CATrends: Baseball Ticket Prices

Consumers balk at hidden junk fees.

In June 2018, a class-action lawsuit was filed against the credit union SEFCU for, among other things, allegedly misrepresenting that it charges overdraft fees when customers do not have enough money in their account to cover a transaction without telling customers that the credit union does not base these charges on the actual amount in the account and instead uses an artificial balance that deducts amounts that have been put on hold for pending transactions. (Story et al v. SEFCU, Case No. 18-cv-764, N.D.N.Y.)

Consumers balk at hidden junk fees.

As years pass and life shifts, the walls around us quietly hold every moment.

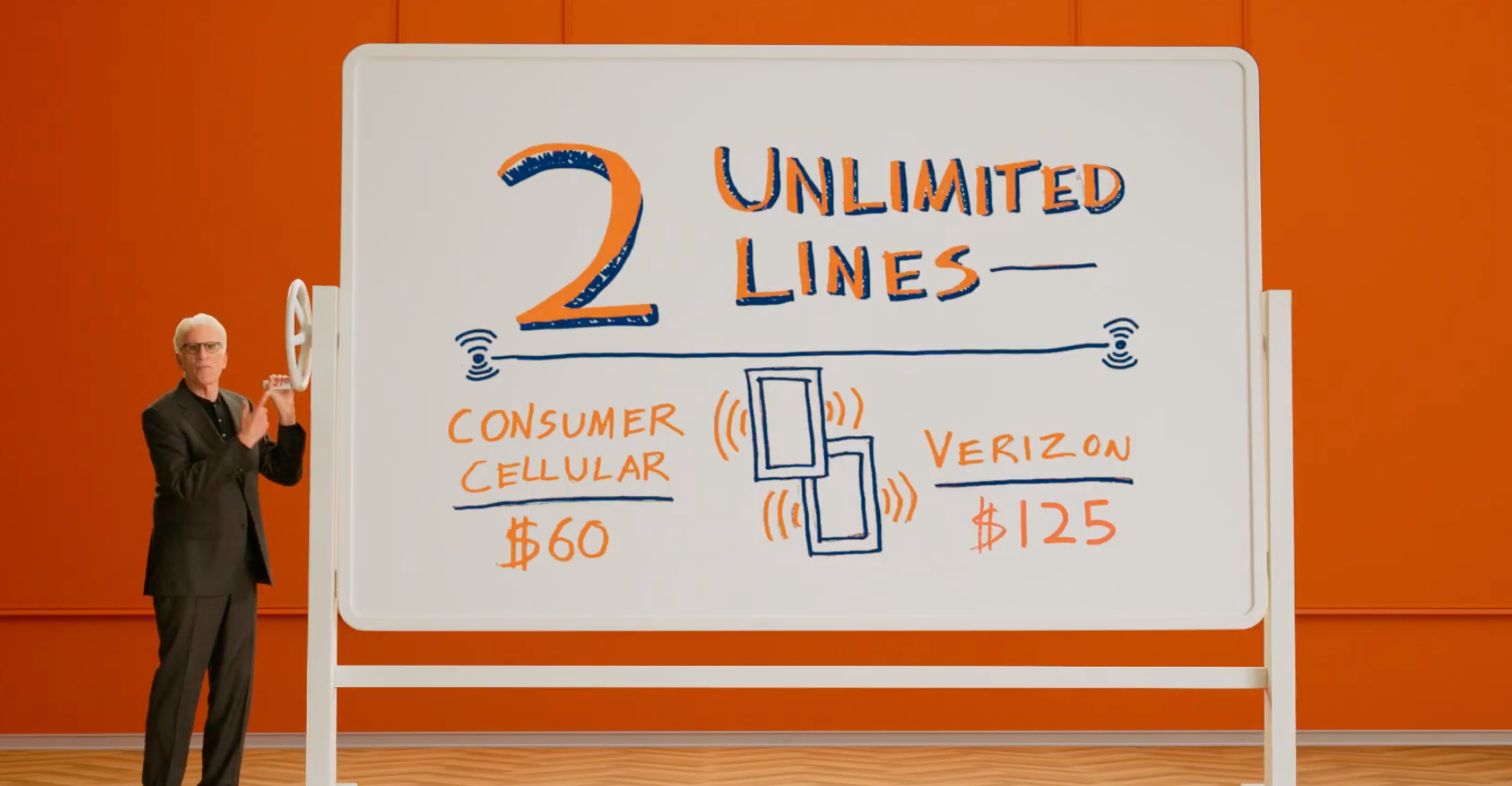

TINA.org uncovers the limits of this carrier’s “unlimited” data plans.

Why TINA.org wants the Supreme Court to address proof of harm in Lanham Act cases.

Letters alert agencies and organizations to company’s improper marketing.