Citibank’s Overdraft and Insufficient Funds Fees

Allegations: Misrepresenting how many overdraft or insufficient funds fees consumers could be charged on a single transaction

In February 2018, a class-action lawsuit was filed against Citibank for allegedly misleadingly marketing that the bank charges no more than $12 a month for basic checking account services without telling customers that there are circumstances – such as when the account does not have enough funds to pay the monthly checking account fee – where they may be charged more than $12 a month. (Lopez et al v. Citibank, N.A., Case No. 18-at-146, E.D. Cal.)

For more information about class-action lawsuits filed against banks and TINA.org’s coverage of them, click here.

Allegations: Misrepresenting how many overdraft or insufficient funds fees consumers could be charged on a single transaction

Allegations: Marketing that the bank is dedicated to military members, veterans, and their families and provides more benefits than required under the Servicemembers Civil Relief Act (SCRA) when it systematically…

What does this marketing term mean?

Guests say online pictures are misleading.

What you see on the website may not be what you get.

Why diabetes patients should research carefully before buying.

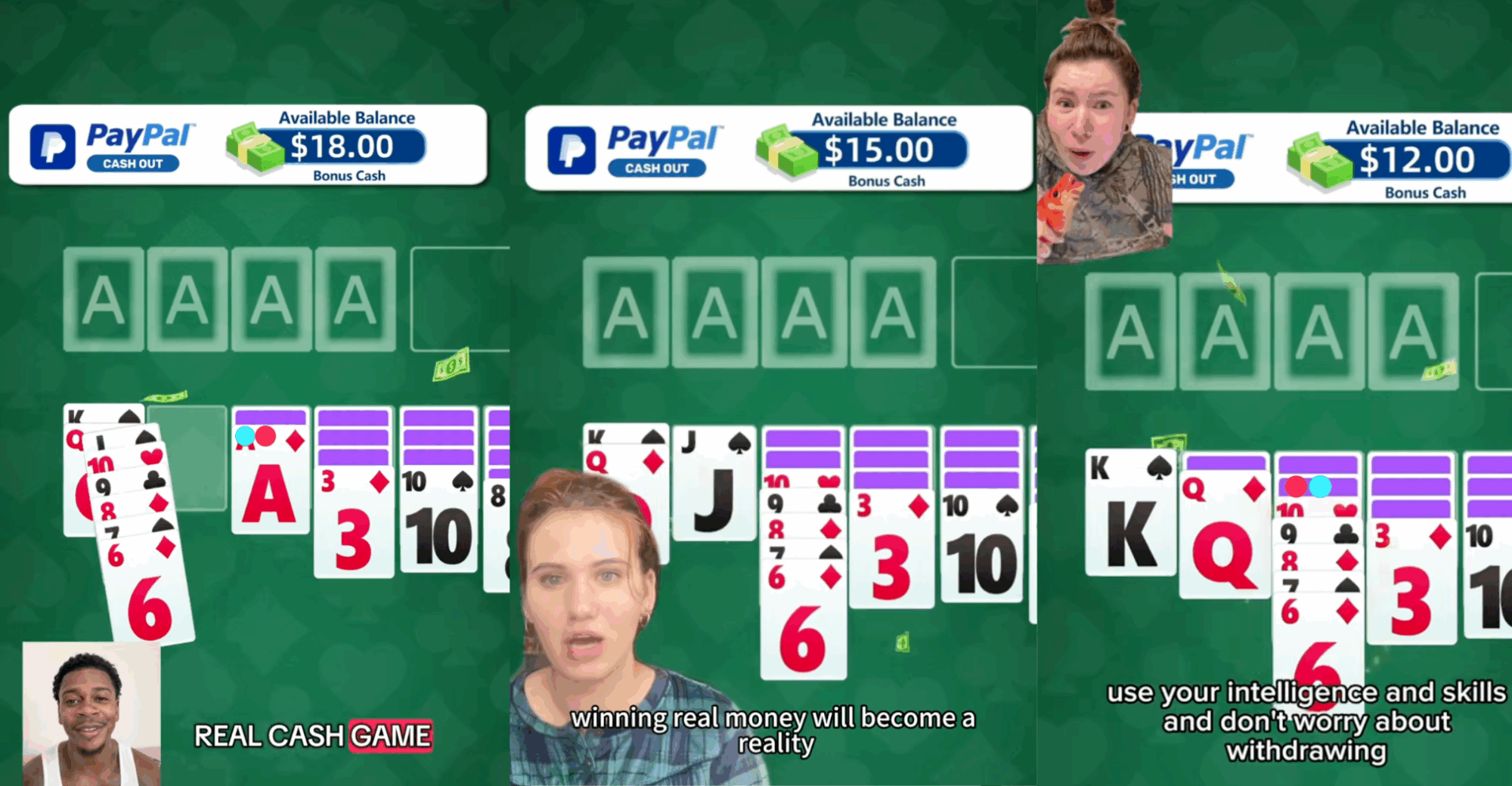

Can you really make bank playing solitaire on your phone?