Quality Inn & Suites (Choice Hotels)

Guests say online pictures are misleading.

June 2019: A federal judge granted final approval of the settlement agreement.

February 2019: A federal judge preliminarily approved a proposed settlement agreement that would reimburse class members for overdraft fees that they were charged when they had enough money in their accounts to cover their transactions. A final fairness hearing is scheduled for June 3, 2019. For more information, go to http://www.overdraftfeessettlement.com/.

2015: A class-action lawsuit was filed against United Federal Credit Union for allegedly promising that customers in its overdraft program would only be charged overdraft fees if there is not enough money in their accounts to cover transactions when, according to plaintiffs, the credit union assessed these fees using an artificial internal calculation based on anticipated future transactions instead of the actual balance resulting in customers being charged overdraft fees when accounts have enough money to cover transactions. (Plaintiffs filed an amended complaint in 2016.) (Gunter et al v. United Federal Credit Union, Case No. 15-cv-483, D. NV.)

Guests say online pictures are misleading.

What you see on the website may not be what you get.

Apple’s new ad is voiced by the late Dr. Jane Goodall.

Why diabetes patients should research carefully before buying.

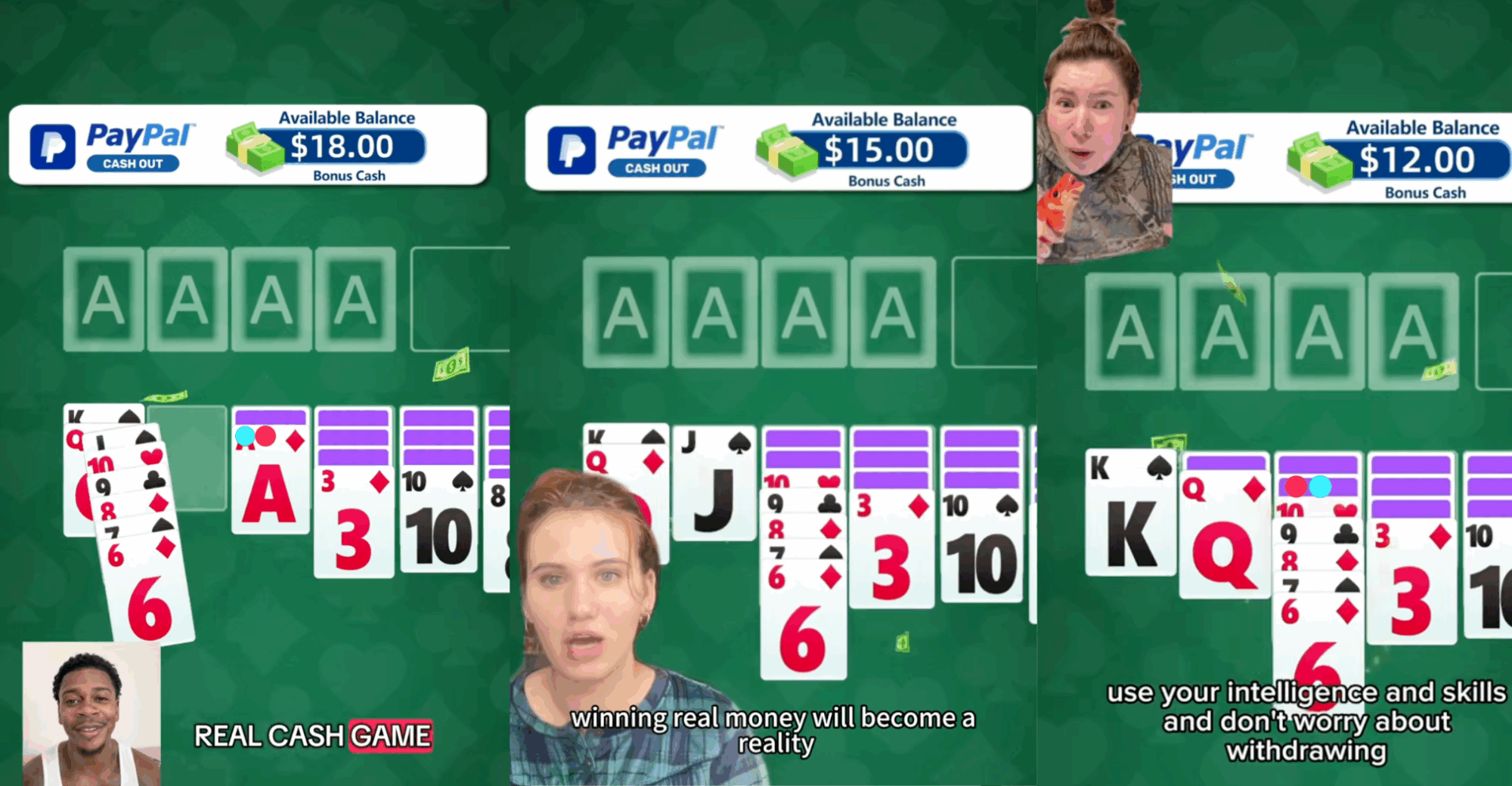

Can you really make bank playing solitaire on your phone?