FTC, Nevada Sue IM Mastery Academy

Complaint alleges IML was a $1.2 billion scam.

Agency worries MLM defendants are dissipating assets.

|

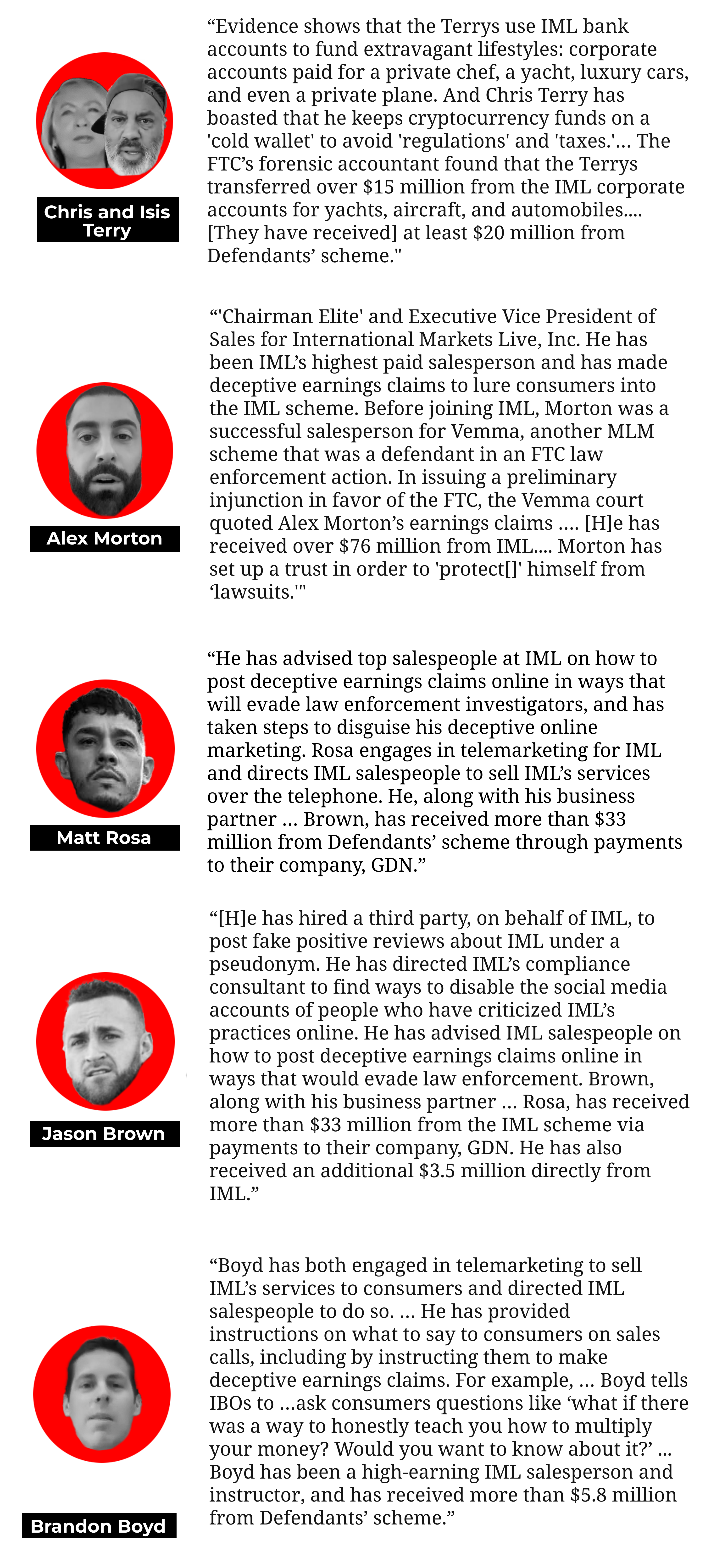

UPDATE 10/22/25: In recent months, there have been several developments in the FTC and Nevada’s case against IM Mastery Academy, which the government alleges operated “a wide-ranging investment training and business venture scam.” Since August, five of the 10 defendants have reached settlements resulting in monetary judgments totaling $118.5 million (of which $13 million will ultimately be paid): Alex Morton will pay $10 million ($76.2 million judgment); Brandon Boyd will pay $500,000 ($6.3 million judgment); and Jason Brown, Matthew Rosa and their company, Global Dynasty Network, will together pay $2.5 million ($36 million judgment). In addition, these five defendants are permanently prohibited from engaging in a variety of misleading conduct, including making earnings claims without the proper substantiation. And Morton in particular is permanently banned from taking part in any multilevel marketing of trading-training services. Meanwhile, regulators have obtained a preliminary injunction against the remaining five defendants, which include Christopher Terry and Isis Terry. Our original article follows.

—

On May 30, the FTC and state of Nevada filed a motion for a preliminary injunction in federal court against the financial education MLM IM Mastery Academy (aka IML, IMMA and IYOVIA) and six individual defendants – the owners of the company and four top distributors. The commission informed the court that the timing of its motion was based on the fact that IML was suspending its operations, a concern that IML may destroy relevant evidence as it shuts down, and worry that defendants may be hiding or squandering assets that should be saved for future consumer redress. According to the FTC, defendants have caused more than $1.2 billion in estimated worldwide consumer harm since 2018, including $535 million in harm to U.S. consumers.

