CFPB Proposes Paycheck Advance Rule

TINA.org joins coalition of consumer organizations in support of the proposed rule

How tax preparation services may actually make your life harder.

| | Isaiah Keyes

UPDATE 5/10/22: TurboTax owner Intuit has agreed to pay $141 million for allegedly falsely advertising tax services as free, as part of an agreement with 50 states and the District of Columbia. The FTC’s case against Intuit is ongoing.

A few years ago, I sat at the dining room table, feeling like a bona fide, genuine Real Adult. I was filing my taxes for my first real-world job, all on my own!

By “all on my own,” of course, I mean that I was using TurboTax, the D-I-mostly-Y tax prep service from Intuit.

TurboTax had hooked me with its advertising, which promised a variety of tax help – free of charge. It was quite the effective message to me at the time, as someone whose assets fit in their coat pockets and whose bank account rarely, if ever, needed a comma.

After two hours of tracking down line items and student loan information at TurboTax’s behest, the time came for me to submit my returns. I was pleasantly surprised by the smooth process until I encountered a confounding message on the final screen: My “free” return was apparently going to cost me $127.62, a figure that included two state returns (I moved a couple months after graduating), the “Deluxe” tax prep option I apparently needed to purchase, and some $7.62 in sales tax.

At that point, I dove into the terms and conditions, realized that I’d been had, and used some choice bona fide, genuine Real Adult language aloud at the dining room table. The reason I had been pushed towards the “Deluxe” service was that TurboTax’s Free Edition only covers “simple” tax returns – in other words, just Form 1040, without adding any other schedules.

Defeated, I entered my credit card information. I didn’t want to go through the whole process again.

My story, while personally depressing, is not entirely unique. TurboTax’s flexible (and excessive) use of the word “free” has caused it significant legal trouble and led to numerous class-action lawsuits. Now, the FTC is suing Intuit for allegedly “misleading consumers into believing that they can file their taxes for free with TurboTax.”

So Intuit is lying?

Yeah, basically. Here’s what the FTC alleges Intuit fails to convey in its advertising:

In fact, most tax filers can’t use the company’s “free” service because it is not available to millions of taxpayers…In 2020, for example, approximately two-thirds of tax filers could not use TurboTax’s free product.

Yup, you read that right: Most consumers are being advertised a price they can’t get since they don’t meet Intuit’s narrow definition of “simple” tax returns. For context, in 2019 ProPublica found that over 40 million taxpayers used TurboTax. That means TurboTax is potentially misrepresenting the cost of its services to tens of millions of consumers with every one of its ads.

All for a service that most Americans – about 70% of us, in fact – are eligible to get for free. More on that below.

So why do we put ourselves through this?

