Costco Rotisserie Chicken: ‘No Preservatives’

Lawsuit cries fowl over preservative-free claims.

July 2015: A federal judge dismissed this case concluding, among other things, that the plaintiffs failed to meet the heightened pleading standard required for fraud-based claims.

July 2013: A class-action lawsuit was filed in July 2013 against Ace Cash Express, Inc. (and amended in August 2014) for allegedly advertising its loans as a form of quick, easy, short-term credit to cover unexpected or emergency expenses (like car repairs or medical bills) when, according to the plaintiffs, Ace Cash Express provides expensive, long-term debt accompanied by unconscionable terms and conditions. (Johnson et al. v. Ace Cash Express, Inc., Case No. 13-cv-01186, D. DE.)

For more of TINA.org’s coverage of payday loans, click here.

Lawsuit cries fowl over preservative-free claims.

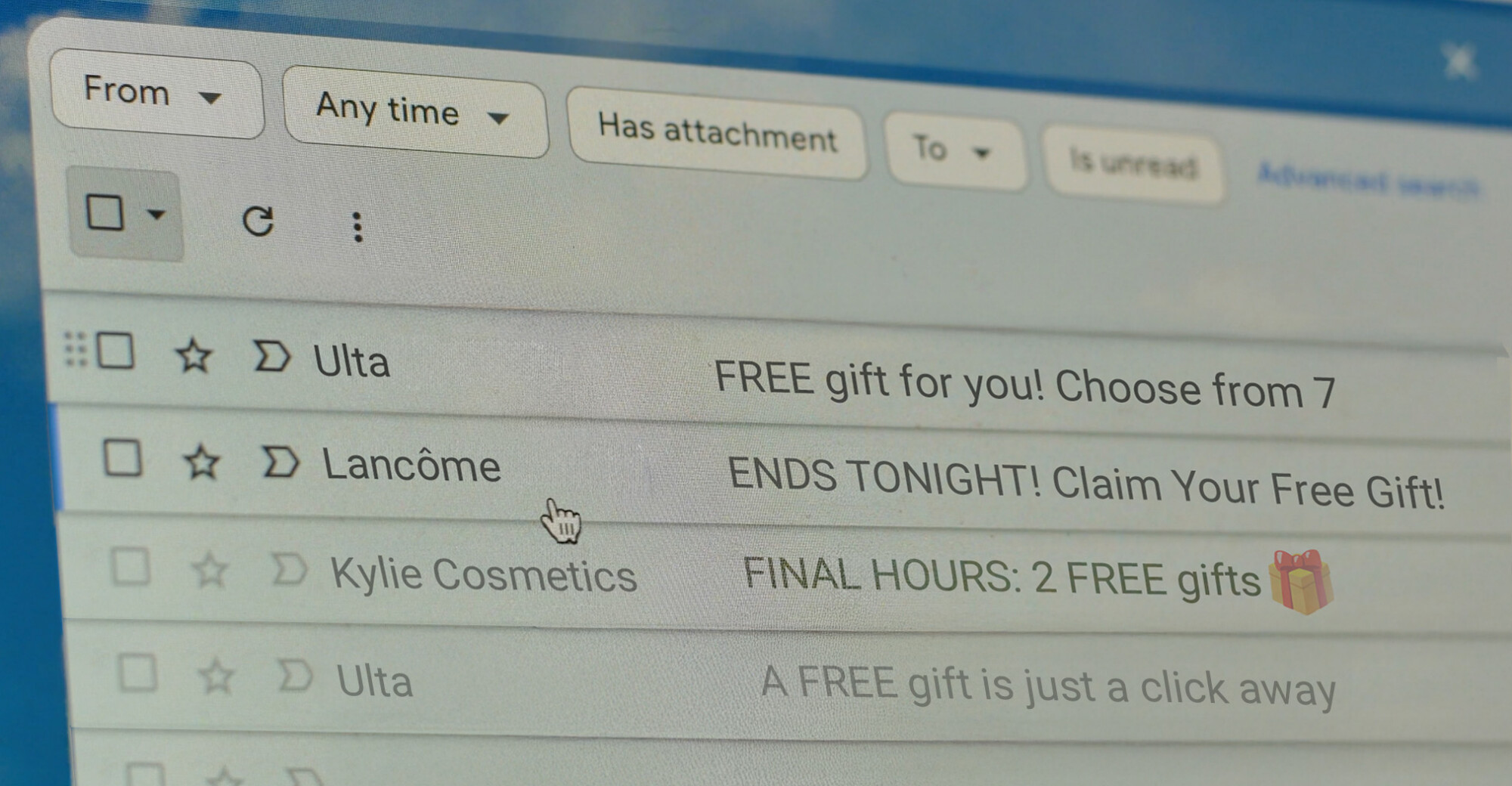

Lawsuits target misleading subject lines.

It’s so good, so good, so good.

MADISON, CONN. Jan. 27, 2026 – Beverage giant Keurig Dr Pepper is deceptively marketing its single-serve K-Cup pods as “recyclable” in violation of state and federal laws, according to an…

TINA.org nails down the truth behind these US-origin claims.