Plaintiffs attached nearly 7,000 pages of evidence in support of their motion, which included more than a dozen affidavits from victims of the IML scheme, BBB complaints against the company, an IML distributor survey, three affidavits from TINA.org, and declarations from FTC investigators, a data analyst, an economist and a forensic accountant. The documents attached to these declarations are a treasure trove of damning evidence against the defendants. But assuming you don’t have the time (or perhaps inclination) to read this tome, below is a sampling of quotes from the plaintiffs’ motion and their exhibits along with evidence collected by TINA.org. It offers an unvarnished perspective into the thoughts, feelings and strategies of IML, its owners and top distributors, which often appears at odds with the marketing.

“The Individual Defendants are liable for injunctive and monetary relief because … they directly participated in or had control over IML’s deceptive marketing, and knew of, or at minimum recklessly disregarded, the false, misleading, and unsubstantiated nature of the claims. … Defendants have been dissipating ill-gotten gains from the scheme by, among other things, moving funds offshore or into cryptocurrency to evade regulations and taxes, and living extravagant lifestyles.”

FTC: “Since at least 2018, when consumer watchdog Truth In Advertising (‘TINA’) first confronted IML about the scheme’s earnings claims, IML has told consumer advocates, self regulatory bodies, and payment processors that it strictly adheres to consumer protection laws by closely monitoring and enforcing IML compliance policies against deceptive earnings claims.”

February 2019, C. Terry/Brown

C. Terry: “That’s the great thing about network marketin[g]”

Brown: “Always can get new blood”

C. Terry: “They keep making new 18 year olds everyday”

FTC: “Defendants, including IML’s compliance staff, have conspired to further the scheme by instructing salespeople on how to continue to make deceptive claims ‘under the radar’ of the compliance program and law enforcement. For years, IML went so far as to make it the Company’s policy to prohibit its salespeople from using the Company’s name, or hashtags identifying IML, in social media posts.”

