Cascade ‘Free & Clear’ Dish Detergents

What does this marketing term mean?

In October 2014, a federal judge approved a $20,350,000 settlement of a false advertising class-action lawsuit against ING Bank . The complaint, which was originally filed in 2011, alleges, among other things, that the company represents that borrowers can reset the interest rate on their mortgages at any time for a low, fixed cost ($500 for Orange Loans and $750 for Easy Orange Loans) when, in reality, the company charges borrowers more than the promised flat fee. According to the settlement terms, class members are expected to receive about $175 per loan account. (Yarger et al v. Capital One, N.A., successor by merger to ING Bank, F.S.B., d/b/a ING Direct, Case No. 11-cv-154, D. DE.).

For more information about home mortgages, click here.

What does this marketing term mean?

Guests say online pictures are misleading.

What you see on the website may not be what you get.

Why diabetes patients should research carefully before buying.

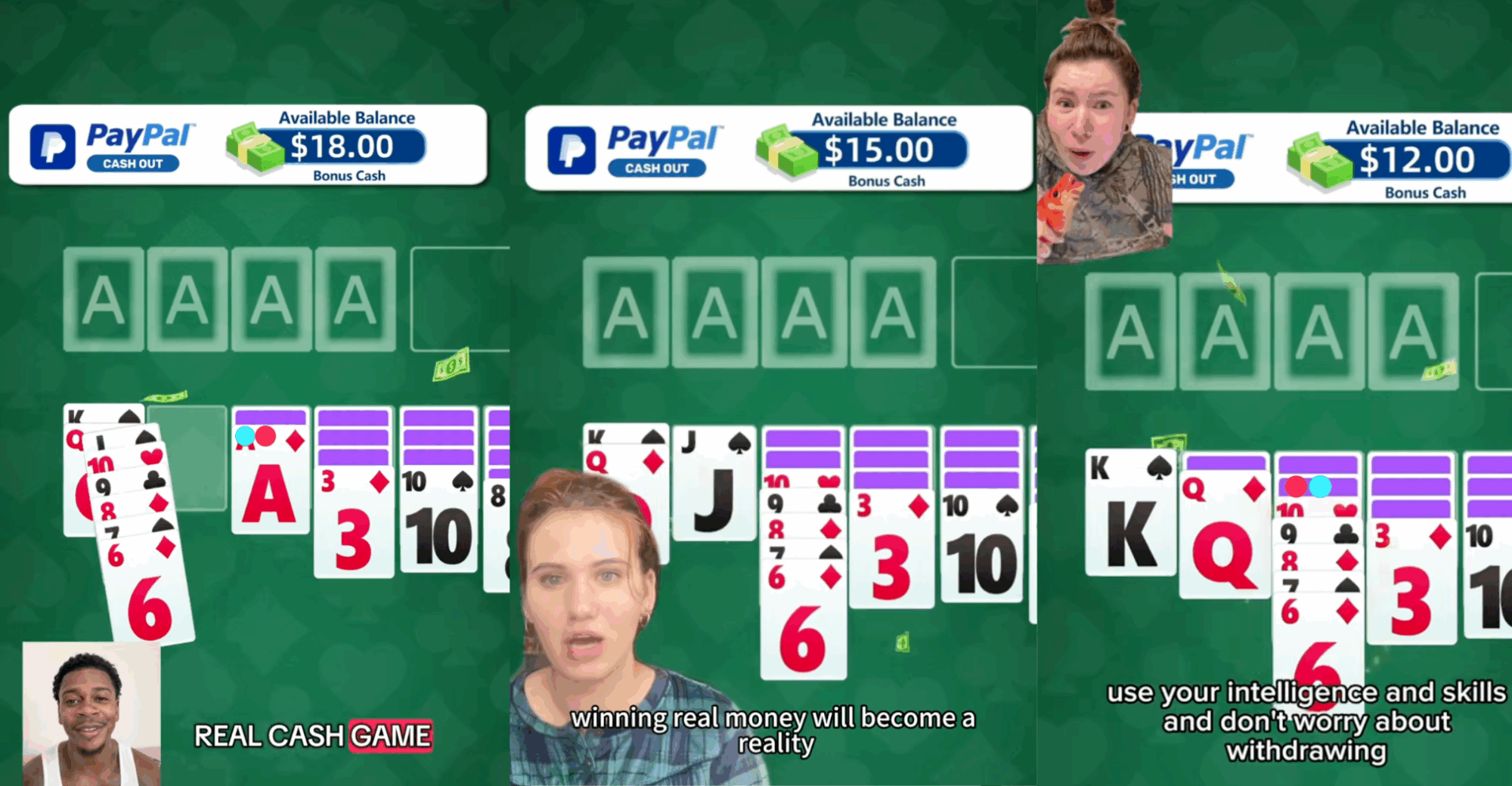

Can you really make bank playing solitaire on your phone?