So You Say Your MLM Offers “Supplemental Income” – What Does That Mean?

Exploring the MLM industry’s latest pivot.

Vemma settlement clarifies FTC’s position on what constitutes a legitimate MLM.

| Peter Vander Nat, Ph.D | William Keep, Ph.D.

The recent FTC settlement with Vemma represents a strong victory for consumer protection in prohibiting pyramid schemes. To appreciate the terms of the FTC order, let’s recall that Vemma’s proposal for its members to become successful and rich was deceptively simple. An aspiring participant need only enroll two Affiliates who each purchase sufficient product to become bonus-qualified, each one of whom in turn enrolls two others who purchase enough product to become bonus-qualified, ostensibly continuing on indefinitely, while all involved would become rich in due course. Briefly, the core proposal was this: get two and get rich – a form of magical thinking worthy of Alice in Wonderland.

The Vemma Order

Both in general thrust and specific terms, the elements of the Vemma order are an exemplar of the Chairwoman’s recent advice to the DSA. Going back as far as the FTC Staff Advisory of 2004, a well-known avenue to disguise rewards for recruitment as commissions on a product sale is to have participants make monthly “qualifying purchases”; i.e., purchases which qualify a participant to receive bonuses and commissions. The Chairwoman’s advice reiterates that an important part of legitimate multilevel marking is a compensation system that is not funded primarily by participant purchases undertaken to meet the qualifications for rewards –in common parlance, pay-to-play.

From the court’s review of the company’s sources of revenue, it becomes evident that Vemma’s reward system was funded predominantly through participant qualifying purchases. The FTC order now prohibits the company “to link or tie any participant’s compensation, or eligibility to receive compensation, to that participant’s purchase of goods or services.”

The Chairwoman further reminded the DSA that the main business purpose of an MLM, properly construed, is to engage in profitable sales to persons who are not participants in the business opportunity. And the Vemma order now specifically prohibits “paying a participant any compensation related to the sale of goods or services in a fixed pay period unless the majority of the total revenue generated during the period by the participant and others within the participant’s downline is derived from sales to persons who are not participants in the business venture.”

The order thus establishes a clear and simple 51% rule; i.e., regarding any stated downline, the majority of sales must be to consumers outside the business venture in order for any one in that downline, including the top participant, to be paid compensation by the company – coincidentally (should scholarly etiquette permit us to note this), a rule consistent with our analysis of case law published fourteen years ago.

Clearer Messaging

The FTC’s public messaging to consumers about the difference between a pyramid scheme and a legitimate MLM is continually more on the mark and easier for consumers to understand. In a staff blog at the agency’s website re the Vemma settlement it states: “Keep in mind that in a legitimate multilevel marketing program you make money by selling the product, not by recruiting others to join and buy product” – a message that is a definite step up from a more elliptical industry summary that in a legitimate MLM you make money by selling product, not recruiting.

That version is not squarely on the mark, as a pyramid scheme with an MLM structure could readily retort, as did BurnLounge (a convicted pyramid scheme), that they sell an abundance of product and that no one gets paid any compensation apart from product sales. However, there one discovers from business records that BurnLounge was primarily, and in practice, referencing the company’s own sale of product to its “Moguls”; i.e., it was mostly identifying participant purchases.

The strong action in Vemma further signals the MLM industry that the following trio of questions, though simple in nature, can provide the basis for an FTC action against an MLM:

These questions equally pertained to BurnLounge.

Under Vemma’s business model the sole product seller was the parent company and the only significant product buyers were the distributors. And the distributors (also called Affiliates) were relieved of any selling obligation; indeed, compensation from the company required only that the participant be bonus-qualified; i.e., that the Affiliate purchase the requisite amount of product. These purchases overwhelmingly comprised the funding source for the rewards paid out by Vemma (and in general terms applicable to BurnLounge as well).

Also noteworthy is that at the preliminary injunction hearing, Vemma’s chief financial officer stated, “It was important to let customers purchase the product at the same price as our Affiliates… and they can order direct from the company,” confirming that in Vemma’s business model there was no wholesale/retail opportunity at all. In other words, Vemma provided zero retail incentives to its Affiliates.

Importantly, it is evident that the FTC order against Vemma, agreed upon by all parties, rejects the position of the DSA president:

The legal analysis should be: is the product being used by real consumers? Whether the consumer is a distributor is immaterial.

To the contrary, the Vemma order stands for the proposition that whether the distributors are the predominant consumers of the product — an outcome secured by the totality of terms and conditions of that company’s business model — is highly material to pyramid scheme analysis.

The Meaning of a Closed Network System

A critical part of a product-based pyramid scheme is that it is essentially a closed network developed and sustained by fraud. Participants recruit others to join and buy product, who recruit others to join and buy product, etc., while few if any engage in retail activity; i.e., sales to people outside the network.

A critical part of a product-based pyramid scheme is that it is essentially a closed network developed and sustained by fraud. Participants recruit others to join and buy product, who recruit others to join and buy product, etc., while few if any engage in retail activity; i.e., sales to people outside the network.

Vemma’s business model was a paradigm example, as incentives for retail activity were nullified by the rules of the program (just make sure you’re bonus-qualified) and the further provision that customers and Affiliates pay the same product price.

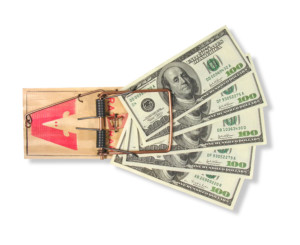

For a moment, place the specific product aside and ask this question: in such a closed network of in-payments comprised of purchases and out-payments comprised of rewards, how would it be possible for a generic participant to receive on a regular basis more than what the generic participant pays into this network?

Answer: it is mathematically impossible. At its core, the fraud requires that in order for a few to win, others must lose. And typically, those who design the rules for such a system are in a position to delimit the set of winners and strongly influence who will be among them.

Consider now whatever product may be adjoined to this closed network and assume that a generic participant pays the company $350/month for product purchases. Even granting a very high profit margin with very low transactional costs, a generic participant could only receive less than $350 a month on a regular basis, as some of the revenue is needed for the cost of goods sold and the operational costs for the system.

Thus, one sees the deception involved with lucrative income claims made to general participants in a closed system of purchases and related rewards. If some of the participants receive multi-thousands of dollars a month it can only be so because the rules of the program secure that the vast majority of participants are not in a position to recoup their own in-payments. While the specific rules may vary from one pyramid program to another, the constant is that every pyramid scheme is a transfer scheme; i.e., the losses of the vast majority comprise winnings for a few.

The import of the Vemma order is that in a legitimate multilevel marketing program the participants make money primarily by profitably selling product to persons outside the business venture — not by primarily being rewarded for recruiting more participants to buy product from the company.

Exploring the MLM industry’s latest pivot.

Court also finds that defendants made false and deceptive earnings claims.

Former FTC economist outlines issues with new “anti-pyramid” bill.