Agora Still Using Deception and Dark Patterns to Ensnare Seniors

TINA.org refers publishing giant to FTC for enforcement action.

This crypto scam has cost hundreds of people thousands of dollars.

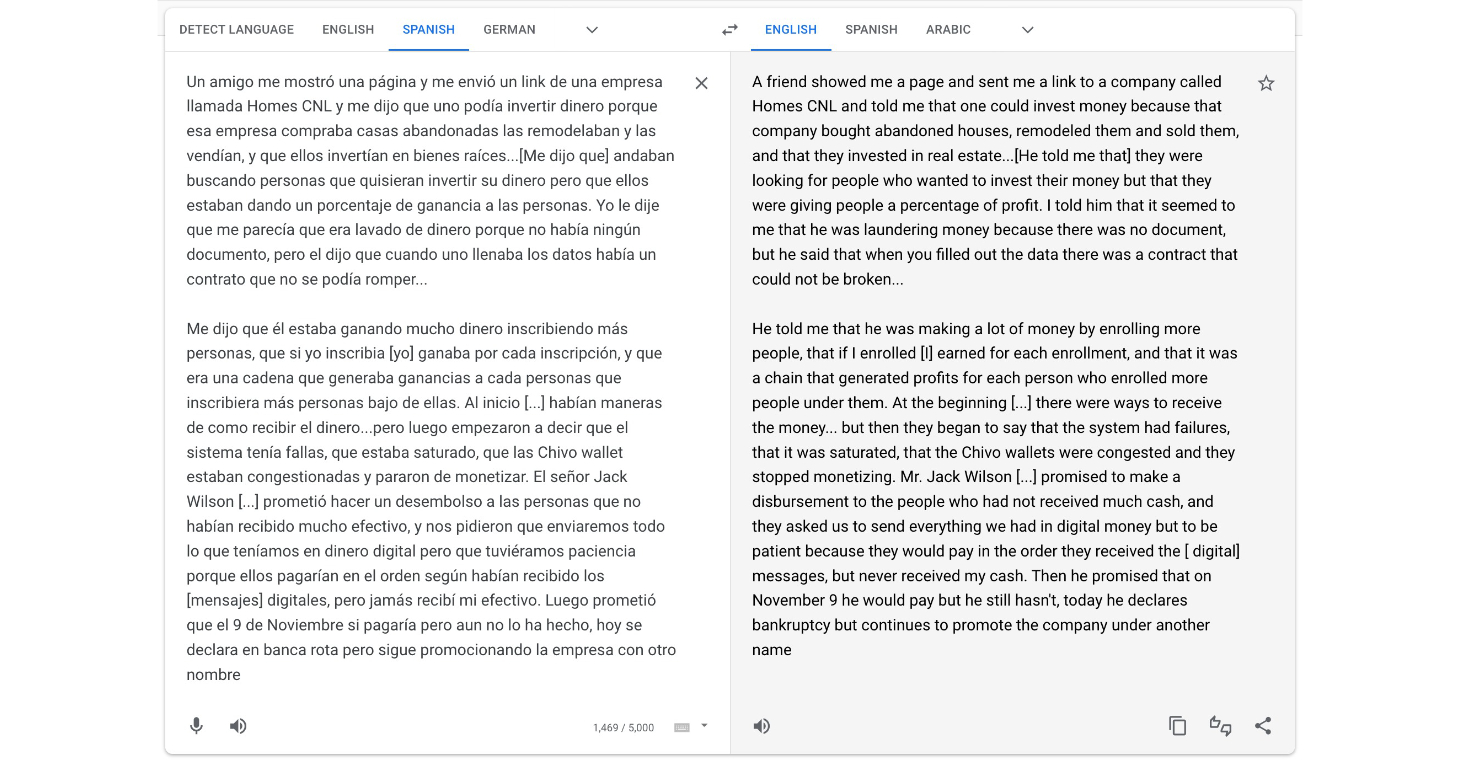

Since late last week, TINA.org has been inundated with very similar consumer complaints – over 700, at the time of this writing – which describe, in Spanish, a pair of nearly identical companies allegedly defrauding consumers, in some cases to the tune of several thousand dollars.

After identifying the source of these complaints – an organized group of Spanish-speaking victims fighting back against their scammers via a Change.org petition – TINA.org looked into their allegations against Homes CNL and Smart CNL.

Here are some things you should know about this family of “CNL” companies. TL;DR: Yes, these companies are Multilevel Marketing – a way of distributing products or services in which the distributors earn income from their own retail sales and from retail sales made by their direct and indirect recruits.s that have characteristics of both pyramid and Ponzi schemes, and they are targeting Latino communities in the U.S. and abroad with crypto-based fraud.

