TINA.org Supports FTC’s ‘Click to Cancel’ Rule against Industry Challenge

Companies should not be able to trap consumers into subscriptions that they do not want.

Deceptive mailings attempt to trick homeowners into thinking they need to take action.

| Isaiah Keyes

“Watch your mailbox over the next couple months,” our real estate agent told my partner and me upon closing on our first home. “You’re going to get flooded with scams.”

Our agent went on to explain that deed registries are publicly accessible, so scammers can search them to find homeowners’ names and addresses. They then inundate homeowners with offers for unnecessary services, many of which are disguised as bills or designed to look like the sender is affiliated with the government or the homeowner’s lender.

Sure enough, over the next few weeks we accumulated a stack of deceptive mail offers for various mortgage-related services. So I decided to have some fun and grade these scammers on how effectively they put together their operation.

I’ve graded on a scale of 1-10, with 1 being the worst – or least likely to trick a homeowner into thinking they need to take action – and 10 being the best, or most likely to fool a homeowner into believing they need to do something. Hey, if I’m going to be scammed, it should at least be by someone who takes pride in their work!

Of course, there are other types of mortgage scams, like closing scams and relief or refinancing scams, but luckily I didn’t come across any of those.

Without further ado…

Click on the company to see how they earned their score.

“Home Mortgage Group” prominently discloses on the envelope that this is an offer, instead of claiming it’s a bill or important document. That’s not a bad disclosure, so I had to dock points from their total for not being deceptive enough.

However, the letter’s seemingly-official watermark (and the fact that carefully-cut laminate windows on the envelop hid the “PROPOSED FOR” language above my name) earned those points right back.

The accompanying letter explains that “Home Mortgage Group,” aka Globe Life, is offering “Mortgage Protection Insurance” for “as low as” $10.99 a month, which they claim will protect my mortgage from missed payments due to death or serious injury. Globe Life President Jason Harvey states that “Acceptance is guaranteed if you are between the ages of 18 and 69,” and that “this valuable offer is currently not available to everyone.” Nothing says “selective” like “everyone’s qualified!”

Also worth noting, “Mortgage Protection Insurance” (MPI) is more often referred to as Mortgage Protection Life insurance (MPLI). When Globe Life omits that one word from its plan title, it bears an uncanny resemblance to Private Mortgage Insurance (PMI), a common form of insurance lenders may require for borrowers paying less than 20% down.

Score: 4/10

Some homeowners may actually want MPLI (though you may not need it). But Globe Life’s crafty naming, omission of the company name from the envelope and watermarking are all deceptive.

This was a better effort than Globe Life, but it still falls short. The envelope looks like it could be legitimate:

This “important notice” of “dated” and “time-sensitive” material is addressed “to borrower,” which gives the impression that it may be affiliated with our lender. Sure enough, when I opened the letter I was greeted by our lender’s name in giant letters at the top of the page…

…followed by the significantly smaller disclaimer on the right-hand side that the company behind this mailing is not actually affiliated with our lender. I’m sure that won’t cause any confusion at all. In what will turn out to be a common theme, this was another a MPLI offer – the sender (named only in a footnote) is LeadPros, who will connect you with companies that offer MPLI plans.

Overall Score: 6/10

Even though the front of the envelope is well-designed, once the recipient opens the letter it is quickly disclosed that it’s just an offer for insurance (though the fact that the insurance may not be necessary isn’t so prominently disclosed). Also, creating a false sense of urgency by claiming to be “time-sensitive” is a common dark pattern used by bad actors, which may alert homeowners to the deception afoot.

The companies behind these postcards all need to discuss an incredibly important, “time sensitive” matter with us ASAP. Apparently, they were in such a rush to let us know, they all forgot to put their name on their mailings.

Meanwhile, the real name of our lender is plastered all over the cards, but the fine print in the bottom right corner discloses that the senders aren’t affiliated with, sponsored or endorsed by our lender, and that our information was not provided by our lender. In fact, we’ve seen this scam before.

Overall score: 2/10

These one-sided, vaguely phrased postcards that tell you to call an 800-number raised my eyebrows, and might make some other homeowners skeptical as well. That being said, the fact that the only company named on the card is our lender – which, to reiterate, is not affiliated with the sender in any way – is definitely an attempt at making us think it’s from our lender.

