seabird, the puffin—is a legal defense used by marketers to avoid claims of false advertising. Boiled down to its essence, puffery is simply permissible lying. That’s right my friends, ads can legally lie to you as long as the lie is so obvious an exaggeration that you know not to take it seriously. But drawing the line between what’s clearly BS and what are factual assertions can be a tricky matter. Take the list below for example – can you spot the two phrases courts found to be factual assertions as opposed to plain and simple BS?

Courts found that the last two entries were actually factual assertions capable of verification, whereas the rest of the entries were considered mere puffery – statements extremely unlikely to convince a consumer about the truth of the matter asserted. Clear as a bell, right?

Unfortunately, separating marketing fact from fiction isn’t always that easy, and when marketers are challenged on murky claims they won’t hesitate to say they’re just puffin with you.

Take the defense of Standard & Poor’s Rating Services in the $5 billion fraud case brought against it by the U.S. government. In that case, S&P recently tried to claim that alleged fraudulent statements it made about its objectivity and independence were simply puffery comments that no reasonable investor would have relied on. The court characterized the defense as follows:

[S&P] lead[s] off with a proposition that is deeply and unavoidably troubling when you take a moment to consider its implications. They claim that, out of all the public statements that S&P made to investors, issuers, regulators, and legislators regarding the company’s procedures for providing objective, data-based credit ratings that were unaffected by potential conflicts of interest, not one statement should have been relied upon by investors, issuers, regulators, or legislators who needed to be able to count on objective, data-based credit ratings.

Yup, that’s exactly what S&P claimed. But no doubt, this is one example of the puffery defense that even our feathered friend the puffin would reject.

Vitaminwater made a similar puffery defense, claiming that “no reasonable consumer could reasonably be misled into thinking vitaminwater was a healthy beverage.” For more on that, click here.

I was surprised when I learned that there are no specific rules or regulations governing alcohol advertising on television. While tobacco products are prohibited from advertising on TV altogether, it’s…

By the time Paul Gauguin left his wife and five kids to pursue a painting career in Tahiti, Polynesian women were not wandering around the island half naked. In fact,…

Diamonds, energy supplements and cholesterol reducing drugs made legal headlines in the I-think-you’re-lying-to-me category during the week of February 11, 2013. Two new false advertising actions were filed: It’s a…