TINA.org Joins Consumer Advocates to Keep FTC Bipartisan

Why agency independence is in the best interests of consumers.

Exploring the MLM industry's latest pivot.

| Stacie Bosley

Earnings and lifestyle representations abound in multi-level marketing (MLM) promotion and recruitment, and the representations often reflect outcomes that are not achieved by the typical MLM participant. A recent TINA.org investigation found (in line with its similar investigation in 2017) that, of 100 MLM companies, 98 percent misrepresented the amount of money typical participants were likely to earn while “most MLM participants make no money or lose money.” In its Earnings Claims Guidance document, the industry’s own self-regulatory body (the Direct Selling Self-Regulatory Council or DSSRC) acknowledges the issue of representing life-changing money, rewards or “time freedom” when most MLM participants earn “at best, no more than modest or supplemental income and many lose money.”

Pressure is mounting for MLM firms to rein in their representations. The Federal Trade Commission has weighed in on the issue of earnings and lifestyle representations in multiple ways: initiating an Advanced Notice of Proposed Rulemaking on Deceptive or Unfair Earnings Claims and a review of the Business Opportunity Rule; communicating concerns directly to the DSSRC; and issuing new staff guidance, reiterating and expanding upon the agency’s prior business guidance. The list goes on: the FTC’s enforcement actions have continued to identify problems with representations (see here and here for examples); under Operation Income Illusion, the FTC joined with law enforcement partners to crack down on deceptive income claims during the pandemic, including in the MLM industry; and the FTC issued Notice of Penalty Offenses letters to MLM firms, warning of financial penalties for misrepresentations. Add state-level enforcement actions, private class action cases, and anti-MLM content and media to the mix – the result is a spotlight on MLM claims and their potential to generate serious consumer harm.

