America’s Best

Why your options may be limited in claiming this eyeglasses deal.

June 2019: This action was voluntarily dismissed When a complaint is dismissed without prejudice, an amended version of the complaint can be refiled., the reasons for which have not been disclosed.

May 2019: A class-action lawsuit was filed against Sandals Resorts for allegedly misleadingly representing that the local government tax it charges guests is a fee imposed by the government when, according to the plaintiffs, the resorts are allowed to keep a portion of the “tax” as a profit pursuant to an agreement with the local government. (Feldman et al v. Sandals Resorts International, LTD. d/b/a Sandals, Unique Vacations, Inc. d/b/a Unique Vacations, Case No. 19-cv-22046, S. D. FL.)

Why your options may be limited in claiming this eyeglasses deal.

Complaint alleges gym chain puts up roadblocks to cancellation.

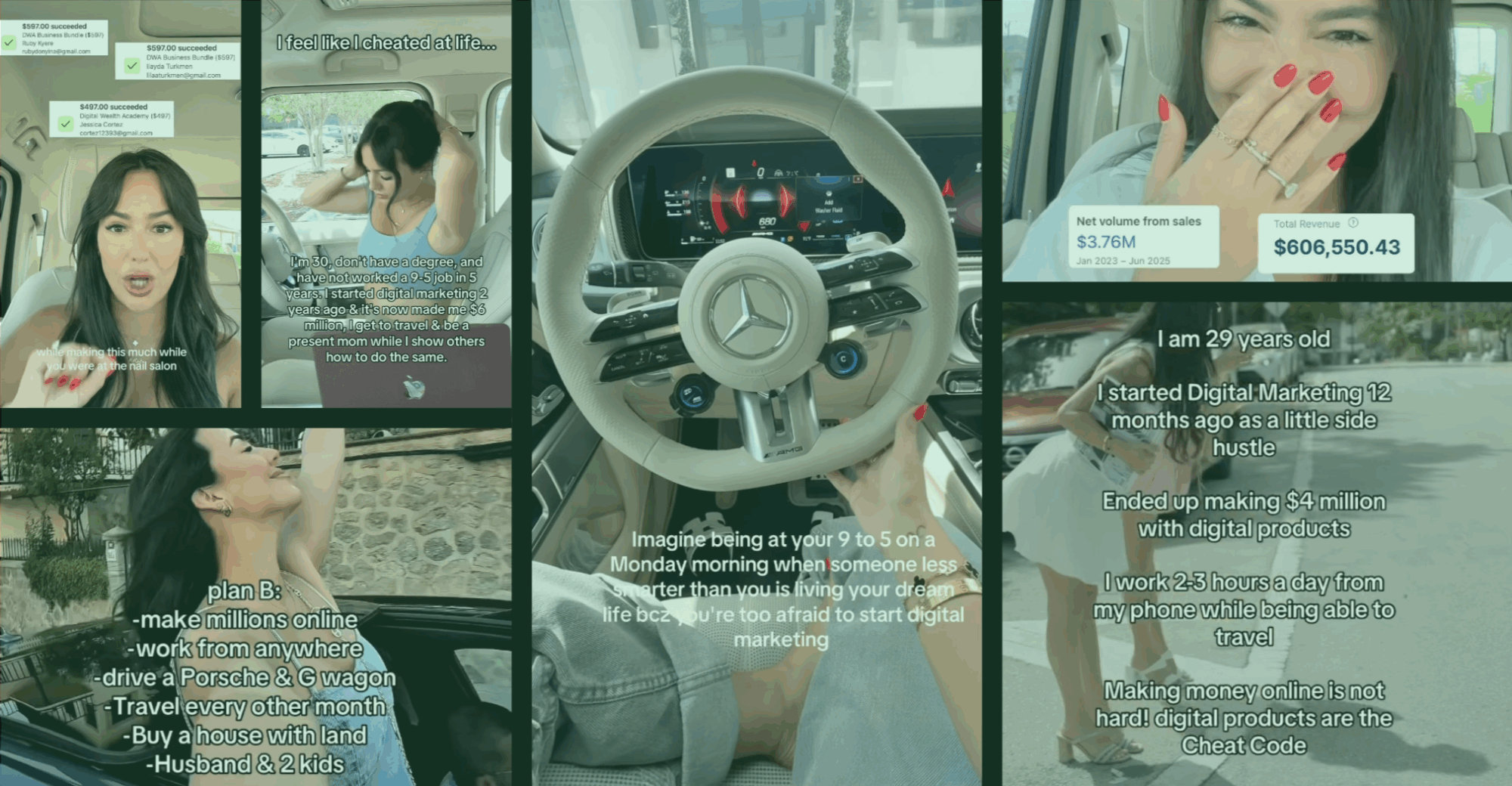

Aspiring entrepreneurs may want to think twice before signing up for this enticing offer.

Can you really escape the 9 to 5 with this money-making opportunity?

Can this product really protect against a mosquito-borne disease?