Hinge: The Dating App Designed to be Deleted

Hinge is the dating app for people who want to get off dating apps.

In October 2013, a class-action lawsuit was filed against Willis of Colorado Inc., Willis Ltd., Willis Group Holdings Ltd., Willis North America, Inc., and Amy S. Baranoucky regarding their allegedly fraudulent involvement with and marketing of Stanford Financial Group, a financial services company based in Houston, Texas that was seized by U.S. authorities in 2009 because of charges of fraud.

With respect to the deceptive advertising allegations, the 90-page complaint claims that Stanford Financial misled Mexican and Venezuelan investors in a number of ways. Specifically, Stanford Financial allegedly misled investors into believing that investments in “SIB” Certificates of Deposits (CDs) were (1) safe and sound because SIB was part of the Stanford Financial Group based in Houston and therefore subject to U.S. government regulation; and (2) even safer than U.S. bank-issued CDs because Stanford Financial had unique Lloyds of London insurance policies in place that went above and beyond FDIC insurance. In reality, however, SIB was an Antiguan offshore bank, and Stanford Financial was operating a massive Ponzi scheme that collected billions of dollars from investors, according to the complaint.

The plaintiffs claim that the Willis defendants helped Stanford Financial with this false and deceptive marketing, among other things. (Janvey, et al. v. Willis of Colorado Inc., 13-cv-03980, N.D. Tex.)

Hinge is the dating app for people who want to get off dating apps.

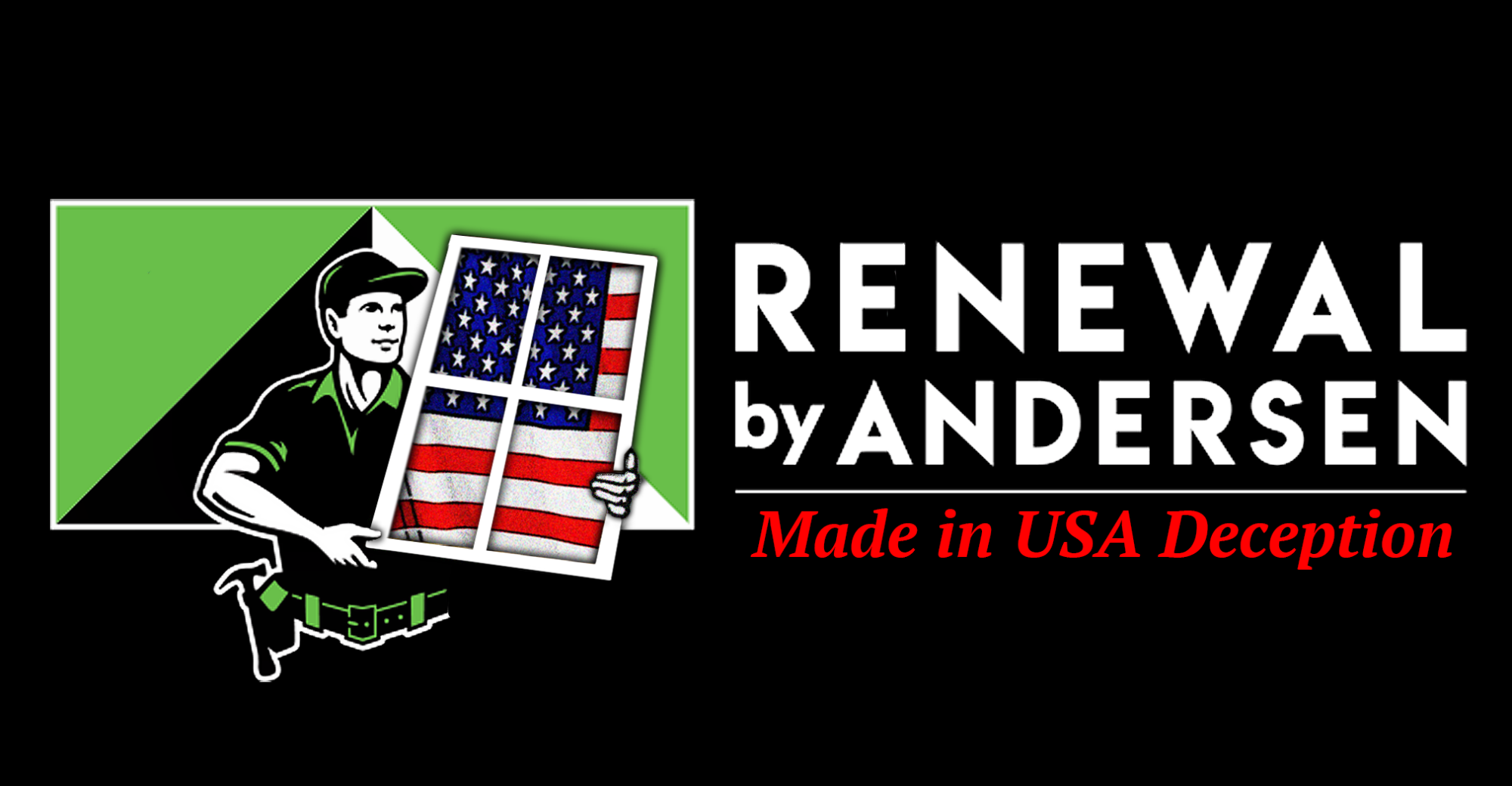

TINA.org files FTC complaint against company.

Don’t let the American flags fool you.

Can supplements really help your child reach new heights?

How brands exploit kid influencers and their followers.