J.G. Wentworth

If you have a structured settlement but you need ‘cash now,’ you may want to call someone else.

FTC alleges company pressures consumers into overpaying for its tax filing software.

Do-it-yourself tax filers, take note: Two of the most popular online tax preparation companies have recently been reprimanded for deceptively advertising their services as “free.”

After barring TurboTax owner Intuit from deceptively marketing its tax filing software as “free” in January, the FTC last month filed an administrative complaint against H&R Block accusing the company of misleading consumers.

But here’s where the FTC’s case against H&R Block is different: Not only does the agency allege that the company advertises its tax prep products as “free” when they are not free for many consumers (a fact that isn’t disclosed until consumers have started their tax return), the FTC also claims H&R Block engages in “data-wiping practices” that pressure consumers into overpaying for its software.

Specifically, according to the agency’s complaint, H&R Block deletes the tax information of consumers who choose to downgrade to a less expensive product during the filing process. This, the FTC says, presents consumers with an unfair choice: pay for a more expensive product they don’t want or need or lose all the tax information they’ve already entered and start the filing process from scratch. In addition, the FTC alleges, H&R Block requires that consumers communicate with customer service if they want to downgrade.

By contrast, upgrading to a more expensive product does not require any communication with customer service and the tax information is seamlessly transferred to the new product, according to the FTC.

In response to a request for comment on the FTC’s complaint, Dara Redler, chief legal officer at H&R Block said, “We believe we provide our clients with a great deal of value, unmatched tax expertise, and fair and transparent pricing,” adding:

H&R Block has offered a free DIY filing option for more than 20 years to help millions of Americans file their taxes. … H&R Block allows consumers to downgrade to a less-expensive DIY Product via multiple mechanisms while ensuring the preparation of accurate tax returns.

The takeaway? Consumers interested in filing their taxes for free should explore all their options. One place to start is the IRS’s website.

Find more of our coverage on tax preparation services here.

If you have a structured settlement but you need ‘cash now,’ you may want to call someone else.

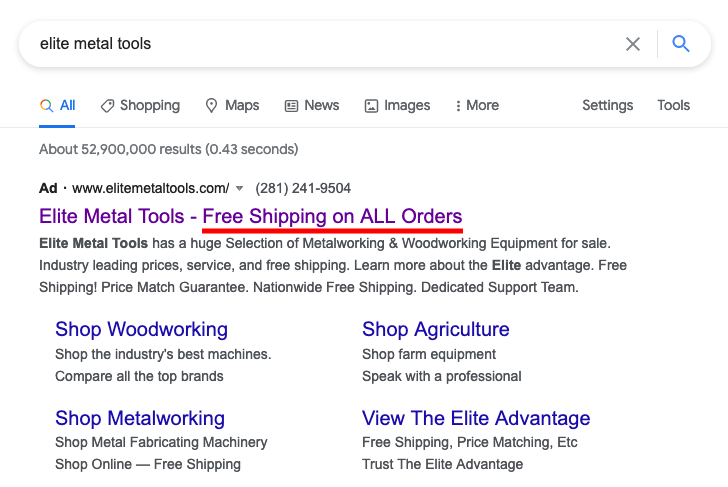

“Free Shipping on ALL Orders” turns out only to be good on around 90 percent of orders.

Company’s ads attempt to scare consumers into paying for title monitoring services that they may be able to get for free.