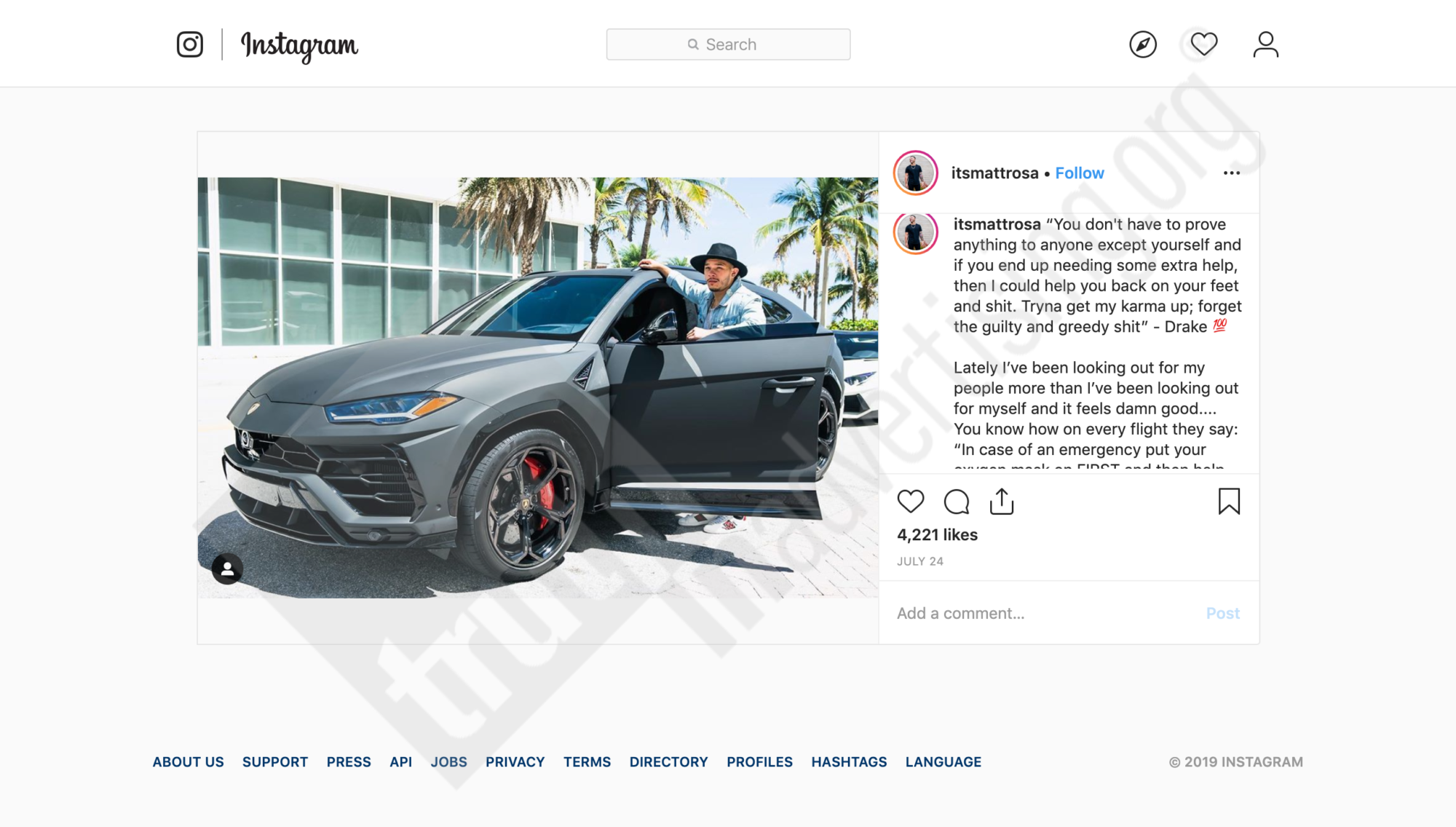

October 2019, Brown/Rosa

Brown: “Mikey please made private … We can’t do anything with lifestyle … Not gonna risk the check … Bro Tina blasted us for smaller shit … If FTC comes in … our life is over … You know Tom [Alkazin, top Vemma distributor] has to pay back millions … That shit scares me, FTC don’t fuck around and if we aren’t clean. We could be held liable … They considered DAVIDs [Imonitie’s] post with watches an income claim … Jets Lambos … Def lifestyle claim”

Rosa: “TINA did and Tina isn’t government … Bs bro … Tina gonna look for anything doesn’t mean they right”

Brown: “Remember FTC comes in, they make the law … Top earners go down with the company brother … We … Of all people … Should be careful … Make video private to you can only see when some one sends to you”

Rosa: “Tina can’t find what they can’t find … I took link off my bio … Stupid af … fuck Tina … in the face … Aggressively”

FTC: “Defendants have rewarded top salespeople that make deceptive claims, schemed to continue defrauding consumers, and directed their salespeople to disguise their unlawful conduct to prevent law enforcement action against the scheme.”

