1st Phorm’s ‘110% Money-Back Guarantee’

Money-back guarantee comes up woefully short of advertised percentage.

In March 2020, a class-action lawsuit was filed against iThink Financial Credit Union for allegedly misleadingly promising that it only charges overdraft fees and non-sufficient funds fees on a transaction if an account does not have enough money to cover it when, according to plaintiffs, the credit union charges overdraft fees even when there is enough money to cover a transaction. Plaintiffs also claim that the credit union falsely promises to charge only one fee on a single transaction when, according to the complaint, the credit union charges another fee every time a rejected payment is reprocessed for payment resulting in multiple fees on a single transaction. (Collier et al v. iThink Financial Credit Union f/k/a IBM Southeast Employees’ Credit Union, Case No. 20-cv-80430, S.D. Fl.)

For more of TINA.org’s coverage of banks, click here.

Money-back guarantee comes up woefully short of advertised percentage.

Is it still a guarantee if it has strings attached?

Lawsuits allege “100%” marketing on front label is misleading.

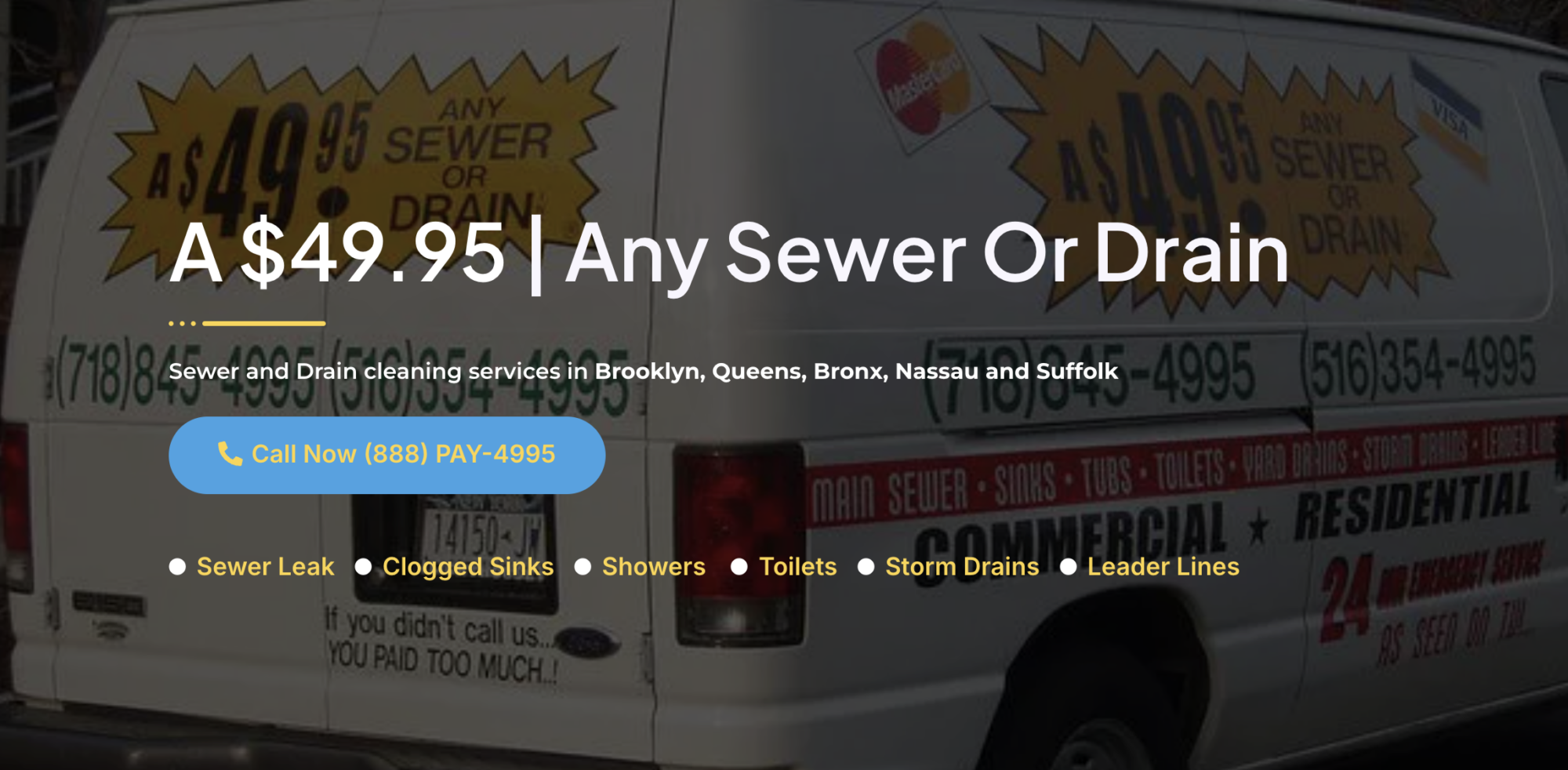

TINA.org reader was charged a lot more than the advertised price. He’s not alone.

TINA.org explores the divide between the marketing and the science.