Now whoever put this one together clearly cares about the art of the grift! In a strange way, I feel proud of how much effort they put in, similar to how you may feel proud of your cat for dropping a desiccated mouse corpse at your feet. “Thanks, buddy…this might be gross and useless, and it feels like you may have committed a crime, but at least I know you care about me.”

The envelope warns us that the matter is time sensitive; though if this is the second notice, as the envelope claims, we must have totally missed the first. “Records Division” is a nice touch, though it’s dubious that the “records” for our North Carolina home are housed several hundred miles away in Kennesaw, GA. That’s one red flag.

Inside was a prepaid return envelope (addressed to “Direct Mail Network, LLC”) and a form labeled “FINAL MORTGAGE NOTICE COMPLETE AND RETURN,” asking us to “Please Respond By” Jan. 20, 2022.

It’s easy to skip over the text on the left-hand side (which extols the benefits of yet another MPLI plan) and not notice additional red flags, such as the idea that the local government would ask for the “best times to call” or would need you to confirm the borrower’s name when it’s already addressed to you.

Overall score: 9/10 I believe it’s likely that a homeowner would give this company their contact information.

For one thing, the only listed company name is “Records Division,” surely trying to trick homeowners that this is really from a government entity. The inclusion of a prepaid envelope could also serve to gloss over the unusual faraway return address, as it makes respondents able to reply without copying down an address.

This offer also doesn’t actually ask for money upfront, which could raise red flags for a recipient. The only point deduction is due to the prominent display of Kennesaw, GA on the envelope, which should be a clear sign that this is not really from their local government (unless, I suppose, they are one of the roughly 33,000 people people in Kennesaw, in which case this trick may be extra effective).

This one had my favorite envelope by far. Note the warning on the right-hand side:

That warning – that anyone who interferes with the delivery of this letter may face severe penalties – makes the letter seem incredibly important and official.

That is, until you look up the piece of US Code being referenced and realize the listed penalties are just the normal ones for stealing, opening or destroying any piece of mail that goes through the USPS. That means this letter is exactly as special as virtually every birthday card, cable offer or box of burnt photos and bad poetry from a vindictive ex that you’ve received.

There’s more deception inside:

