Overdraft Fees at BayPort Credit Union

In June 2020, a class-action lawsuit was filed against BayPort Credit Union for allegedly misleadingly representing that it only charges overdraft fees on transactions if a checking account does not have enough money to pay for a transaction when, according to plaintiffs, the credit union charges such fees on transactions that do not actually overdraw an account. (Driver et al v. BayPort Credit Union, Case No. 20-cv-90, E.D. Va.)

For more of TINA.org’s coverage of banks and credit unions, click here.

Class-Action Tracker

The Latest

Spirit Halloween Costumes

What you see on the website may not be what you get.

‘Noninvasive Blood Glucose Monitors’

Why diabetes patients should research carefully before buying.

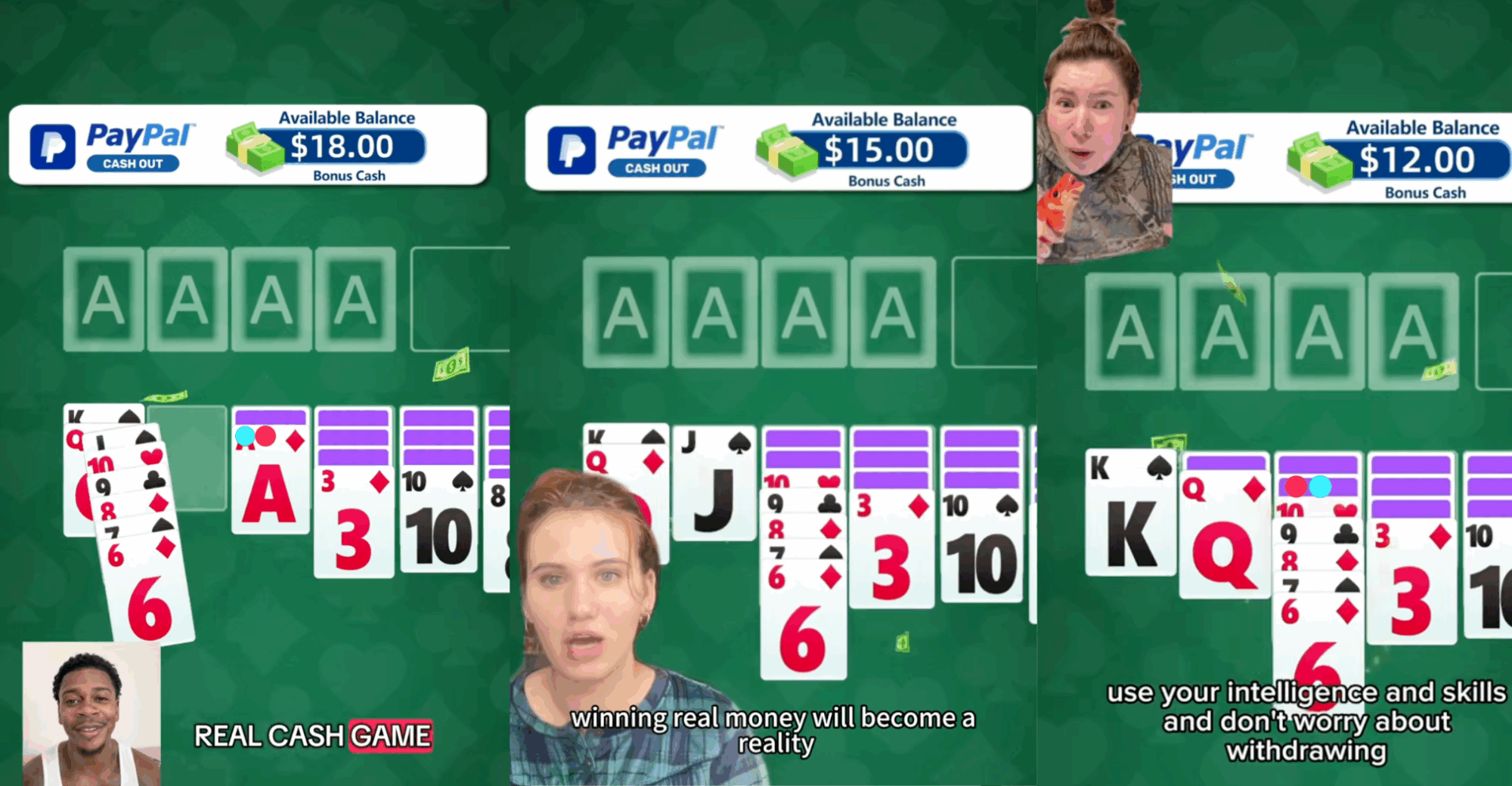

Solitaire Clash

Can you really make bank playing solitaire on your phone?

TideWe

Don’t get lost in this outdoor company’s dubious origin story.

Homeaglow’s $19 house cleaning service traps customers in hard-to-cancel subscriptions, watchdog group says

Stephanie Zimmermann, Chicago Sun Times