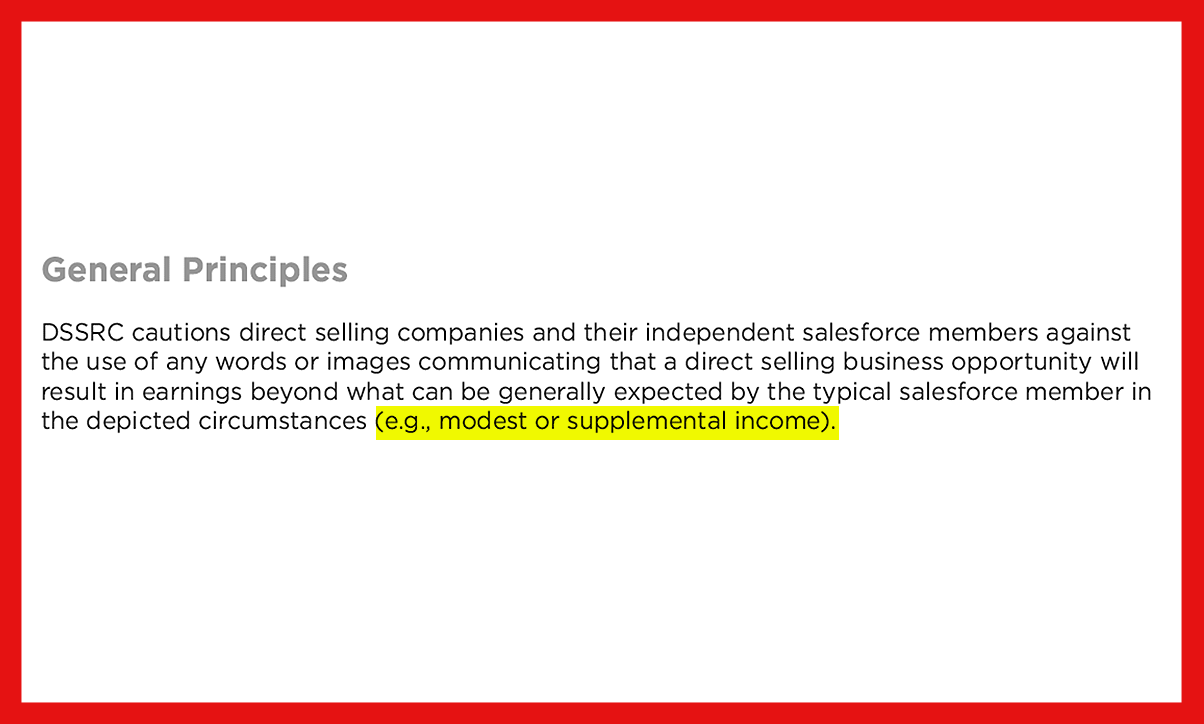

The MLM industry and the DSSRC, specifically, seem to be encouraging a shift toward claims such as “extra income,” “modest income,” and “supplemental income” to represent expected outcomes to new or current MLM participants. For example, the DSSRC guidance, shown in Figure 1, equates the typical participant’s outcome with “modest or supplemental income.”

Figure 1. Excerpt from the DSSRC’s Guidance on Earnings Claims for the Direct Selling Industry (highlight added)

Similarly, the DSSRC Earnings Claims guidance states that phrases like “time flexibility” might be “problematic if used to convey the capacity to earn career-level income to new participants, but not when used to suggest the ability to earn supplemental income on a flexible schedule.” Again, “supplemental income” appears to be conveyed as safe ground. The DSSRC conveyed this same sentiment – that claims of “modest” or “supplemental income” appropriately reflect the typical outcome for an MLM participant – in its comment to the FTC’s Earnings Claims ANPR when it argued that egregious claims have been replaced by more appropriate representations:

At the time of the program’s inception, DSSRC recognized that there was a proliferation of false and misleading claims being disseminated on social media regarding the amount of income that could be generally expected by typical salesforce members through participating in the direct selling opportunity. Since that time, DSSRC has observed a diminishment in egregious income claims that convey earnings beyond modest or supplemental income.

At the 2024 Direct Selling Summit, an employee of Momentum Factor (a company that runs FieldWatch, a monitoring software platform used by many MLM firms) also noted that many of its clients consider “supplemental income” and similar terms to be safe ground when he recounted the company’s recent attempts to include such terms in its monitoring reports:

When we saw the FTC letters coming out and the TINA letters…we started monitoring and looking for terms like ‘other income’ and ‘modest, supplemental income.’ What we realized is that a lot of companies were not sure that that was something they wanted to search for or wanted in their results, and so what we realized quickly was that there is a lot of confusion on this. Companies are not sure that it really is a risky term that needs to be monitored for.

If phrases such as “supplemental income” are being recommended or used to represent an MLM business opportunity, it stands to reason that MLM firms and regulators need to know a few key things. First, what does “supplemental income” mean to consumers when the phrase appears in an MLM context? Second, how do consumer interpretations of “supplemental income” (or similar phrases) stack up against the reality of MLM participant outcomes?

We can look to some relatively new data sources for some answers. Direct Selling News published a series of articles entitled “Generational Insights,” based on responses to the Direct Sales Generational Engagement Study. Regarding compensation, respondents in the study were asked: “how much money would you have to make per month in direct selling to absolutely convince you that it’s worth it.” Older individuals (aged 36-55) were more likely to report that direct selling would be “worth it” if they made $1,000 or more per month while younger individuals (aged 18-35) were more likely to respond that $250-$499 per month would make it worth doing. Overall, 83% “reported that they would choose direct selling if they knew they could make $500 of extra income each month.” The article’s conclusion? “Phrases like ‘supplemental income’ are your friends.” It is important to note that, while these questions did not explicitly ask about expenses, a reasonable interpretation is that respondents asked about “extra income” were thinking about additional money earned net of expenses (i.e., adding extra money to existing sources of earnings).