The CNL companies claim to offer real estate investment opportunities for consumers, telling them that:

The company also heavily emphasizes recruitment of new investors, describing a 1% “Matrix Bonus” flowing upwards from new recruits to those who brought them on in a distinctly triangle-shaped pattern:

Many of the consumer complaints TINA.org has received specifically name the companies’ CEO, Jack Wilson – one victim even nominated him for our Wall of Shame for “conning thousands of people.”

While TINA.org was unable to verify Wilson’s identity, some have doubted whether or not he even exists.

In addition, both Homes CNL and Smart CNL claim to be based in Washington state, but the Secretary of State’s business database doesn’t appear to have a listing for either. Further thickening the plot is the fact that both companies’ websites list addresses in Seattle, WA that are both for high-rise office buildings but neither address provides a suite or floor number. And the phone number listed for both companies (which is the same) leads to a generic voicemail message that does not mention a company name.

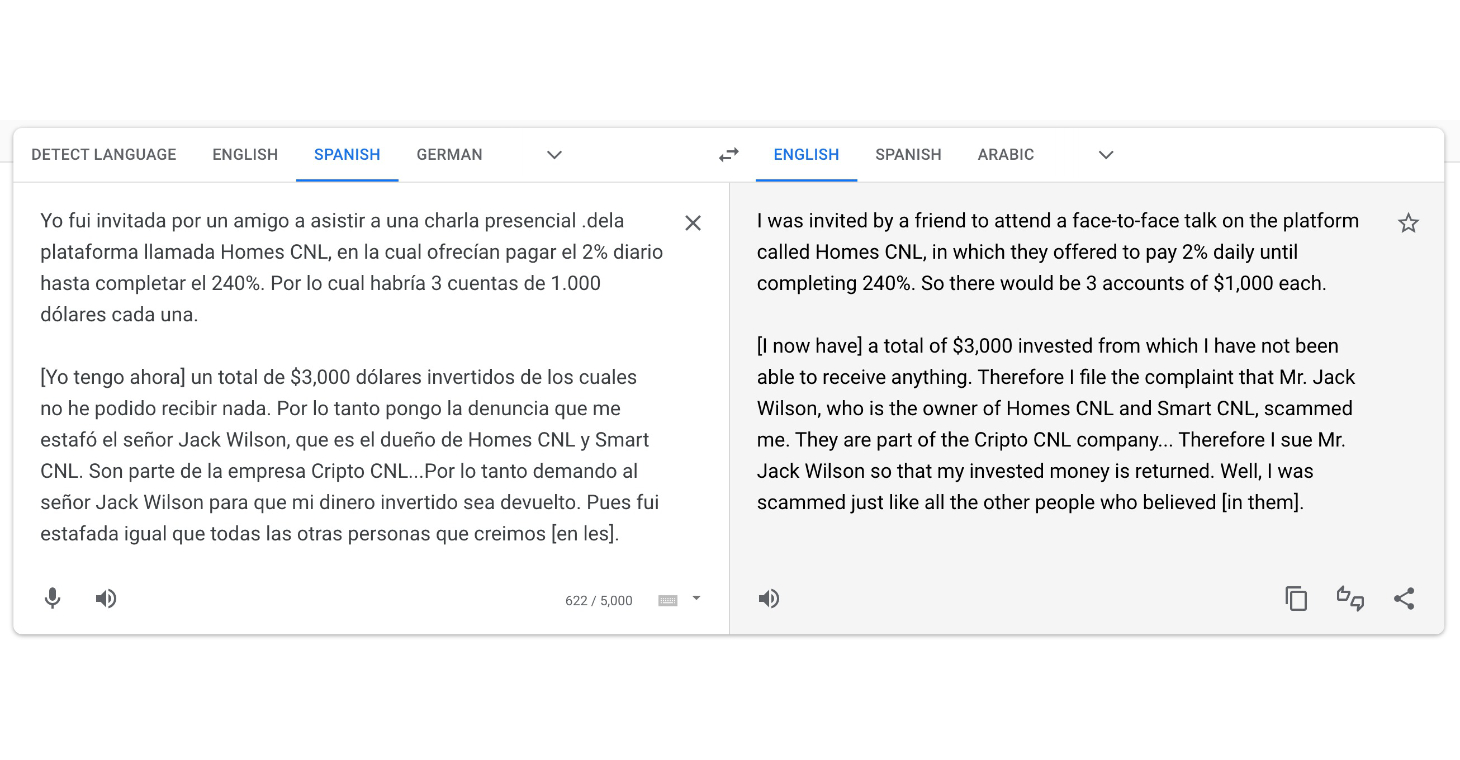

As TINA.org has written before, any guaranteed return on investment should raise eyebrows. But consumers should be especially wary of any guaranteed returns that are astronomically high, like those described in the CNL complaints:

“…[Homes CNL] promised to pay 2% daily on the investment, that is, as an ROI up to 240%, in addition to paying other bonuses for affiliation or recruitment…”

A daily 2% return on investment is a bold claim, considering that the average annual return on investment for residential real estate is about 10%.