March 2020, Rosa: “Stop posting about [the COVID-19] crisis and the company…FTC don’t play that shit…And will shut us down…Hope FTC gets corona…Fuckers.”

FTC: “In June 2020, in a text exchange that included Chris Terry and the then-head of IML compliance, Defendant Morton wrote in response to a suggestion that salespeople stop using IML’s name on social media in light of a recent FTC enforcement action against another training scheme: ‘Yes. We CAN do this, will take time and effort but we CAN & SHOULD. We want to be here in 10 years. That happens by staying under the radar.’ Defendant Rosa replied: ‘I’m down for a blackout. None of us use company [name] as it is. … love the idea bro.’ And Brown concurred: ‘As much as I like the idea of social media, I REALLY like the idea of 20-30-40 years of making this impact and money… If no one knows we exist … do we?’”

September 2020, Morton: “We can say it’s personal or complain that it’s too strict, but regardless if we don’t do better at following the current guidelines and rules it’s not going to end well… I just got on social for 4min and I see 4-5 posts that easily could get flagged by the FTC or Tina… regardless of what we think. we HAVE to do better. Everyone in this group. All of us.”

FTC: “In April 2021, Chris Terry and Defendant Brown discussed a BBC documentary that detailed how poorly consumers fared when they traded using IML’s services. While sharing the video with Brown, Chris Terry commented, ‘so it’s our fault lol…We need massive PR to combat this in the UK.’ Brown responded: ‘As long as regulators don’t get involved…Our team don’t care about Media.’”

May 2021, Brown: “We have someone on Instagram who is capturing all of our top leaders pages … Sending to the FTC … if we keep treating like a joke … We’ll be a joke … I hope everyone starts taking this serious … Cause FTC is watching now”

May 2021, Boyd: “You can’t go meet with the FTC. It’s like going to meet with Satan and ask, ‘What are your thoughts about God and what we should follow?’ Ain’t happening.”

November 2021, C. Terry: “FTC issued a letter to all companies who are on a list of excessive complaints we are 1 of 1100 companies…. FTC I am sure if investigates us the chairman10’s and above will face legal issues. We do not want to swim in their waters as we will all lose.”

November 2021, C. Terry: “We ARE being watched by FTC its’ an obvious. Each fine is $43k per violation So everyone understands the severity. Should FTC come down on us. Expect a $20-$30m in fines.”

November 2021, Brown/Morton

Brown: “I’m telling everyone … FTC fining $40k per violation … And thy stop arguing”

Morton: “Make ‘em pay the $43k and they won’t mess up.”

FTC: “Defendants have continued to operate their unlawful scheme despite numerous consumer complaints, legal actions and warnings, damning press coverage, alerts from IML’s internal compliance staff, and being on notice of the FTC’s investigation since December 2021.”

FTC: “Defendants not only direct their salespeople to avoid the notice of law enforcement; they have continued to operate despite 21 international government agencies issuing warnings about the scheme. In addition, both the U.S. Commodity Futures Trading Commission (‘CFTC’) and Canadian law enforcement have taken legal action against IML, and in March 2022, several IML IBOs were arrested by the Spanish National Police for, among other things, targeting adolescents for recruitment into IML. Rather than being deterred, Defendants have repeatedly shown disdain for law enforcement agencies tasked with policing their unlawful conduct. For example, Chris Terry sent Defendant Brown a link to an article discussing the arrest of Spanish IBOs via text message; he then wrote ‘Big deal…Who cares,’ and Brown responded ‘Exactly.’ Terry then replied: ‘who gives two fucks not me.’”