We (myself and collaborators at Hamline University), asked a similar question to American adults on the Prolific platform in spring of 2024. Study participants were asked to watch a publicly available MLM “opportunity” video, which stated that participants in the MLM could “build a business on their own terms” to “earn supplemental income.” After watching the video, study participants were asked to report the minimum amount of profit someone in the MLM business would have to make in a typical year, in their opinion, for the business to provide “supplemental income.” Of 274 respondents (after omitting 1 outlier and 7 participants with inconsistent responses), the median response was $6,000 a year (or $500 per month), the mode (i.e., the most common response) was $10,000 a year (more than $800 per month), and the mean was nearly $12,000 a year (or $1,000 a month). In this case, we used the word “profit” to elicit answers net of expenses. Additionally, a reasonable interpretation of “supplemental income” is that it supplements – adds to existing sources of earnings after factoring in expenses.

While the questions and methods differed, these two studies provide insight into consumer interpretations of “supplemental” or “extra” income in an MLM/direct selling context. Results indicate that many American adults are likely to imagine $500 to $1,000 or more per month of “extra” money (after expenses) when they think about what it means to supplement their income or make it worth their time and effort to participate in the industry.

Simply put, no. Not based on the evidence to-date. As TINA.org’s investigation revealed, most MLM participants make no money or lose money. Company income disclosure statements (IDS’s) and enforcement actions all indicate that the typical participant in an MLM firm nets well below $500 a month and, again, often loses money.

In a recent letter to the DSSRC, the FTC’s Associate Director for the Division of Marketing Practices, Lois Greisman, identified the same concern we raise above: namely, that the MLM industry is utilizing claims including “supplemental income” when the consumer’s understanding of that term does not likely match the objective reality for the typical MLM participant. Greisman recounts a conversation with an industry executive regarding the meaning of the phrase “supplemental income:”

The Direct Selling Association (“DSA”) has made statements acknowledging that, at best, most MLM participants make ‘modest or supplemental income,’ and the DSSRC’s Guidance encourages MLMs to say in the IDS that most participants make ‘modest or supplemental income.’ When I posed a question about what that phrase means to Adolfo Franco, DSA Executive Vice President and Chief Operating Officer, at DSA’s September 2023 Legal and Regulatory Seminar, I recall he said: ‘$1200 per year.’ I then responded by pointing out that such a sum translates to $100 per month and $25 per week. I am very skeptical that a potential participant would take away from a claim of ‘modest or supplemental income’ that they would earn only $25 per week.

The data supports Associate Director Greisman’s skepticism. Very few respondents in the Direct Sales Generational Engagement Study (10 to 13 percent in each age group) indicated that “less than $250” per month would be enough extra income to justify staying in the industry – and those responses were likely net of expenses. Among the Prolific respondents, 23 percent reported a minimum “supplemental income” number of $1,200 per year or less, and again, respondents were asked to report a number net of expenses.

In her letter to the DSSRC, Associate Director Griesman additionally pointed out that – regardless of the consumer’s interpretation – the term “supplemental income” cannot reflect the typical outcome if the typical MLM participant earns no money or loses money, net of expenses:

Should expenses nullify income for many participants, any projected earnings claim—even an income claim for $25 per week—is likely to leave a net impression that is deceptive… As I have said before, I have yet to see any business opportunity marketing for any MLM that creates a net impression that most participants earn some $25 per week. And should expenses erase income for many participants, even that claim would not be truthful.

