Little Ceaser’s Crazy Puffs

No eyebrows were harmed in the making of this Crazy Puffs commercial

In October 2013, a class-action lawsuit was filed against Willis of Colorado Inc., Willis Ltd., Willis Group Holdings Ltd., Willis North America, Inc., and Amy S. Baranoucky regarding their allegedly fraudulent involvement with and marketing of Stanford Financial Group, a financial services company based in Houston, Texas that was seized by U.S. authorities in 2009 because of charges of fraud.

With respect to the deceptive advertising allegations, the 90-page complaint claims that Stanford Financial misled Mexican and Venezuelan investors in a number of ways. Specifically, Stanford Financial allegedly misled investors into believing that investments in “SIB” Certificates of Deposits (CDs) were (1) safe and sound because SIB was part of the Stanford Financial Group based in Houston and therefore subject to U.S. government regulation; and (2) even safer than U.S. bank-issued CDs because Stanford Financial had unique Lloyds of London insurance policies in place that went above and beyond FDIC insurance. In reality, however, SIB was an Antiguan offshore bank, and Stanford Financial was operating a massive Ponzi scheme that collected billions of dollars from investors, according to the complaint.

The plaintiffs claim that the Willis defendants helped Stanford Financial with this false and deceptive marketing, among other things. (Janvey, et al. v. Willis of Colorado Inc., 13-cv-03980, N.D. Tex.)

No eyebrows were harmed in the making of this Crazy Puffs commercial

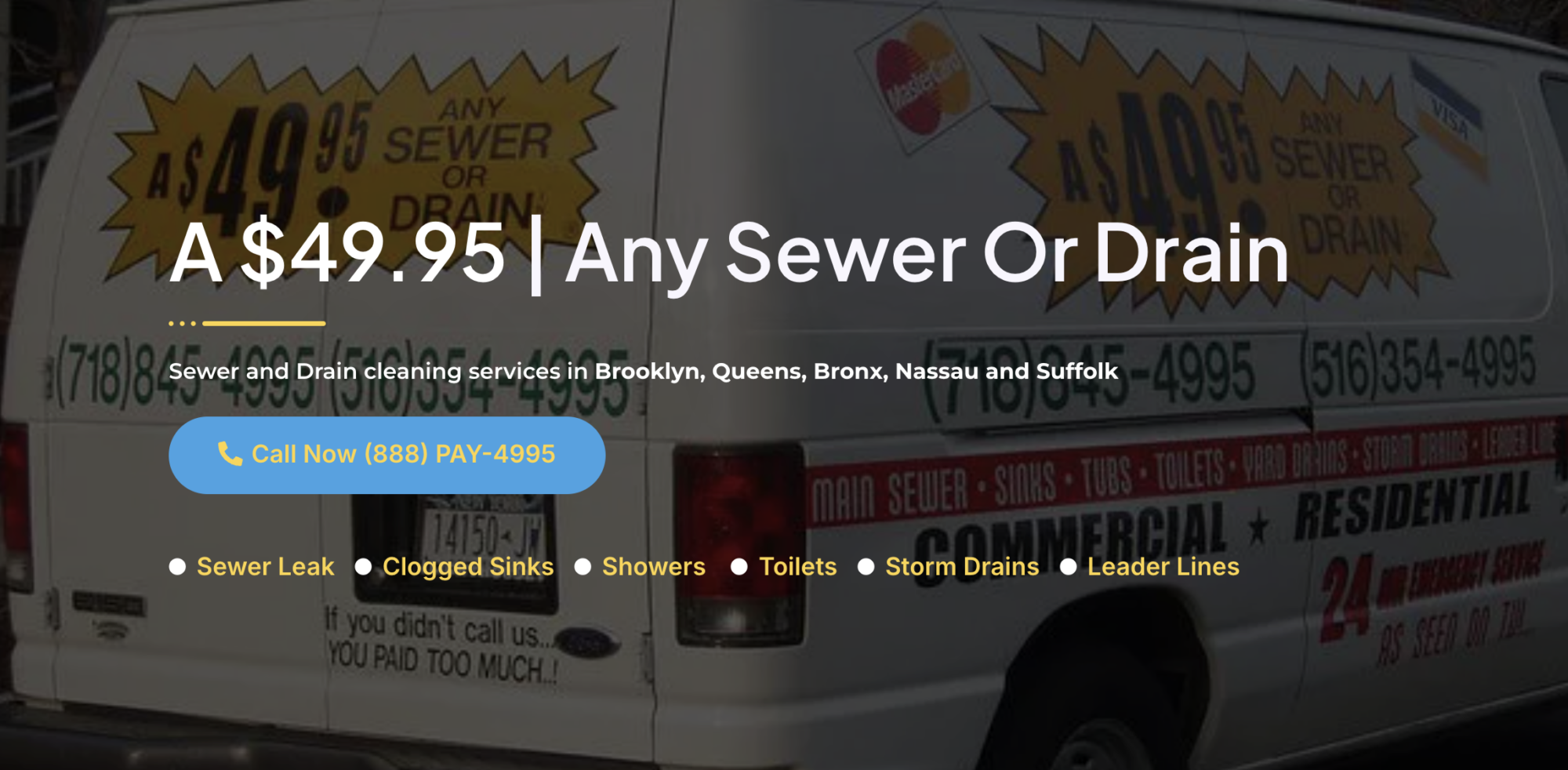

TINA.org reader was charged a lot more than the advertised price. He’s not alone.

TINA.org explores the divide between the marketing and the science.

Be wary of these life-changing claims.

TINA.org reader receives a suspicious email.