Wells Fargo’s Military Benefits Program

Allegations: Marketing itself as a bank dedicated to military members, veterans, and their families when it charges interest rates that are so high they violate federal law and the bank’s…

In May 2017, a class-action lawsuit was filed against The Window Source for allegedly deceiving customers about the sales and financing of its windows in four ways. Specifically, plaintiffs claim that the company:

(McCoy et al v. Wells Fargo, N.A. d/b/a Wells Fargo Financial National Bank, and The Window Source, LLC, Case No. 17-cv-360, S. D. MS.)

Allegations: Marketing itself as a bank dedicated to military members, veterans, and their families when it charges interest rates that are so high they violate federal law and the bank’s…

Allegations: Failing to disclose that consumers will be charged a $12 “Deposited Item Returned Unpaid Fee” if a check they attempted to deposit bounces

Allegations: Misrepresenting when consumers will be charged overdraft fees

Allegations: Marketing Zelle as safe without disclosing the risk of losing money in scams and that the bank does not reimburse consumers for lost funds

Allegations: Misrepresenting when consumers will be charged overdraft fees

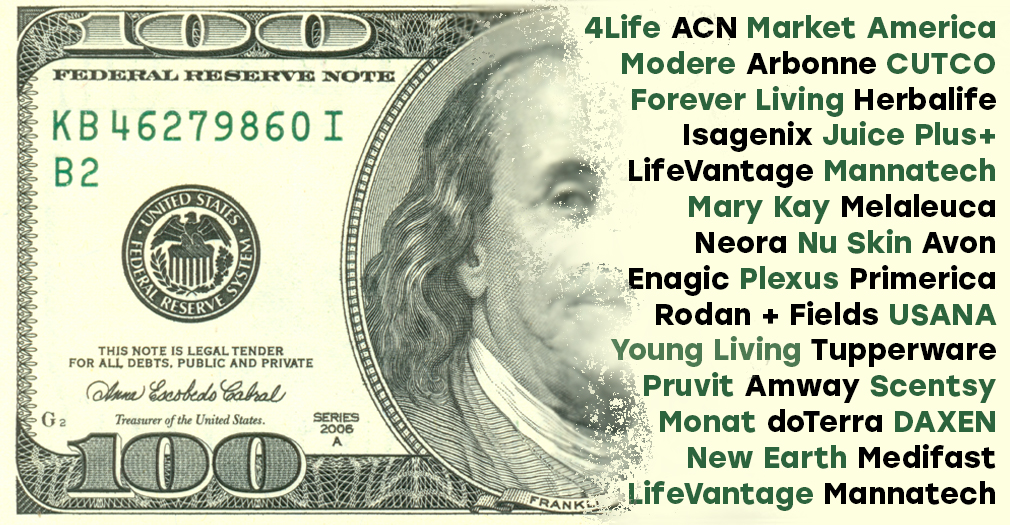

The consumer advocacy organization truthinadvertising.org (TINA.org) has published the results of a yearslong investigation into the multilevel marketing (MLM) industry that found widespread use of deceptive income claims to promote…

Why you may find it hard to “do your slice.”

TINA.org investigation finds 98% of MLMs using misleading income claims.

Inquiry finds price comparison uses wireless carrier’s lowest tier plan but not one of its competitors.

FDA warns consumers that devices cannot be trusted to give accurate blood sugar measurements.