Similarly, CNL’s assertion that it offers investors “sustainable results…in a market that is growing and that strengthens every day” doesn’t match the reality that every market – including the real estate market CNL companies claim to operate within – fluctuates wildly.

The CNL sites also make inappropriate income claims that mirror those TINA.org has seen in previous investigations into other MLMs, such as showing mansions, private jets and stacks of cash, or claiming that distributors can achieve the “life of [their] dreams” via the business opportunity.

In reality, most MLM participants make little to no money or even lose money. When discussing the earnings of its distributors, an MLM may not make deceptive use of unusual earnings realized by only a few distributors without running afoul of the law. Likewise, a failure to disclose that the structure of a program ensures that the vast majority of consumers cannot achieve substantial income is deceptive under the law.

Homes CNL and Smart CNL websites are nearly identical, with most of the language, images and other content being copy-and-pasted from one to the other.

An almost exact duplicate of an allegedly “unique” business opportunity is a red flag.

Homes CNL and Smart CNL aren’t just copies of each other, either. The two companies are reincarnations of Crypto CNL, a website that was first registered in November of 2021 and shut down sometime in June 2022. Archive.org captures from before the site went dark show that Crypto CNL advertised the exact same compensation structure and investment returns that Homes CNL and Smart CNL currently market, albeit with slightly different graphics.

At least two of Homes CNL’s Spanish-speaking promoters have recently been in serious legal trouble with financial regulators.

In 2017, the SEC fined Andrew Arrambide (shown here speaking at an event for Homes CNL in Ecuador) over $100,000 for promoting Uninvest Financial Services aka the Wings Network, which the agency described as an “international pyramid scheme targeting Latino communities in the U.S.” That judgment also banned Arrambide from marketing any company or program where participants are “compensated or promised compensation solely or primarily” for recruiting others.

In a similar vein, BehindMLM identified Juan Carlos Guinea as promoter for Homes CNL. Guinea was previously affiliated with AWS Mining, a crypto company that was later ordered by Texas regulators to cease its operations for misleading investors with guarantees of 200% profits, burying its risk disclosures, and not being properly registered with securities authorities. (TINA.org could not independently verify whether or not Guinea is, or has recently been, a promoter for Homes CNL or Smart CNL.)

The role that crypto-assets will play in the future economy is still unclear. For now, though, regulators say consumers should be extremely cautious of any crypto-related business opportunities.

One reason to be careful is that cryptocurrency is, by design, very difficult to trace, police and regulate. As the SEC has warned, crypto-fraudsters can “quickly send your money overseas, with little chance of you being able to get it back.”

That warning is increasingly relevant: Last week, the CFPB issued a report analyzing the dramatic rise in crypto-asset consumer complaints over the past few years. Of the 8,300-plus crypto-related submissions the agency has handled in recent years, a whopping 40% allege fraud or a scam, while another 16% describe assets not being available when promised. Both of these issues are named in the Change.org petition and the CNL complaints flooding TINA.org’s inbox:

“…at the beginning, [Crypto CNL] paid [distributors] for several months…but it suddenly stopped paying, and at the same time changed its name to Homes CNL…it later made the excuse that the payment gateway and blockchain software through which it paid commissions to investors and affiliates no longer worked…The fact is, after three months of various communications by Zoom and Telegram, [Wilson] failed. He failed with the payment dates, and to this day does not pay.”

Before making any investment, consumers should do their due diligence and research the company offering the asset. This is doubly true for assets that are tied to cryptocurrency, which is rapidly becoming a preferred strategy for scammers.

If you have already given money to Homes CNL, Smart CNL, Crypto CNL or any other version of this scam that TINA.org is yet unaware of, you may want to consider filing fraud reports with the FTC and SEC.

TINA.org refers publishing giant to FTC for enforcement action.

A master list of known and alleged scams.

From fairwashing to fragrance, consumers have plenty to watch out for in 2021.