AARP Membership

The only thing more “ridiculous” than the touted benefits is the cancellation process.

With gas prices hitting record highs, now averaging $4.23 a gallon in the United States, we could all use a gas buddy.

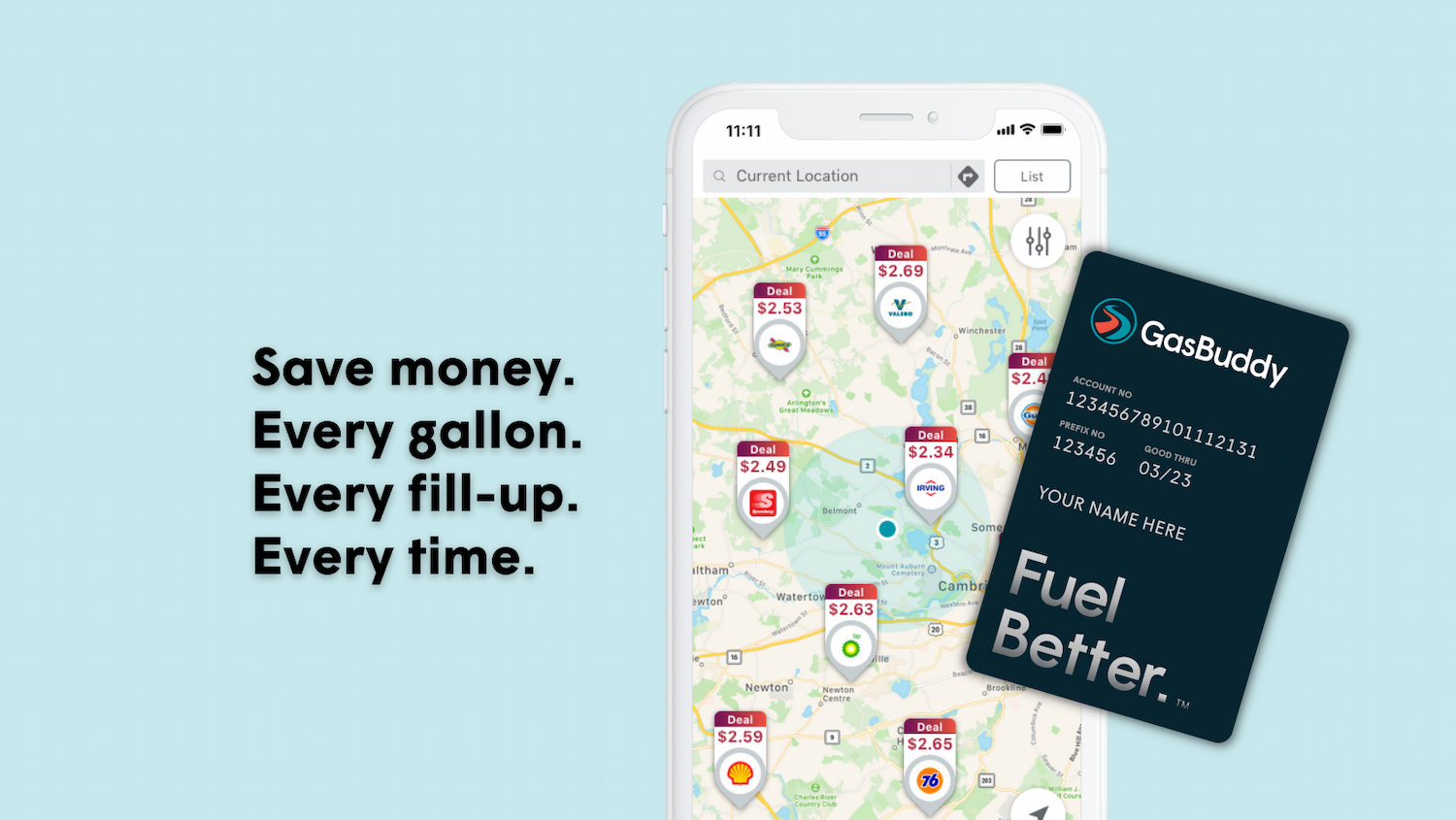

GasBuddy claims its payment card, which links to a user’s checking account, has saved consumers more than $17 million at the pump. But according to a class-action complaint filed against the company earlier this month, there are “huge, undisclosed risks” of using the card, despite claims by GasBuddy that the card works like a debit card.

[T]he service is nothing “like a debit card,” and transactions may be approved even when there are insufficient funds in an account and/or payments may not occur for several days after they are made.

The complaint continues:

While Plaintiff has saved a few pennies per gallon when using GasBuddy, he has incurred at least $200 in overdraft fees or NSF Fees (non-sufficient funds fees) from his bank as a result of using the card – penalties that far outweigh the benefits of the service.

While signing up for the card is free, the plaintiff, a Texas resident, pays GasBuddy $4.99 a month for a “premium” service that provides higher discounts on gas, according to the complaint.

In response to a request for comment on the pending lawsuit, a GasBuddy spokesperson said the company “denies any and all liability and plans to vigorously defend the case.”

GasBuddy also has an app for drivers looking for the cheapest gas. The app’s privacy practices have come under scrutiny in recent years.

In 2019, Car and Driver warned, “Free apps can have a cost, and with GasBuddy, the cost is letting advertisers know who and where you are.” And in 2020, GasBuddy landed on Popular Mechanics’ list of “11 Apps You Should Delete from Your Phone Right Now,” due to its data collection practices.

The GasBuddy spokesperson said that users need to opt-in to share location data and the company complies with all applicable privacy laws.

Find more of our coverage on auto ads here.

Our Ad Alerts are not just about false and deceptive marketing issues, but may also be about ads that, although not necessarily deceptive, should be viewed with caution. Ad Alerts can also be about single issues and may not include a comprehensive list of all marketing issues relating to the brand discussed.

The only thing more “ridiculous” than the touted benefits is the cancellation process.

Car wrap scam has plenty of gas left in the tank.

If you can take the time to fill the tank yourself, don’t pay Budget to do it.