Bethpage Federal Credit Union

Allegations: Misrepresenting when consumers will be charged overdraft fees

In July 2019, a class-action lawsuit was filed against Bethpage Federal Credit Union for allegedly misleadingly representing that customers will be charged only one non-sufficient funds (NSF) fee on a single transaction when, according to the plaintiffs, the credit union charges multiple fees on a single Automated Clearing House transaction. According to the complaint, the credit union reprocesses transactions that have been rejected for having insufficient funds and charges another NSF fee every time that it is rejected. (Corbett et al v. Bethpage Federal Credit Union, Case No. 19-cv-4194, E. D. NY.)

Allegations: Misrepresenting when consumers will be charged overdraft fees

Lawsuits take aim at so-called non-disparagement clauses.

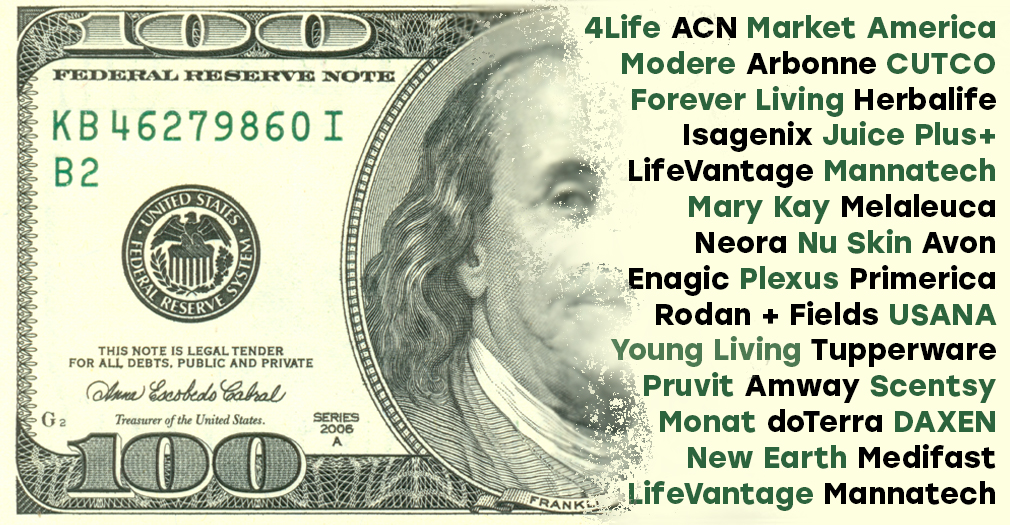

The consumer advocacy organization truthinadvertising.org (TINA.org) has published the results of a yearslong investigation into the multilevel marketing (MLM) industry that found widespread use of deceptive income claims to promote…

Why you may find it hard to “do your slice.”

TINA.org investigation finds 98% of MLMs using misleading income claims.

Inquiry finds price comparison uses wireless carrier’s lowest tier plan but not one of its competitors.