Best Reader Tips of 2021

This year reader tips led to dozens of ad alerts, as well as a complaint to regulators.

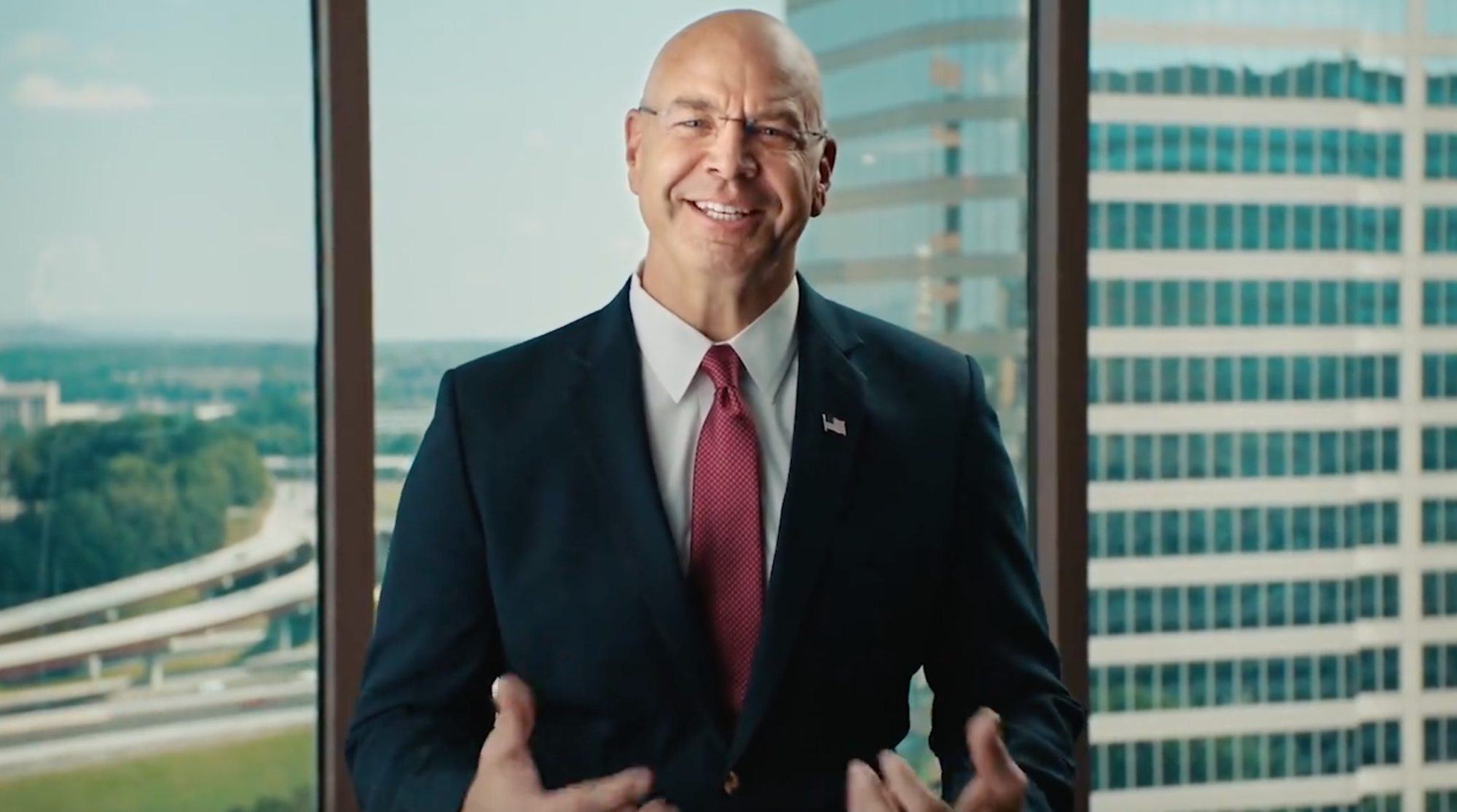

Editor’s Note: TINA.org has published a new ad alert on a Ty J. Young Facebook ad that started running in the summer of 2021 that makes a number of questionable claims. A previous update to this story in 2015 noted the launch of a new URL, www.neverlosemoney.com, which had redirected to www.tyjyoung.net but is now available for purchase. Our original article follows.

