TurboTax

TINA.org filed an amici brief supporting FTC in case against Intuit regarding misleading TurboTax Free Edition ad campaign.

May 2021: This case was voluntarily dismissed When a complaint is dismissed with prejudice, it cannot be refiled..

March 2021: The Court denied preliminary approval of a settlement agreement. (In Re Intuit Free File Litigation, Case No. 19-cv-2546, N.D. Cal.)

May 2019 – January 2020: Multiple class-action lawsuits regarding the marketing for TurboTax’s free tax filing services were consolidated into one case in California. The complaints allege that the company deceptively markets free tax filing services to low-income taxpayers but then directs consumers who are eligible for free tax filing services to the software they must pay for and makes it difficult for consumers to find its free tax services. The complaints also allege that these practices violate an agreement the company entered into with the IRS in which Intuit agreed to provide free tax filing services to low-income taxpayers.

Another lawsuit filed in May 2019 alleges that Intuit marketed free tax services for members of the military in the 2018 tax year using similar deceptive marketing tactics. (Nichols et al v. Intuit Inc., Case No. 19-cv-2666, N.D. Cal.)

A Consolidated Class Action Complaint was filed in September 2019. (In Re Intuit Free File Litigation, Case No. 19-cv-2546, N.D. Cal.)

TINA.org filed an amici brief supporting FTC in case against Intuit regarding misleading TurboTax Free Edition ad campaign.

Allegations: Misrepresenting that it safeguards consumers’ personal information when it failed to do so and there was a data breach in February 2024

Intuit should not advertise TurboTax Free Edition without making clear that most people cannot use it.

Several of this year’s Super Bowl advertisers have run into legal trouble for alleged deceptive marketing.

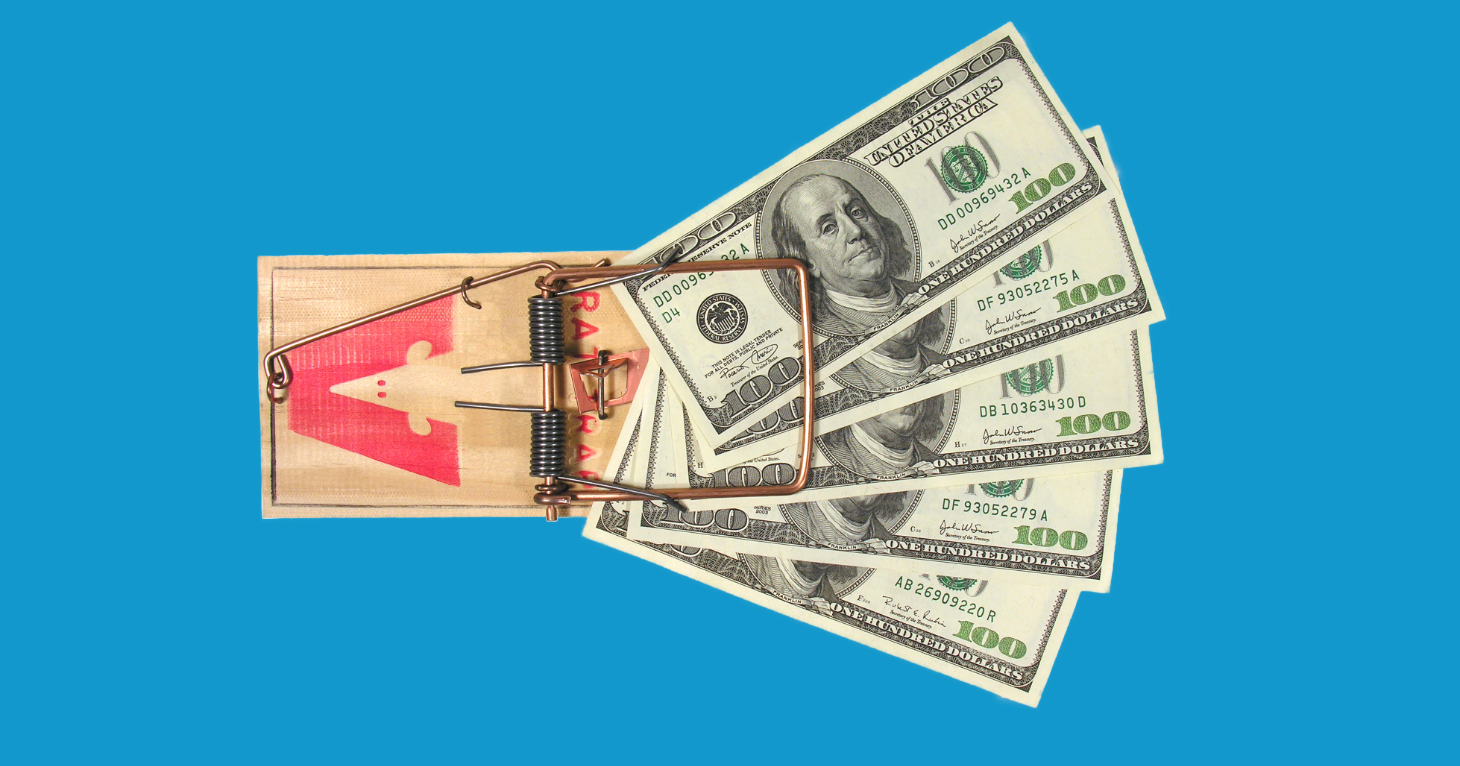

It’s not the first time the company has been accused of pulling a bait and switch.

How tax preparation services may actually make your life harder.

Upgrading your living situation with the help of this credit-monitoring app depends on the credit score your landlord looks at.