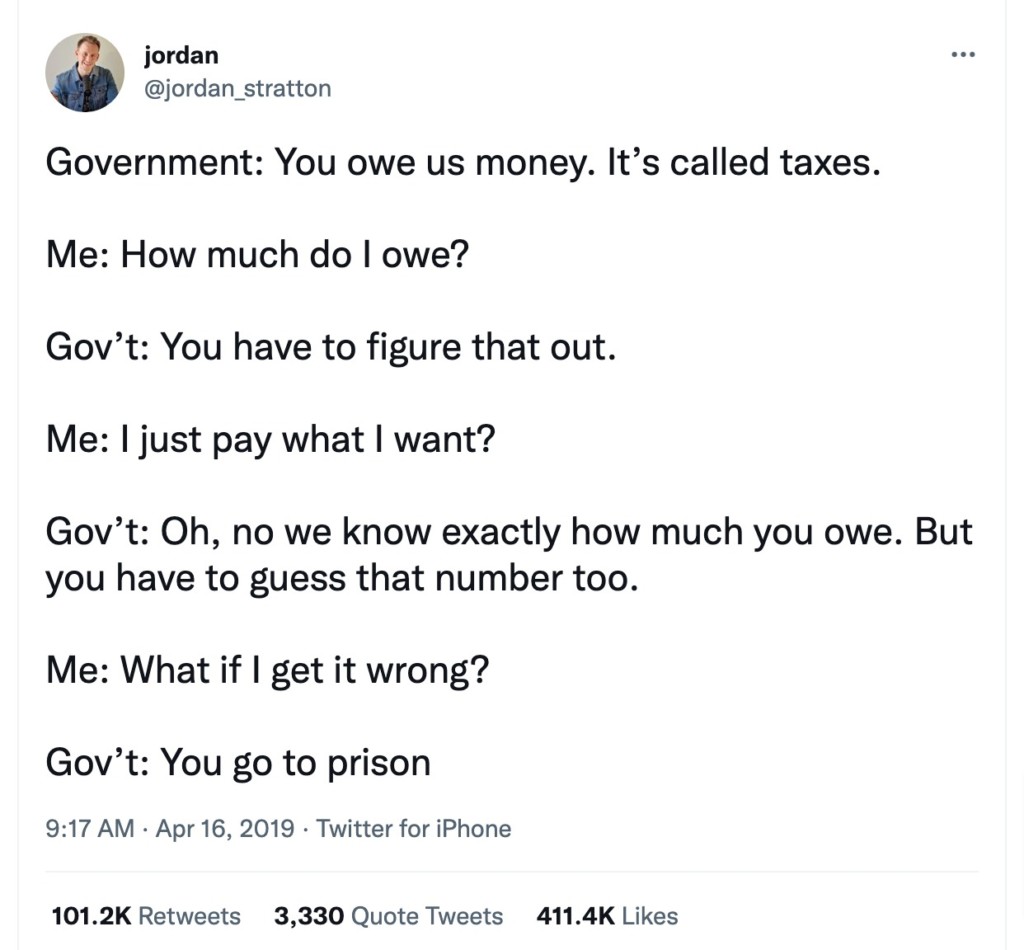

Among its economic peers, the U.S. is fairly unique in requiring most taxpayers to file a return, much to the chagrin of Twitter comedians:

The IRS already collects most Americans’ federal income tax through paycheck-deduction, so returns usually just double-check that the taxpayer and government are even. Why, then, is it made so complicated?

The answer lies in the grease that keeps Congress’ engine running: lobbying. Tax preparation companies devote enormous sums of money every year to fighting income tax simplification, which makes sense: Their business model would be obsolete if taxes were simple enough for taxpayers to handle on their own.

Despite (or perhaps because of) past lobbying efforts by these companies, the IRS Restructuring and Reform Act of 1998 established a partnership between private sector tax preparers and the IRS to provide free online filing options for taxpayers. This arrangement came with the understanding that as long as the private sector companies offered free services, the IRS wouldn’t create its own free filing software that would decimate their business.

And as the Free File agreement has been updated every few years since its inception, those lobbying efforts have continued — and grown. The data show that Intuit spent about a whopping $3.3 million on lobbying in 2021; H&R Block spent $3.4 million. In its 2019 investigation, ProPublica even unearthed internal documents from Intuit boasting about the company’s success in stymieing government efforts to create easy, free online filing.

And that, in a nutshell, is why TurboTax advertises their services as “free free free free free.” As far better journalistic minds than I have said, follow the money.

I’m Mad As Hell, And I’m Not Going to Take This Anymore!

Man, what a mood, Howard Beale.

Luckily, I’ve got good news: You probably don’t have to take this. If your adjusted gross income (basically all of your income from every single source that you make in a year) is under $73,000, or $146,000 for joint filers, you can file for free with a number of official IRS tax preparation partners. According to IRS data, roughly 70% of all taxpayers in 2019 fell under that threshold, so the odds are in your favor.

The only “trick” here is that instead of going to TurboTax, H&R Block or any other service directly, you might want to start your tax journey at the official IRS Free File page. It’s simple: plug in some basic information about your situation and the page will return a list of preparers who will provide you with free and/or low-cost services, according to the IRS (this year, neither TurboTax nor H&R Block are offered through the IRS Free File program). TurboTax et al omits this information.

And outsmarting a company valued at over $130 billion, which pours millions of dollars into lobbying, just to do your patriotic duty and pay your taxes? Now that is being a bona fide, genuine Real Adult.

TINA.org joins coalition of consumer organizations in support of the proposed rule

Intuit should not advertise TurboTax Free Edition without making clear that most people cannot use it.

Federal efforts to rein in such charges have largely been unsuccessful to date.