FTC: “All of these salespeople [see chart below], who collectively earned over $249 million from the IML scheme, should have been terminated under IML’s stated policies. Instead, all of them continued earning commissions after committing 3 (or in many cases, more) earnings claim violations.”

IML: “Chris [Terry] could flip if we suspend one of the main leaders without him knowing.”

FTC: “IML’s instructors are anything but the ‘master’ educators and traders IML claims they are. Many instructors have no formal investment training, and what training they have received comes from IML’s Training Services. IML’s instructors also do not have prior experience working in finance, nor do they possess professional licenses or accreditation.”

FTC: Boyd, who regularly appeared at company conventions to provide financial education, had no professional licenses or accreditations and his trading consisted of a single account valued at less than $1,600 – his training consisted of watching IML-produced videos according to Boyd’s discovery responses.

FTC: “90% of consumers stopped paying for the Training Services within six months, and over 58% stopped paying for the services within one month.”

FTC: “Since at least 2018, IML has scammed consumers into spending hundreds or thousands of dollars with claims that its training products or services (collectively, ‘Training Services’) will enable them to generate substantial earnings through trading in the financial markets. IML has also represented that participants in its MLM business venture (‘Business Venture’) will make substantial earnings. Those claims are false and unsubstantiated.”

August 2023, Morton interrogatory answer: “Mr. Morton’s title of ‘Chairman Elite’ does not provide particular duties or responsibilities, but is instead a reflection of his role as a frequent motivational speaker at the Company’s events. … The Company’s education and training were not part of Mr. Morton’s compensation by or role with the Company. Mr. Morton’s presentations focused on mindset and leadership and did not cover any training relating to earning money on the markets. Mr. Morton does not engage in any individual day trading or securities investing to earn income. Mr. Morton’s investments in securities are limited to long term investments in mutual funds and similar holdings.”

January 2024, Morton: “Hey, man, if I can show you a way to make enough money part-time, would you take a look at something? Hey, Brian, hey, man, if I can show you a way to make extra money from your cell phone, would you watch a video?”

FTC: “In March of 2025, Morton’s counsel represented to the FTC that Morton has resigned from IML ‘on advice of counsel.’”

FTC: “most consumers who purchase the Training Services lose money trading, and nearly all participants in the Business Venture make a pittance or lose money.”

FTC: “Defendants have taken in over $1.242 billion from consumers worldwide between January 1, 2018 and October 31, 2023. During that time period, over 2,461,000 consumers have paid $1,235,480,807 to IML for the Training Services, with the median amount being $235. And over 163,000 consumers paid $7,051,069 to IML in order to participate in the Business Venture and lost money, according to IML’s own data. More than 1,830 complaints from IML purchasers have been filed with the Better Business Bureau or the FTC.”

FTC: “Since 2018, IML has been the subject of numerous foreign law enforcement actions and warnings, media exposés, a consumer watchdog action, and has received over 650 consumer complaints. Defendants have received multiple civil investigative demands from the FTC, and the FTC Synopsis Concerning Money-Making Opportunities. Despite all this, Defendants have continued to use deceptive claims to sell the Training Services and Business Venture. And they have instructed their salesforce on how to continue to engage in deceptive conduct while evading law enforcement oversight. Plainly, Defendants will not stop the fraud themselves—this Court must.”

Seven days after this preliminary injunction motion was filed, Rosa and Brown entered into a proposed settlement with the FTC and Nevada pending FTC commissioner approval. Morton is currently in settlement discussions with the FTC and Nevada. Stay tuned to TINA.org for further developments.

Read more about TINA.org’s investigation of IML.

Complaint alleges IML was a $1.2 billion scam.

Different name, same game.

TINA.org investigation finds 98% of MLMs using misleading income claims.