Ty J. Young, Revisited

Ty J. Young’s fine print continues to be a must-read for consumers.

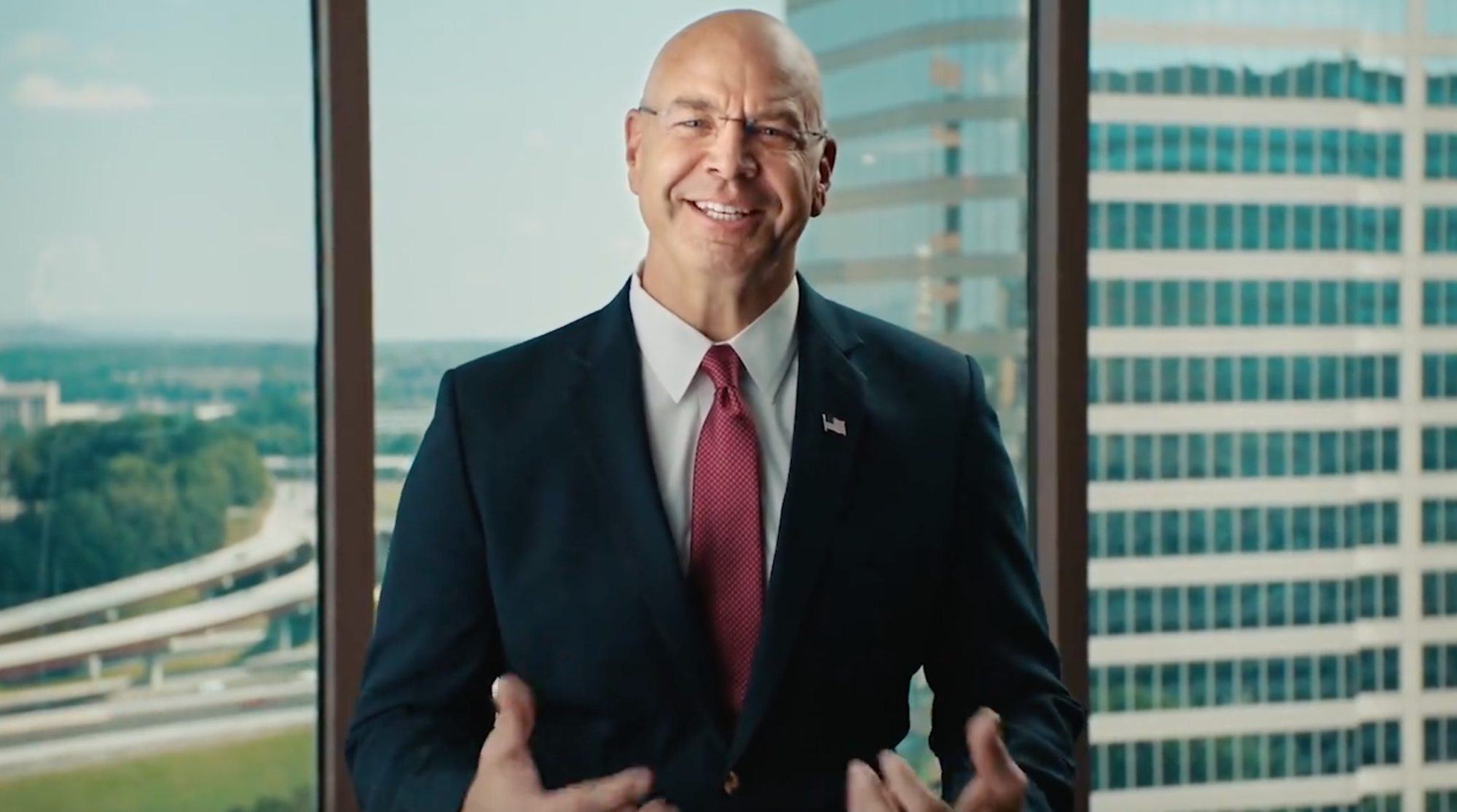

In television ads like the one above, SelectQuote claims to offer “guaranteed” life insurance with no medical exam for individuals aged 45-85. The company also boasts that you can secure coverage for around $1 a day.

But this isn’t your standard life insurance policy. Rather, it’s a type of final expense insurance, also known as burial or funeral insurance, meant to cover end-of-life expenses such as funerals, medical bills and/or unpaid debts. The specific type of final expense insurance discussed in the ad is called guaranteed issue life insurance.

This kind of plan may be enticing for older consumers, especially those with preexisting conditions who may have a hard time finding affordable coverage. But there are some limitations to the coverage that aren’t disclosed anywhere in the ad. (What also might not be clear from the ad is that SelectQuote is not an insurance company. Rather, it is a platform that helps consumers find coverage, which they might be able to find on their own.)

According to SelectQuote’s website, guaranteed issue life insurance only covers up to $25,000 of expenses, which may cover the cost of a funeral but might not leave enough money for other expenses such as high medical bills.

The site also reveals that consumers won’t receive any payment, besides the premiums they’ve already paid, if they die of natural causes within the first two years of coverage.

And while SelectQuote advertises that consumers can find coverage for $1 a day, the ad’s fine print discloses that the advertised rate is not actually for the advertised insurance product. Instead, the “Around $1/day” claim is based on “the lowest available rate” for two entirely different plans – a simplified issue policy and a 10-year term policy.

SelectQuote did not respond to TINA.org’s request for comment.

The bottom line

Shopping for life insurance can be tricky and stressful. Consumers should always do their research (for example, checking the fine print, reading reviews and making sure they understand what the policy covers) before making a decision.

Find more of our coverage on life insurance products here.

Our Ad Alerts are not just about false and deceptive marketing issues, but may also be about ads that, although not necessarily deceptive, should be viewed with caution. Ad Alerts can also be about single issues and may not include a comprehensive list of all marketing issues relating to the brand discussed.

Ty J. Young’s fine print continues to be a must-read for consumers.

A network marketing coach doesn’t deliver on his (expensive) promises.

TINA.org breaks down company’s claim that you can collect “extra” money from the Social Security Administration.