Wells Fargo’s Military Benefits Program

Allegations: Marketing itself as a bank dedicated to military members, veterans, and their families when it charges interest rates that are so high they violate federal law and the bank’s…

Hartsock et al. v. Wells Fargo & Co., Wells Fargo Bank, N.A., and Early Warning Services, LLC d/b/a Zelle

22-cv-759, W.D. Wash.

(June 2022)

Zelle money transfers with Wells Fargo

Marketing Zelle as safe without disclosing the risk of losing money in scams and that the bank does not reimburse consumers for lost funds

Voluntarily dismissed When a complaint is dismissed without prejudice, an amended version of the complaint can be refiled.

Allegations: Marketing itself as a bank dedicated to military members, veterans, and their families when it charges interest rates that are so high they violate federal law and the bank’s…

Allegations: Failing to disclose that consumers will be charged a $12 “Deposited Item Returned Unpaid Fee” if a check they attempted to deposit bounces

Allegations: Misrepresenting when consumers will be charged overdraft fees

Allegations: Misrepresenting when consumers will be charged overdraft fees

This jewelry company may string you along.

Consumer complaints worth remembering.

Herb Weisbaum, Consumers’ Checkbook

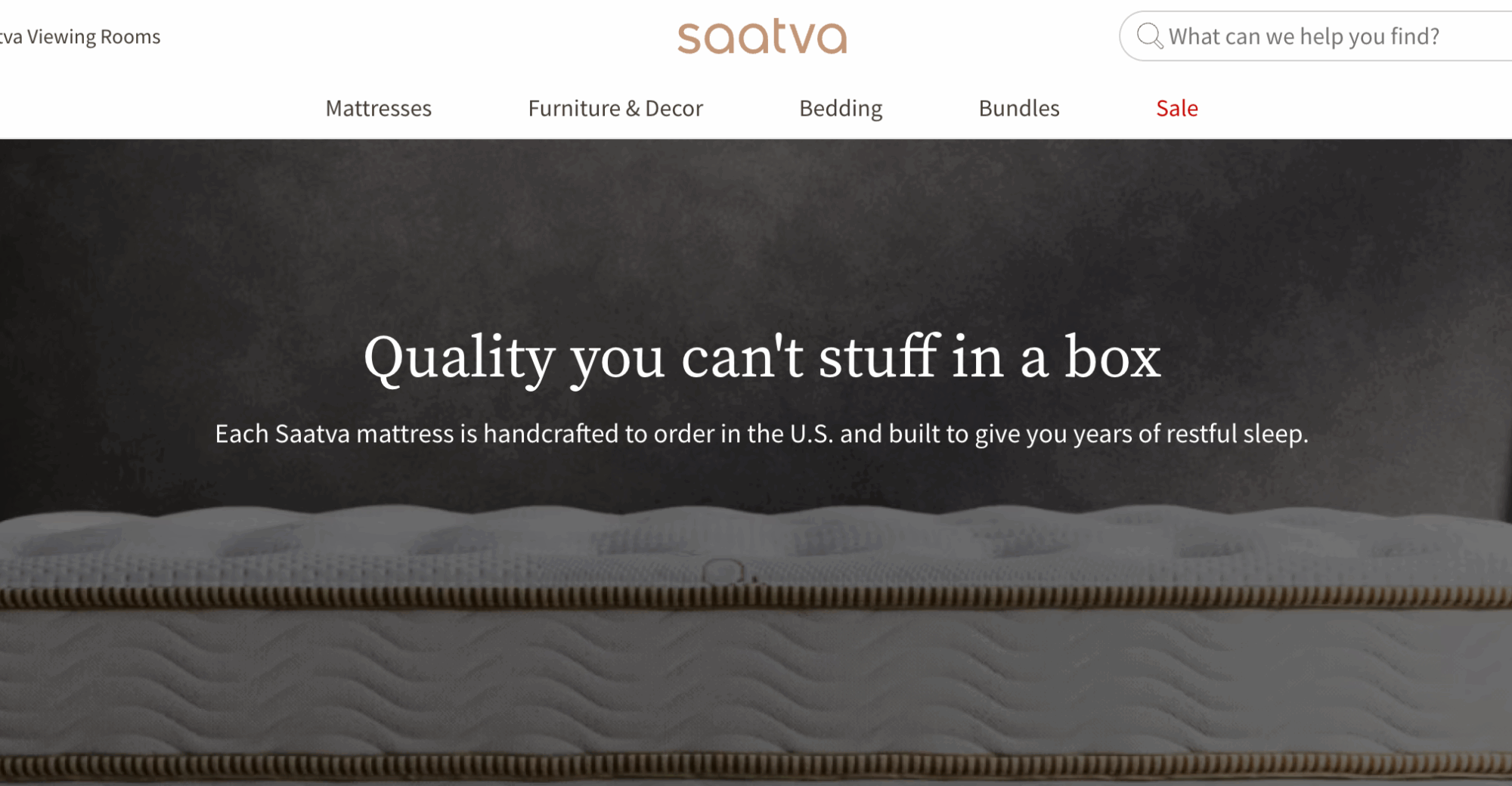

TINA.org pulls back the covers on this company’s Made in USA marketing.

