Overdraft Fees at BayPort Credit Union

In June 2020, a class-action lawsuit was filed against BayPort Credit Union for allegedly misleadingly representing that it only charges overdraft fees on transactions if a checking account does not have enough money to pay for a transaction when, according to plaintiffs, the credit union charges such fees on transactions that do not actually overdraw an account. (Driver et al v. BayPort Credit Union, Case No. 20-cv-90, E.D. Va.)

For more of TINA.org’s coverage of banks and credit unions, click here.

Class-Action Tracker

The Latest

Strung

This jewelry company may string you along.

Best Reader Tips of 2025

Consumer complaints worth remembering.

How Marketers Trick Kids, and Why Parents Should Worry

Herb Weisbaum, Consumers’ Checkbook

Saatva

TINA.org pulls back the covers on this company’s Made in USA marketing.

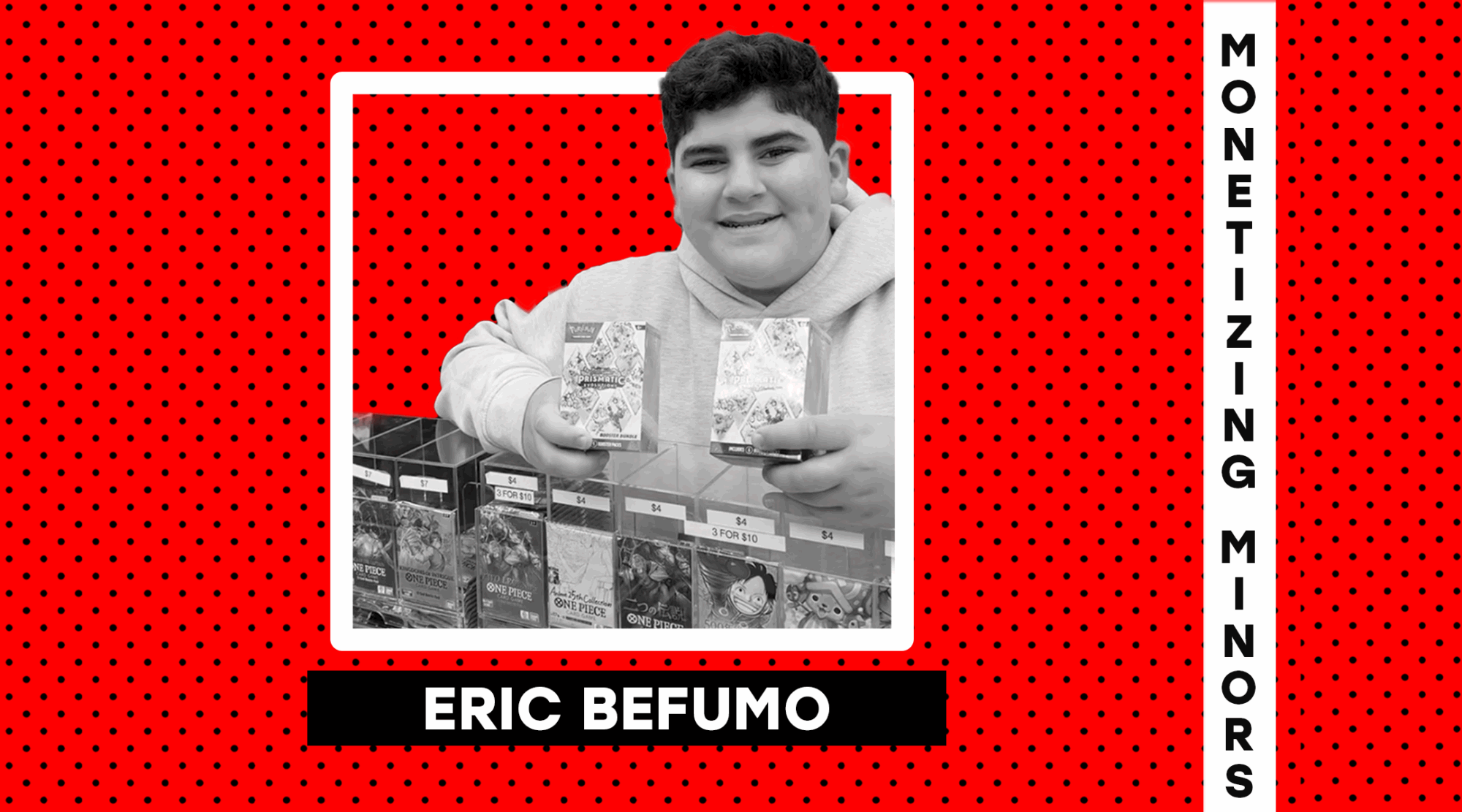

Monetizing Minors: Eric Befumo (aka Big Justice)

Brand partnerships worthy of a big “doom!”