(Did you catch the fine print flashing by at the end of the above video?)

A trip to the Ty J. Young website informs you that you’ve entered the domain of a “wealth management firm specializing in principal protection investment strategies.” As Mr. Young states, among other things, “we keep it simple.” Awesome! Because who doesn’t like simple?

But before you sign on the dotted line, it’s worth reviewing the fine print on Ty’s website:

1. Insurance Salesmen. While Ty J. Young Inc. says that it’s a “national wealth management firm,” the fine print explains that this doesn’t mean it’s an investment advisory firm or registered with, or supervised by, the SEC or any state securities regulatory office for that matter. Au contraire. What “national wealth management firm” means to Ty J. Young Inc. is “an insurance company in the business of selling insurance products and soliciting insurance business.” And just so we’re crystal clear that what we’re really dealing with here are insurance salesmen, the site also notes that, “neither Ty J. Young, Inc., nor any agents acting on its behalf, should be viewed as providing legal, tax or investment advice.”

2. Not a Simple Annuity. The fine print also discloses what the mysterious “Simple…Protected…With a Reasonable Rate of Return” thing is. Wait for it…it’s a fixed index annuity, which is “not a securities product, but a product of the insurance industry and is not guaranteed by any bank or insured by the FDIC.” And while Ty J. Young calls this annuity “simple,” FINRA (the Financial Industry Regulatory Authority) characterizes such annuities as “complex financial instruments.” Consumers may also want to be mindful of what one publication, which provides analysis for wealth managers and registered financial advisors, noted: “the FIAs sold by Young’s firm are a poor investment, and … their complexity positions them to exploit uninformed customers.”

3. All About the Insurance Company. As for the claim of “Protected,” the fine print has something to say about that too. “Any reference to reserving rules does not guarantee the financial strength or wherewithal of a particular insurance carrier, and all accounts are subject to the claims paying ability of the custodian.” FINRA also warns consumers about guarantees:

Your guaranteed return is only as good as the insurance company that gives it. While it is not a common occurrence that a life insurance company is unable to meet its obligations, it happens. There are several private companies that rate an insurance company’s financial strength. Information about these firms can be found on the SEC’s website.

4. Hefty Penalties. Ty J. Young likes to say in its online video that its clients “don’t lose money,” but the fine print lets you know that’s not the end of the story, explaining that, “accounts may have a charge for surrendering the policy early or for early withdrawal.” Yup, that’s for sure because when it comes to equity indexed annuities, gains aren’t the only thing locked in. So is your principal money, perhaps for 10 years or more. Need to take your money out sooner? Sorry. Say hello to an early surrender charge. Oh yeah. And if taken prior to 59 ½ years of age, an early withdrawal may also be subject to taxes and a 10% federal penalty.

5. You Could Lose Money. And one more thing on the you-don’t-lose-money front. When asked whether it’s possible to lose money in equity indexed annuities, FINRA states:

Yes. Many insurance companies only guarantee that you’ll receive 87.5 percent of the premiums you paid, plus 1 to 3 percent interest. Therefore, if you don’t receive any index-linked interest, you could lose money on your investment. One way that you could not receive any index-linked interest is if the index linked to your annuity declines. The other way you may not receive any index-linked interest is if you surrender your EIA before maturity. Some insurance companies will not credit you with index-linked interest when you surrender your annuity early.

So while Mr. Young’s offering may appeal to you, know that a fixed index annuity is not simple and it’s not an investing or retirement panacea. Ask lots of questions. Consult an independent financial advisor. Utilize FINRA and the SEC as resources to assist in your due diligence. As with any investment decision, peel back the layers of marketing persuasion, read the fine print, think about the pluses and minuses as objectively as you can, and only invest in products you comfortably understand.

For more of TINA.org’s coverage of annuities click here.

Additional Resources:

FINRA link – http://www.finra.org/Investors/ProtectYourself/InvestorAlerts/AnnuitiesAndInsurance/P010614

This year reader tips led to dozens of ad alerts, as well as a complaint to regulators.

Ty J. Young’s fine print continues to be a must-read for consumers.