FTC to MLMs: You Lie, You Pay

The agency puts the MLM industry on notice.

How income claims, even truthful ones, can be deceptive when marketing the MLM business opportunity.

| Bonnie Patten

When promoting the business opportunity, multilevel marketing companies and their distributors should generally avoid making any income claims. Why? Because most MLM distributors make little to no money, and touting the possibility of making bank is just plain deceptive.

The law on income representations is really pretty simple: one cannot make an income claim that is not representative of what a typical distributor will earn. (Note: what the typical distributor earns is not the same as average earnings.) As a general matter, the typical distributor earns nothing – especially after taking expenses and costs into consideration – so most MLM income representations will violate FTC law.

In 2016, former FTC Chairwoman Edith Ramirez explained that:

multi-level marketers should stop presenting business opportunities as a way for individuals to quit their jobs, earn thousands of dollars a month, make career-level income, or get rich because in reality, very few participants … do have success of this type, testimonials from these rare individuals are likely to be misleading because participants generally do not realize similar incomes.

That means that even truthful testimonials from top-earning distributors are not acceptable. About three months after Ramirez’s statement, in January 2017, the FTC cautioned that (emphasis in original):

it’s unwise for MLMs to make earnings claims – expressly or by implication – that don’t reflect what typical participants achieve.

Since then, in January 2019, the Direct Selling Association (DSA) in conjunction with the BBB National Programs launched the Direct Selling Self-Regulatory Council (DSSRC), which primarily monitors the direct selling channel for inappropriate product and income claims. In July 2020, the DSSRC issued Guidance on Earnings Claims to “ensure all representations made by direct-selling companies or members of their salesforce comply with legal and self-regulatory standards.”

Further, since the COVID-19 pandemic the FTC has sent more than 10 warning letters to MLM companies concerning deceptive earnings representations. In those letters the FTC has noted that “claims about the potential to achieve a wealthy lifestyle, career-level income, or significant income are false or misleading if business opportunity participants generally do not achieve such results.”

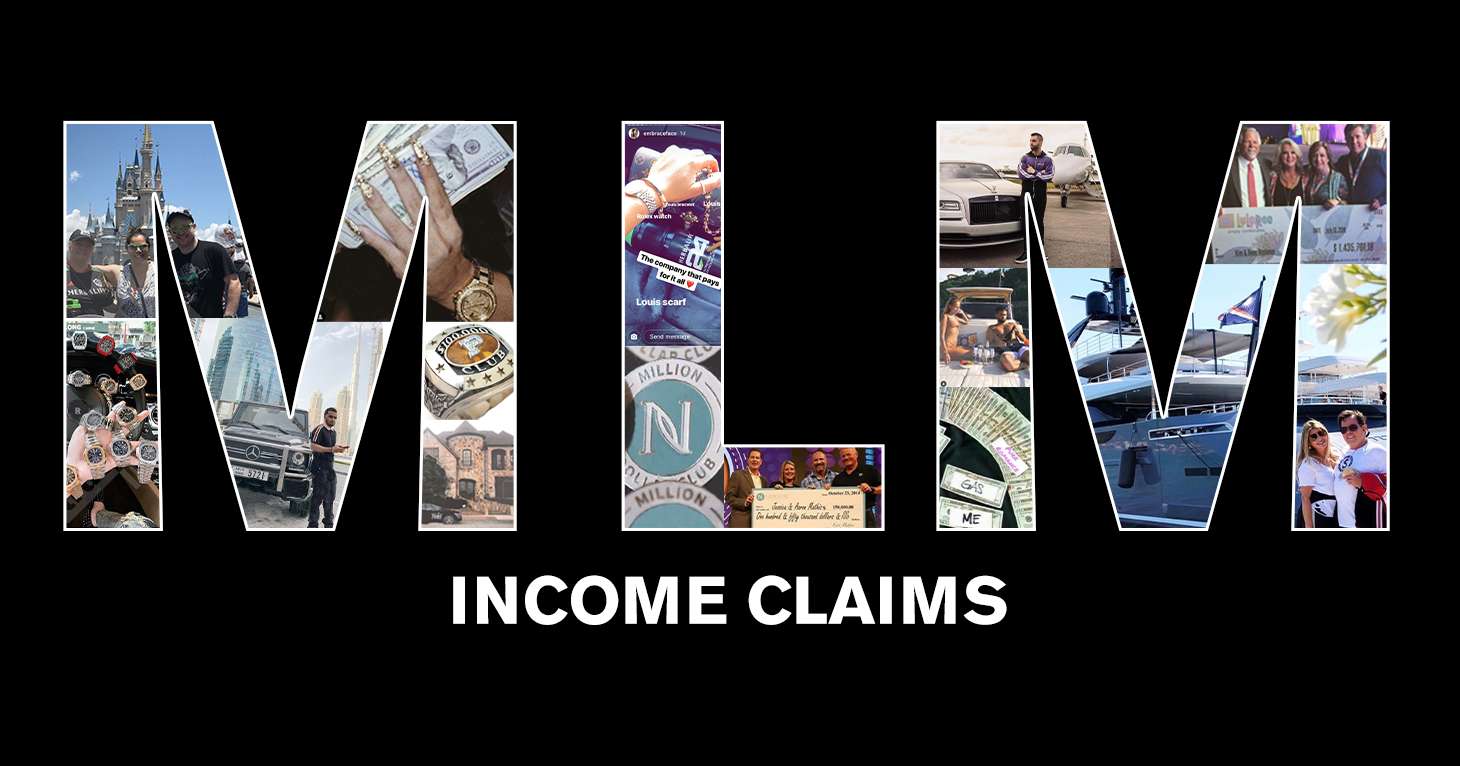

Below is a compilation of misleading income claims derived from FTC letters, decisions, statements and guidelines, as well as DSSRC guidance and decisions. It is an authoritative list of unlawful income representations used to promote MLM businesses. While direct selling companies and their distributors should avoid making atypical income claims altogether, the following language and visual imagery is sure to get those using them in trouble:

While some income and lifestyle claims may be permissible if they are accompanied by a clear and conspicuous disclaimer indicating what the typical distributor earns, many of the examples above highlight wealth that is so extraordinary that they cannot be effectively qualified by a disclosure of generally expected results. Which brings us back to where we started: MLMs and their distributors should generally not make income representations when promoting the business opportunity.

For more of TINA.org’s coverage of MLMs and income claims, click here.

The agency puts the MLM industry on notice.

And if you don’t know, now you know.

Court also finds that defendants made false and deceptive earnings claims.