Wells Fargo Bank’s Deposited Item Returned Unpaid Fee

Allegations: Failing to disclose that consumers will be charged a $12 “Deposited Item Returned Unpaid Fee” if a check they attempted to deposit bounces

Nowlin et al. v. Wells Fargo Bank, N.A.

24-cv-179, E.D.N.C.

(March 2024)

Wells Fargo Military Benefits Program

Marketing itself as a bank dedicated to military members, veterans, and their families when it charges interest rates that are so high they violate federal law and the bank’s own military benefits program

Stayed pending appeal in Espin v. Citibank

Allegations: Failing to disclose that consumers will be charged a $12 “Deposited Item Returned Unpaid Fee” if a check they attempted to deposit bounces

Allegations: Misrepresenting when consumers will be charged overdraft fees

Allegations: Marketing Zelle as safe without disclosing the risk of losing money in scams and that the bank does not reimburse consumers for lost funds

Allegations: Misrepresenting when consumers will be charged overdraft fees

Limits will be pushed. Records will be broken. Trails will blaze.

Can you actually work out without the work?

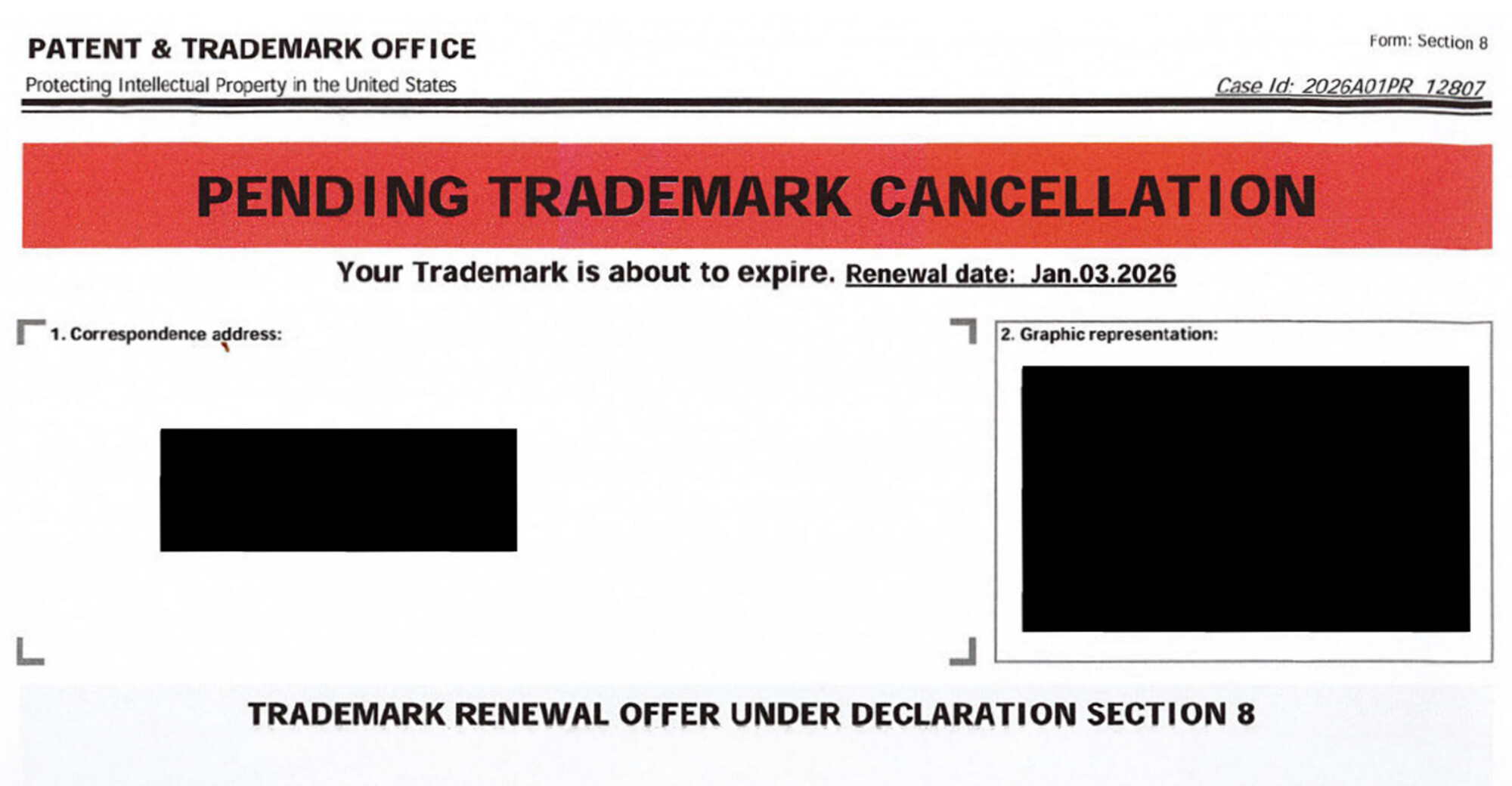

MADISON, CONN. Feb. 11, 2026 – A company calling itself “Patent & Trademark Office” is violating the FTC’s Impersonation Rule as well as the FTC Act by falsely posing as…

Complaint to FTC cites violations of agency’s Impersonation Rule.

TINA.org digs into shop’s purported Newport roots, and more.