Citibank’s Overdraft and Insufficient Funds Fees

Allegations: Misrepresenting how many overdraft or insufficient funds fees consumers could be charged on a single transaction

June 2019: A federal judge granted the bank’s motion to compel arbitration and the case was stayed pending the outcome of arbitration.

February 2019: A class-action lawsuit was filed against Citibank for allegedly misleadingly representing that it charges Foreign Exchange Fees on transactions made outside of the United States without disclosing that it also charges such fees on transactions conducted within the United States on international websites. (Sponheim et al v. Citibank, N.A., Case No. 19-cv-264, C.D. Cal.)

For more of TINA.org’s coverage of banks, click here.

Allegations: Misrepresenting how many overdraft or insufficient funds fees consumers could be charged on a single transaction

Allegations: Marketing that the bank is dedicated to military members, veterans, and their families and provides more benefits than required under the Servicemembers Civil Relief Act (SCRA) when it systematically…

In February 2018, a class-action lawsuit was filed against Citibank for allegedly misleadingly marketing that the bank charges no more than $12 a month for basic checking account services without…

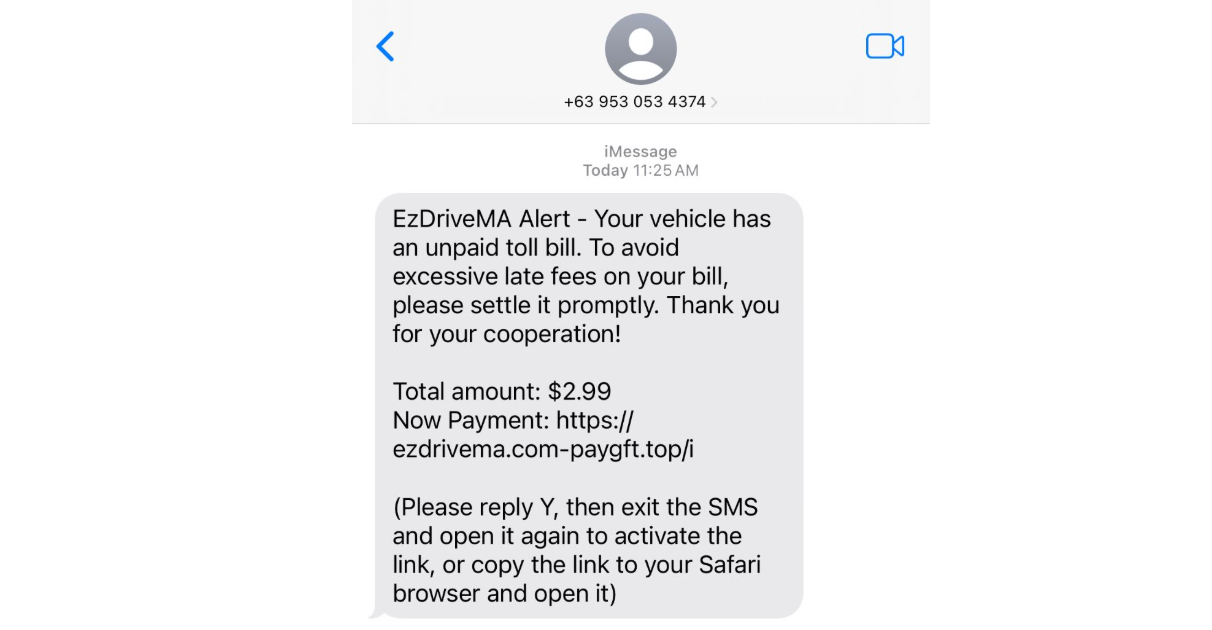

Got a text about unpaid tolls? Here’s what you need to know.

If you’ve been misled by an ad, regulators want to hear from you. We do too.

It’s easier to rack up hidden fees than it is to cancel.

The only thing more “ridiculous” than the touted benefits is the cancellation process.

Under a proposed bill, theaters could be fined for making moviegoers guess.