Credit Union 1 Overdraft Fees

Allegations: Misrepresenting when consumers will be charged overdraft fees

In August 2020, a class-action lawsuit was filed against Credit Union One for allegedly misleadingly representing that it charges overdraft fees only if there is not enough money in an account to cover a transaction when, according to plaintiffs, the credit union charges overdraft fees on certain transactions even when the account has enough money to cover the transaction. (Thompson et al v. Credit Union One, Case No. 20-cv-12318, E. D. Mich.)

For more of TINA.org’s coverage of lawsuits filed against banks and credit unions, click here.

Allegations: Misrepresenting when consumers will be charged overdraft fees

Getting hangry over a hidden delivery fee.

A deceptive marketing trend takes root.

Legislators should protect the work of the Consumer Financial Protection Bureau.

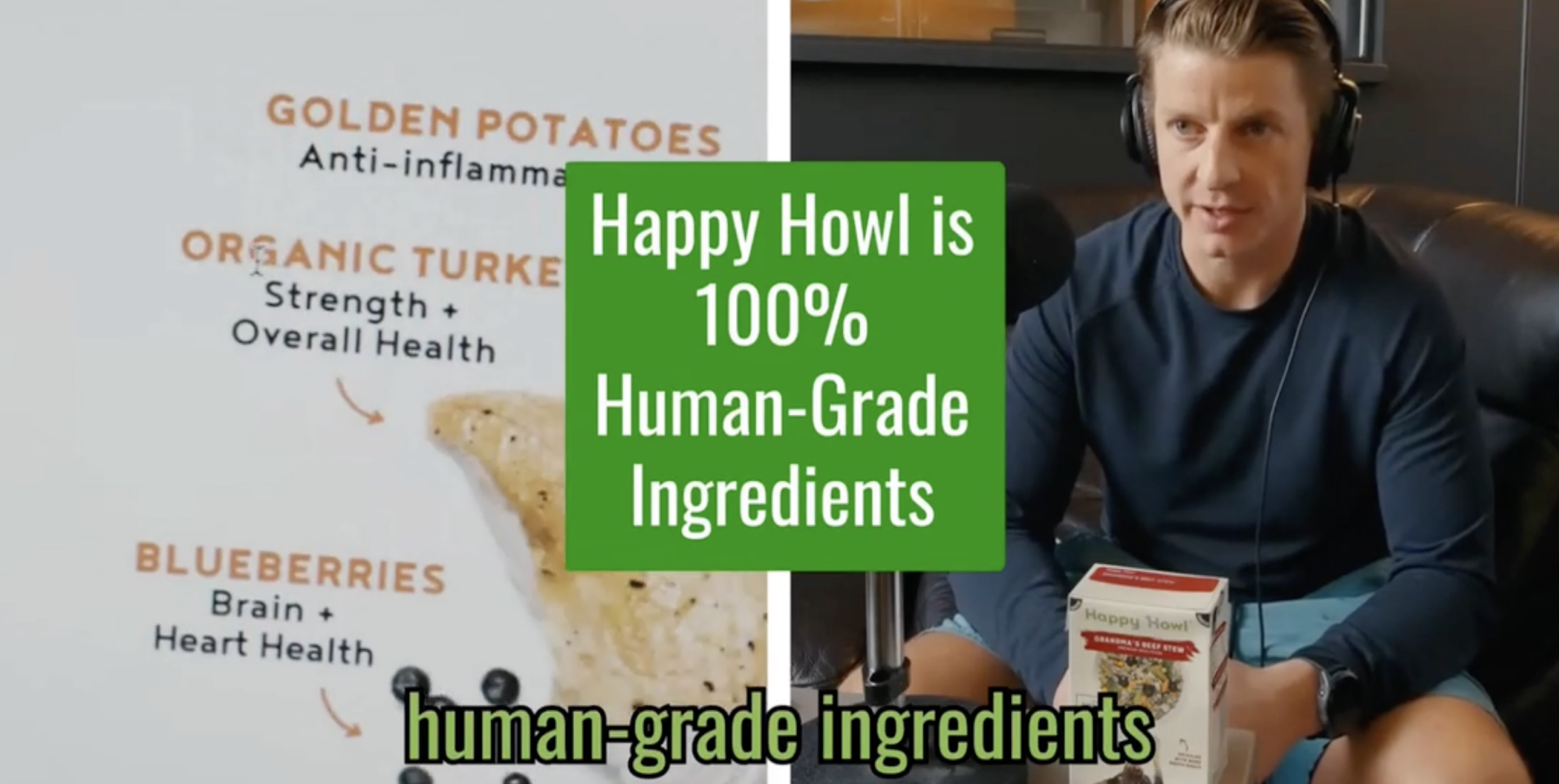

What does “human-grade” dog food actually mean?

The statement, “Manufactured in the USA 100%,” had appeared on product packaging.