TINA.org Webinar: FTC’s Remedial Authority After AMG

In case you missed it, watch the webinar with FTC Commissioner Rohit Chopra.

Married couples' phantom debt collection scheme headlines recent sweep.

Someone calls to settle a debt that they say you owe, threatening garnishment of wages, arrest or other legal action if left unpaid. You pay hundreds or thousands of dollars toward this so-called debt to stop the harassment. But it turns out you didn’t owe any money at all.

That’s how one married couples’ phantom debt collection scheme swindled hundreds of thousands of dollars from consumers, alleged the FTC and Illinois Attorney General Lisa Madigan, whose joint settlement with Aurora, Ill.-based Payday Loan Recovery Group bans the company from the debt collection business and recoups $6.4 million for consumers.

“People should not be bullied, intimidated or scared into paying debts that they don’t actually owe, ” Madigan said at a recent press conference where the Payday Loan Recovery Group case headlined 30 new actions against deceptive and/or abusive debt collectors under a nationwide crackdown dubbed Operation Collection Protection.

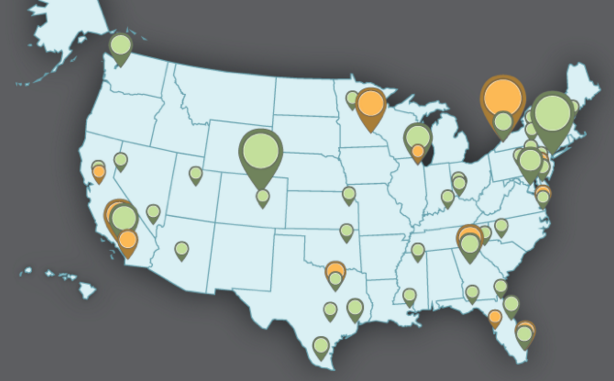

So far this year more than 115 actions have been taken against debt collectors under Operation Collection Protection, according to the FTC (see infographic below). Since 2010, the agency says it’s sued more than 250 debt collectors for breaking the law (which includes harassing or threatening consumers), banned 86 of them, and secured judgments totaling nearly $350 million.

If you get a call from a debt collector, be wary of these deceptive claims.

Find more of TINA.org’s coverage on debt here.

In case you missed it, watch the webinar with FTC Commissioner Rohit Chopra.

Experts weigh in on how to avoid being a victim of these latest campus scams.

There are laws on what collectors can say or do, as the country’s top two debt buyers recently found out.