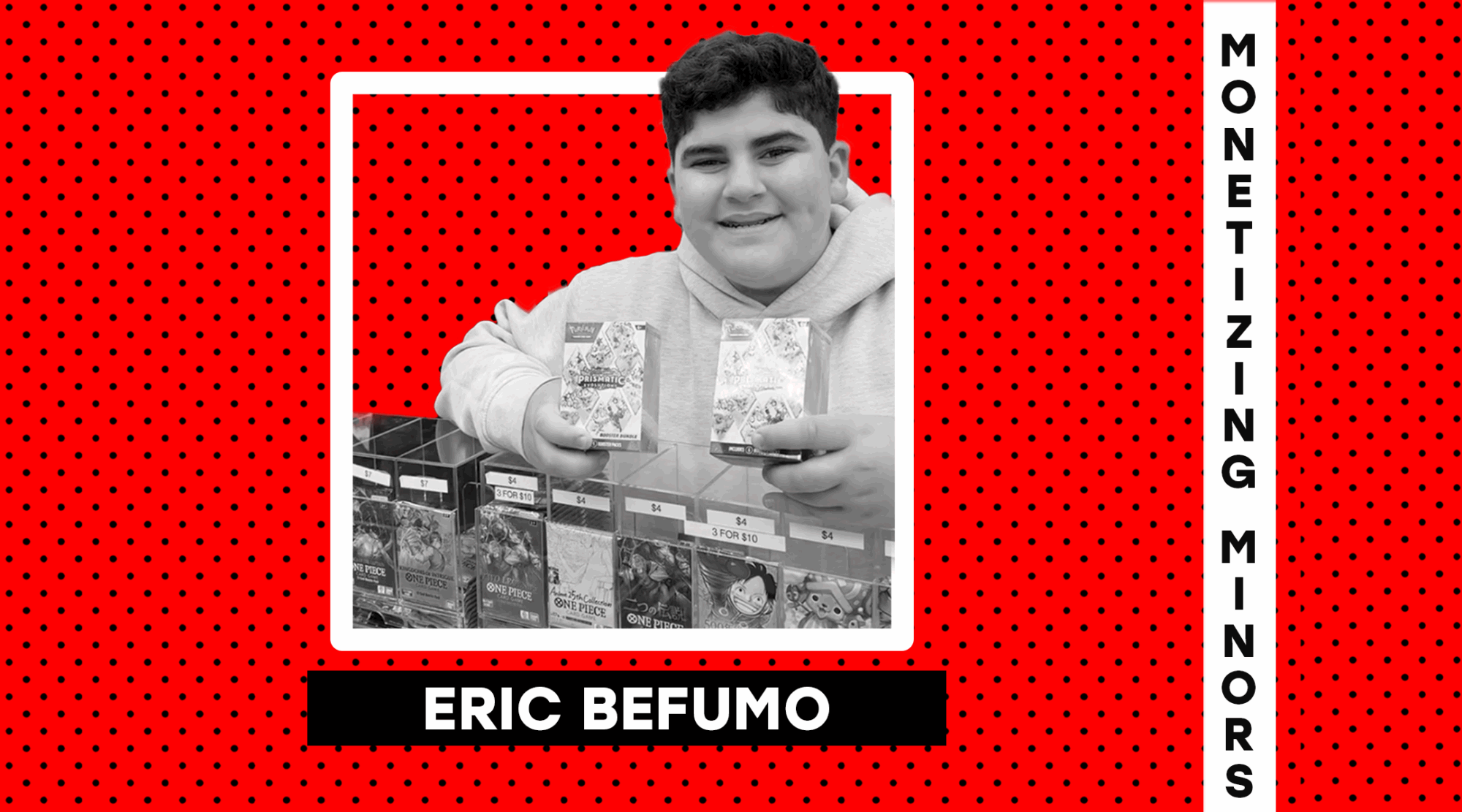

Brand partnerships worthy of a big “doom!”