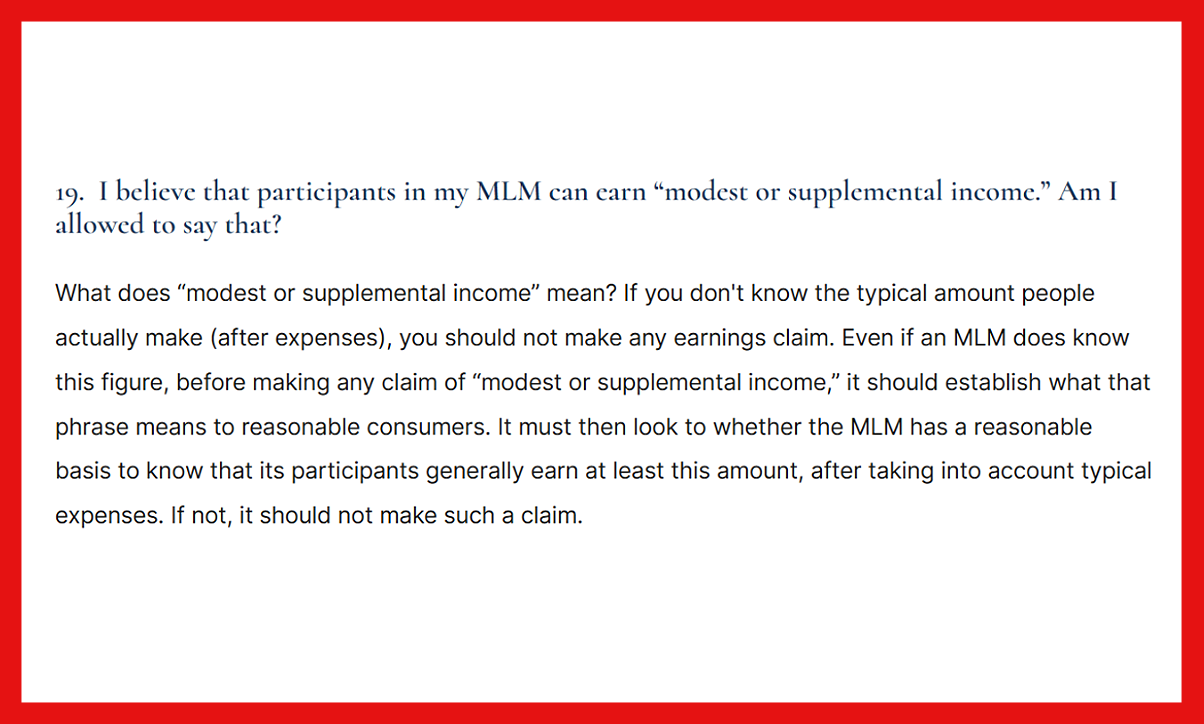

As shown in Figure 2, FTC staff guidance also addresses these issues, explicitly answering the question of whether an MLM can use modest or supplemental income claims.

Figure 2. Excerpt from the FTC’s Business Guidance Concerning Multi-Level Marketing

If consumers tend to interpret “supplement income” to mean more than what typical MLM participant, net of expenses, actually earns – and it appears that they do – then such phrases constitute atypical representations that have the potential to mislead consumers. This begs the very question asked by FTC Associate Director Greisman in her letter to the DSSRC: “how can one use earnings claims to advertise an opportunity that results in the typical participant making little to no money or losing money?” This same question is being asked by the industry itself. At the 2024 Direct Selling Summit, John Sanders of Winston & Strawn (half joking) spoke to a panel about the types of claims that would be acceptable to the FTC:

I have this opportunity. You should know that the vast majority of people lose money in it…and you’re going to spend time and effort and you’re likely never going to receive any sort of earnings…but you have a slight chance of making some modest, supplemental income. I think the FTC would be just fine with that one.

But if Mr. Sanders’ statement reflects the truth for a given MLM and that truth doesn’t sound appealing when spoken aloud, that is all the more reason that this truth must be conveyed to consumers, clearly and fully.

As articulated in the FTC’s recent staff guidance: “should expenses nullify income for many participants, a claim that participants are likely to earn any money would likely leave a net impression that is deceptive” (emphasis added). In other words, so long as the typical MLM participant earns no money or loses money, net of expenses, any claim of income – “modest,” “supplemental,” “extra,” or “other” income – is atypical, posing the risk of consumer harm.

Why agency independence is in the best interests of consumers.

Court also finds that defendants made false and deceptive earnings claims.

A recap of TINA.org pressuring Nerium to #GetReal