Pentagon Federal Credit Union

Allegations: Misrepresenting when customers will be charged overdraft fees

In March 2020, a class-action lawsuit was filed against Pentagon Federal Credit Union for allegedly misleadingly representing that only one overdraft or non-sufficient funds fee is charged if payment of a transaction is declined or puts the account into a negative balance when, according to the complaint, such fees are based on an “artificial available balance” that subtracts the amount of pending debit card transactions instead of the actual money in an account resulting in fees being charged even when there is enough money to cover a transaction. Plaintiffs also claim that the credit union misleadingly represents that it charges only one fee on a single transaction when, according to the complaint, the credit union charges a fee every time a transaction is reprocessed for payment resulting in multiple fees being charged on a single transaction. (Ross et al v. Pentagon Federal Credit Union, Case No. 20-cv-281, E.D. Va.)

For more of TINA.org’s coverage of banks, click here.

Allegations: Misrepresenting when customers will be charged overdraft fees

Guests say online pictures are misleading.

What you see on the website may not be what you get.

Why diabetes patients should research carefully before buying.

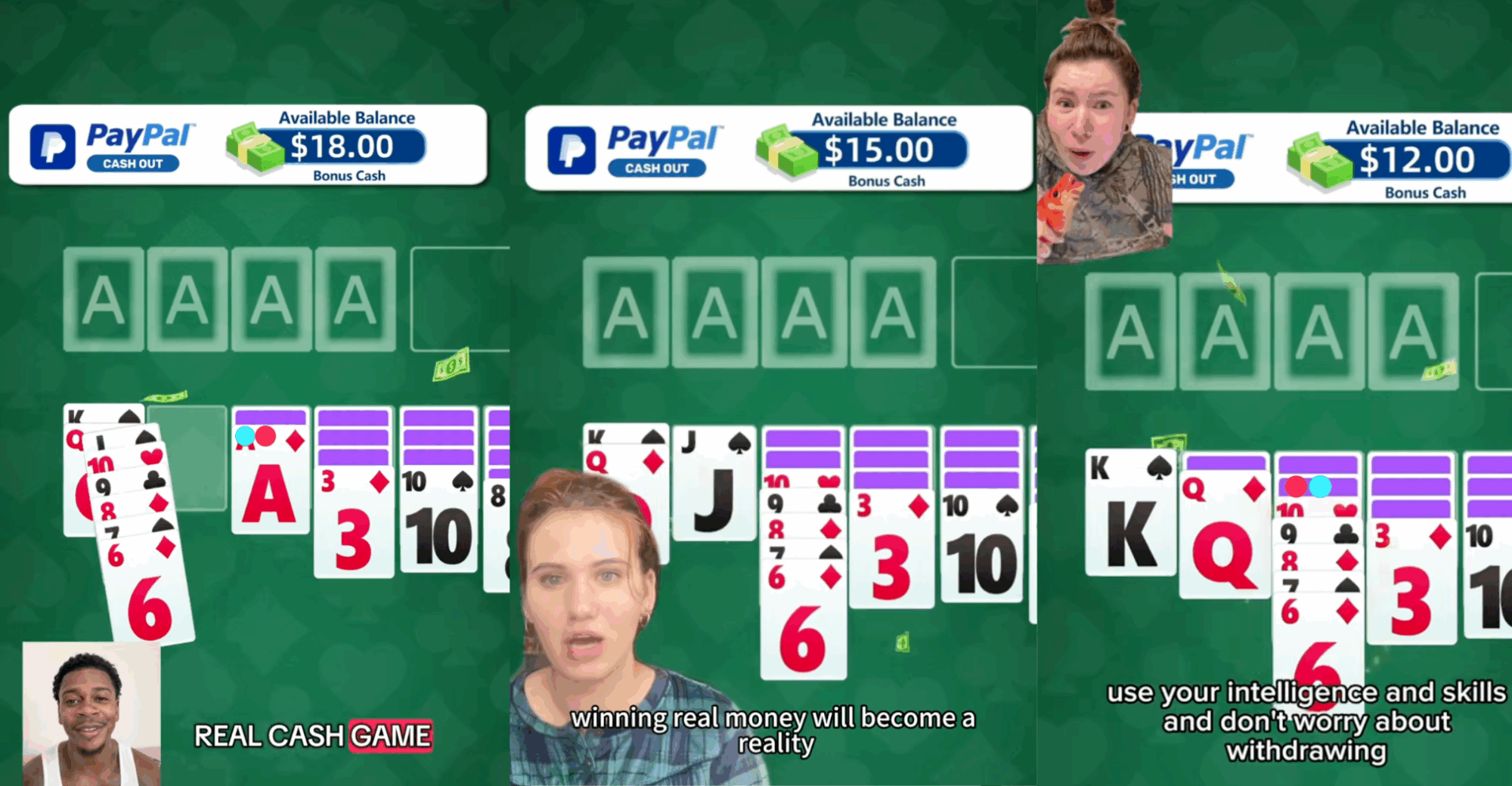

Can you really make bank playing solitaire on your phone?

Don’t get lost in this outdoor company’s dubious origin story.