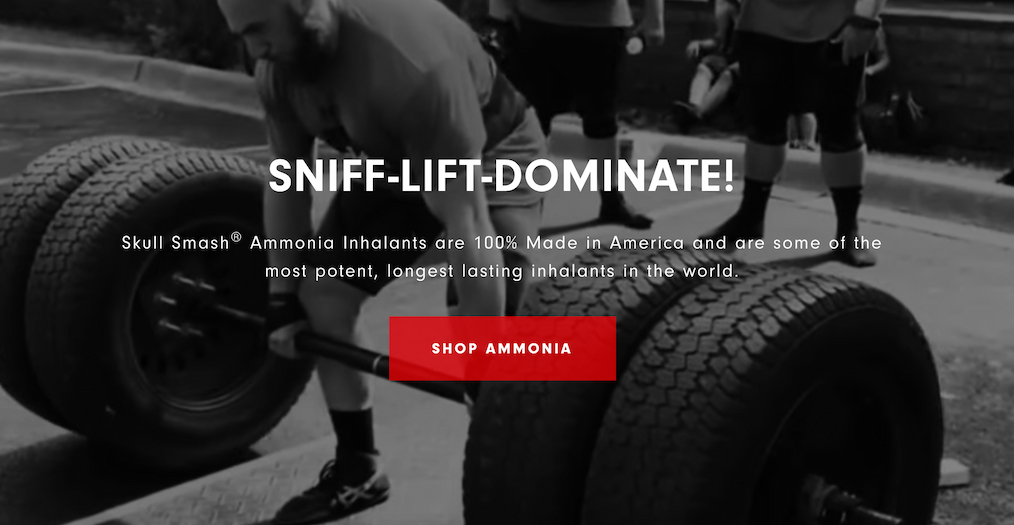

Skull Smash

FDA sniffs out unapproved claims company’s smelling salts increase alertness, focus, and more.

In June 2014, a state court judge preliminarily approved a settlement to a class-action lawsuit against Fidelity & Life Guaranty Life Insurance, Co. The complaint alleges that, among other things, the company deceptively sold its Indexed Universal Life (“IUL”) policies by failing to disclose the high costs associated with these policies. According to the settlement terms, class members with an active IUL policy will receive a one-year 1% increase in the minimum guaranteed interest rate under his/her policy and class members with an inactive IUL policy will be eligible to receive a refund of a percentage of the charges paid at the time of surrender or lapse of his/her IUL policy. (Cressy et. al v. Fidelity & Guaranty Life Insurance, Co.; Paramount Financial Services, Inc.; and Douglas Andrew, Case No. BC514340, Superior Court of California, County of Los Angeles).

For more information about other insurance-related class action lawsuits and TINA.org’s coverage of the issue, click here.

FDA sniffs out unapproved claims company’s smelling salts increase alertness, focus, and more.

Why this piano man may not give you the keys to success.

Dig into these advertising claims.

Advisory opinion letter raises “serious concerns” with self-reg group’s guidance.

Emily Jankowski and Grace Tatter, WBUR | NPR