H.R. 3409: Protecting Pyramid Schemes, not Consumers

Former FTC economist outlines issues with new “anti-pyramid” bill.

FTC case-by-case prosecution of pyramid schemes not enough to deter them.

| Peter Vander Nat, Ph.D.

Now is time for ever greater clarity in the prosecution of pyramid schemes; case in point, Vemma. The FTC’s analysis of Vemma shows an organization that rewards participants primarily for recruitment, while its products (nutrition drinks) are just incidental to the proposed money-making venture. What is evident from the presentation of the facts is just how blatantly this scheme operated. Outrageous income representations all over the Internet and other venues, $200 million in annual revenues for the past two years, operating for more than 10 years, and involving multi-thousands of participants. The FTC will surely prevail and I laud its action. Yet, it is also an example of the limitation of case-by-case prosecution. Certainly, Vemma was aware of the FTC’s clear victory in BurnLounge (2008 – 2014) and other similar recent actions (e.g., in FHTM and Global Information Network, both in 2013) but none of these strong actions, as well as a string of other FTC prosecutions, deterred this organization from blatantly continuing on.

And then there is this: Could more than a handful of readers say when the following was written and by whom?

Modern pyramid schemes generally do not blatantly base commissions on the outright payment of fees, but instead try to disguise these payments to appear as if they are based on the sale of goods or services. The most common means employed to achieve this goal is to require a certain level of monthly purchases to qualify for commissions. While the sale of goods and services nominally generates all commissions in a system primarily funded by such purchases, in fact, those commissions are funded by purchases made to obtain the right to participate in the scheme. Each individual who profits, therefore, does so primarily from the payments of others who are themselves making payments in order to obtain their own profit … Such a plan is little more than a transfer scheme, dooming the vast majority of participants to financial failure.

The quote is from the FTC Staff Advisory on Pyramid Scheme Analysis, January 2004 – issued about the same time as when Vemma was initiated. As seen from the FTC’s filing of this case, could there be a more apt summary of the government’s core complaint against Vemma?

And then there is also this. In a posting by Chapman Capital in January of 2013, Mr. Chapman — who is again much in the news that surrounds Vemma– claimed: “Essentially, the [Advisory] letter states that if a product is marketable, the FTC is OK with the MLM. …” If there were a contest for the most inadequate characterization of the Advisory, I think Mr. Chapman’s summary could win first prize. My thesis is this: while case-by-case prosecution always remains necessary, it is not sufficient to deter pyramid schemes — and all the more in the face of continuing public misinformation that simply muddies the waters. We need the clarity that would be granted by a federal pyramid rule.

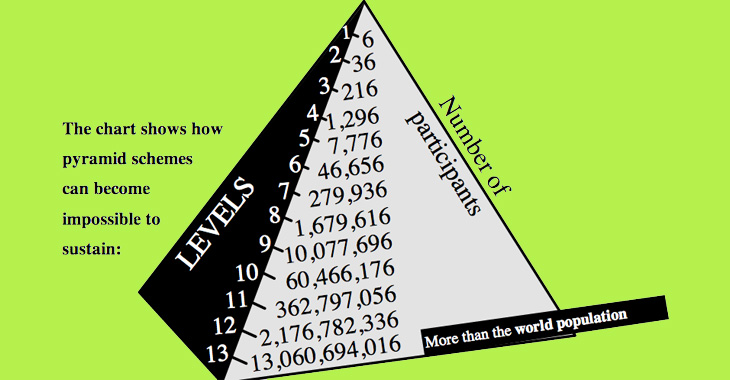

Presently, the government generally faces two types of circumstances: (I) cases in which it presents overwhelming up-front evidence that shutters the company immediately via a court injunction (e.g., FHTM and other ex parte actions, such as Vemma), or (ii) the government faces protracted litigated cases in which the agency argues, each time again, for a line of demarcation between a legitimate MLM and pyramid scheme and that the line has been crossed. And more, for the security of its litigation, the agency presents an abundance of evidence regarding income misrepresentations and purported company rules that are entirely ineffective in preventing a pyramid scheme, resulting in substantial, quantified losses for the vast majority of participants (as in BurnLounge and other cases). The first circumstance is effective in stopping a limited number of slam-dunk pyramid schemes, while the second is not sufficient to deter the ongoing propagation of pyramid schemes. We need the promulgation of a federal pyramid rule if we are ever to combat ongoing pyramid scheme harm.

Based on my experience with pyramid schemes over many years, I sketch two critical elements that a federal pyramid rule should include. First, the rule would set forth the meaning of a pyramid scheme in a multi-level marketing context (MLM). There are other contexts the rule may also address, but the latter is the most urgently needed. The characterization is not new – as it is based on the Koscot test– and has appeared in virtually every FTC pyramid case over the last 19 years. In an MLM context, an organization is a pyramid scheme if it rewards participants primarily for recruitment, while the firm’s product is incidental to the proposed business opportunity; moreover, the incidental nature of the product is chiefly evidenced by the payment of recruitment rewards having no cognizable or substantive relation to retail sales; i.e., sales to consumers who buy the product for their own end-use and are not incentivized to buy product for the sake of the business opportunity.

As a second main element, the rule would allow that once the government has established to the satisfaction of a court that the above characterization applies to a specific organization, the company is entitled to present affirmative defenses, such as what are commonly called “Amway defenses” (1975-1979). However, the burden of proof regarding such defenses falls on the company and not on the government to prove the contrary, and the rule would expressly say so. If the defendant claims a “70% rule” and/or a “retail sales rule,” or whatever other company rule is deemed relevant, the company must show that such rules exist, are enforced, and are effective in securing a connection with retail sales so as to defeat the government’s finding of a prima facie pyramid scheme. Or, in the words of the Omnitrition court (1996): “The key to any anti-pyramiding rule in a program like Omnitrition’s, where the basic structure serves to reward recruitment more than retailing, is that the rule must serve to tie recruitment bonuses to actual retail sales in some way (emphasis added). Only in this way can the second Koscot factor (recruitment rewards unrelated to retail sales) be defeated.” Such codified clarity would streamline pyramid prosecutions. A firm with a prima facie pyramid structure (as delineated above) either has been enforcing appropriate safeguards and has collected the relevant data, or it has not and quickly loses in the face of government prosecution under the rule.

NOTE: This blog should be read in the context of two subsequent blogs by the same author, one highlighting the fatal flaws of the industry-backed bill H.R. 5230 and the other supporting FTC Chairwoman Ramirez on the regulatory framework she outlined when speaking to the Direct Selling Association.

The views, opinions, and positions expressed in this blog post do not necessarily reflect the views, opinions, and positions of TINA.org.

Former FTC economist outlines issues with new “anti-pyramid” bill.

Vemma settlement clarifies FTC’s position on what constitutes a legitimate MLM.

Readers have told us to look into these MLMs.