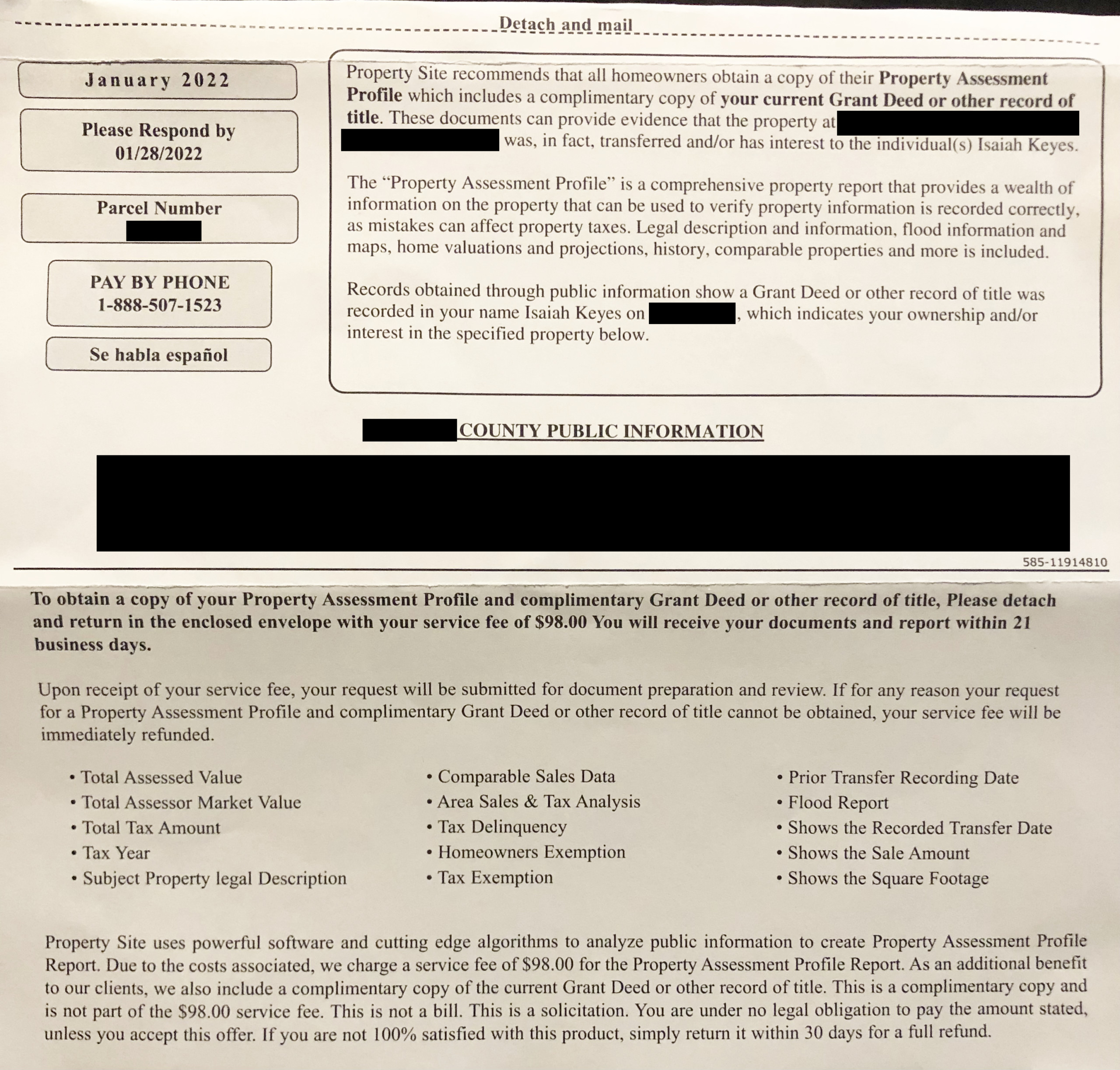

A “recorded deed notice” certainly sounds like something that would be required, and a $98 service fee seems plausible.

When I opened the envelope, the letter was folded into thirds, so the image above was exactly what I saw. If I followed the instructions to “detach and mail” the portion above the dotted line (along with $98 in the provided prepaid envelope) without unfolding the letter and reading it, I would have missed lots of important information conveniently left below the fold:

If that’s a lot and you don’t want to read it, I don’t blame you – that’s the point. What it doesn’t say explicitly (but does translate to) is that the $98 “service fee” is NOT something you owe, and (as hinted by the italicized fine print at the top of the page) has nothing to do with ensuring your deed gets recorded by the government.

In other words, this “recorded deed notice” isn’t really a notice about your deed’s recording so much as it’s a company saying “we noticed someone already recorded your deed. Wanna buy something?”

The $98 “service fee” isn’t a fee you owe, it’s just the cost of Property Site’s “Property Assessment Profile,” which Property Site “recommends that all homeowners obtain.” The company goes on to claim that the report “can be used to verify property information is recorded correctly, as mistakes can affect property taxes.”

In reviewing the mailing’s bullet-point description of the offer, it is unclear what, if anything, this service provides that was not already handled during the sale itself. For example, accurate and up-to-date property assessments (which include “comparable sales data”), legal descriptions of the property in question and tax data are required by most lenders before they’re willing to back the purchase at all. And why would homeowners need to see the “Sale Amount” after they’ve purchased the property?

Overall score: 9/10

Not only is this offer disguised as a bill, it explicitly tells the recipient to “detach” the explanation of what the “bill” is for – if that were any slimier, it could be a French delicacy.

I again had to deduct a point for a prominent out-of-state mailing address, though – if I didn’t fall for Kennesaw, GA, I’m definitely not going to fall for Norco, CA, but many homeowners, depending on where they live, easily could.

And the winner is…

It’s a tie! Both Records Division and Property Site finish with a score of 9/10!

The takeaway? Homeowners should be suspicious of any document sent to them about their mortgage that isn’t from an entity directly involved with the sale. Remember that legitimate companies won’t hide their names from their advertisements, and that if you ever doubt a document’s authenticity, you can ask your agent and/or lender.

Companies should not be able to trap consumers into subscriptions that they do not want.

Intuit should not advertise TurboTax Free Edition without making clear that most people cannot use it.

TINA.org submits comment in support of FTC’s proposal to ban fake celebrity endorsements, romance scams and other impersonation scams.